JPMorgan Chase & Co. trimmed its holdings in shares of Dr. Reddy's Laboratories Limited (NYSE:RDY - Free Report) by 21.6% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 500,723 shares of the company's stock after selling 138,035 shares during the quarter. JPMorgan Chase & Co. owned approximately 0.06% of Dr. Reddy's Laboratories worth $39,782,000 as of its most recent SEC filing.

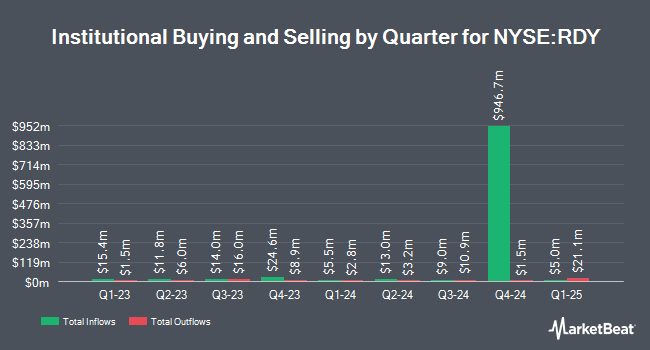

A number of other large investors also recently bought and sold shares of RDY. World Investment Advisors LLC purchased a new position in shares of Dr. Reddy's Laboratories in the 3rd quarter worth approximately $3,459,000. Frank Rimerman Advisors LLC acquired a new position in shares of Dr. Reddy's Laboratories during the second quarter worth $2,633,000. Caprock Group LLC purchased a new stake in shares of Dr. Reddy's Laboratories during the 2nd quarter valued at $997,000. Natixis Advisors LLC acquired a new stake in shares of Dr. Reddy's Laboratories in the 2nd quarter worth $777,000. Finally, Dimensional Fund Advisors LP increased its position in Dr. Reddy's Laboratories by 12.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,003,782 shares of the company's stock valued at $76,455,000 after buying an additional 114,294 shares in the last quarter. Institutional investors own 3.85% of the company's stock.

Dr. Reddy's Laboratories Price Performance

Shares of NYSE:RDY remained flat at $15.44 during trading on Monday. The stock had a trading volume of 2,410,406 shares, compared to its average volume of 1,817,569. The company has a quick ratio of 1.36, a current ratio of 1.92 and a debt-to-equity ratio of 0.02. Dr. Reddy's Laboratories Limited has a 1 year low of $13.43 and a 1 year high of $16.89. The firm has a market capitalization of $12.89 billion, a PE ratio of 24.66 and a beta of 0.53. The business's 50-day moving average price is $14.78 and its 200-day moving average price is $15.51.

Analyst Upgrades and Downgrades

Several equities research analysts have weighed in on RDY shares. StockNews.com downgraded Dr. Reddy's Laboratories from a "buy" rating to a "hold" rating in a report on Friday, December 6th. Nomura downgraded shares of Dr. Reddy's Laboratories from a "buy" rating to a "neutral" rating in a research report on Thursday, December 19th. Finally, Barclays decreased their price target on shares of Dr. Reddy's Laboratories from $17.40 to $17.00 and set an "overweight" rating for the company in a report on Wednesday, November 6th.

Get Our Latest Stock Report on RDY

Dr. Reddy's Laboratories Company Profile

(

Free Report)

Dr. Reddy's Laboratories Limited, together with its subsidiaries, operates as an integrated pharmaceutical company worldwide. It operates through Global Generics, Pharmaceutical Services and Active Ingredients (PSAI), and Others segments. The company's Global Generics segment manufactures and markets prescription and over-the-counter finished pharmaceutical products that are marketed under a brand name or as a generic finished dosages with therapeutic equivalence to branded formulations, as well as engages in the biologics business.

Featured Articles

Before you consider Dr. Reddy's Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dr. Reddy's Laboratories wasn't on the list.

While Dr. Reddy's Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.