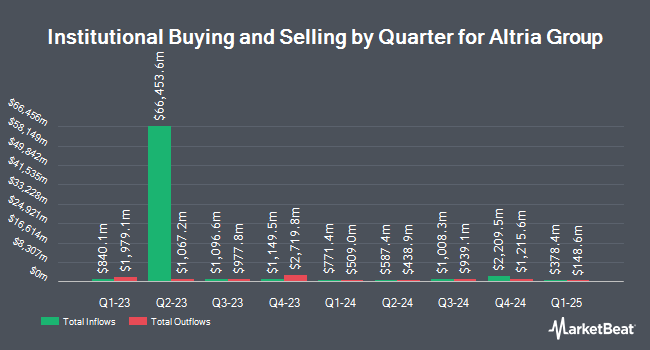

JPMorgan Chase & Co. trimmed its stake in Altria Group, Inc. (NYSE:MO - Free Report) by 10.1% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 8,545,983 shares of the company's stock after selling 958,496 shares during the period. JPMorgan Chase & Co. owned about 0.50% of Altria Group worth $446,870,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Financial Life Planners bought a new position in Altria Group in the fourth quarter worth $25,000. VSM Wealth Advisory LLC acquired a new position in shares of Altria Group in the 4th quarter valued at $29,000. True Wealth Design LLC lifted its holdings in shares of Altria Group by 420.0% during the 3rd quarter. True Wealth Design LLC now owns 572 shares of the company's stock worth $29,000 after acquiring an additional 462 shares during the period. Legacy Investment Solutions LLC acquired a new stake in shares of Altria Group during the 3rd quarter valued at about $34,000. Finally, Marshall Investment Management LLC bought a new stake in Altria Group in the fourth quarter valued at about $32,000. 57.41% of the stock is currently owned by institutional investors and hedge funds.

Altria Group Price Performance

Shares of MO stock traded down $1.25 during trading hours on Tuesday, hitting $58.77. 5,908,858 shares of the company's stock were exchanged, compared to its average volume of 8,870,596. The stock's 50-day moving average is $55.23 and its 200-day moving average is $53.65. Altria Group, Inc. has a 52 week low of $40.65 and a 52 week high of $60.20. The stock has a market cap of $99.36 billion, a price-to-earnings ratio of 8.97, a price-to-earnings-growth ratio of 2.89 and a beta of 0.56.

Altria Group (NYSE:MO - Get Free Report) last posted its quarterly earnings data on Thursday, January 30th. The company reported $1.29 earnings per share for the quarter, beating the consensus estimate of $1.28 by $0.01. Altria Group had a net margin of 46.90% and a negative return on equity of 258.72%. Equities research analysts forecast that Altria Group, Inc. will post 5.32 earnings per share for the current fiscal year.

Altria Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Tuesday, March 25th will be given a dividend of $1.02 per share. The ex-dividend date of this dividend is Tuesday, March 25th. This represents a $4.08 dividend on an annualized basis and a dividend yield of 6.94%. Altria Group's payout ratio is currently 62.29%.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on MO shares. Bank of America raised Altria Group from a "neutral" rating to a "buy" rating and lifted their price objective for the company from $55.00 to $65.00 in a report on Friday, December 6th. Morgan Stanley decreased their price target on Altria Group from $54.00 to $53.00 and set an "equal weight" rating on the stock in a research note on Friday, January 31st. Finally, UBS Group increased their price objective on Altria Group from $42.00 to $46.00 and gave the stock a "sell" rating in a research note on Tuesday. Two analysts have rated the stock with a sell rating, three have given a hold rating and four have issued a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $54.00.

Read Our Latest Analysis on MO

Altria Group Profile

(

Free Report)

Altria Group, Inc, through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States. The company offers cigarettes primarily under the Marlboro brand; large cigars and pipe tobacco under the Black & Mild brand; moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands; oral nicotine pouches under the on! brand; and e-vapor products under the NJOY ACE brand.

See Also

Before you consider Altria Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Altria Group wasn't on the list.

While Altria Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.