JPMorgan Chase & Co. boosted its stake in Radius Recycling, Inc. (NASDAQ:RDUS - Free Report) by 92.5% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 159,621 shares of the basic materials company's stock after buying an additional 76,702 shares during the period. JPMorgan Chase & Co. owned 0.57% of Radius Recycling worth $2,429,000 as of its most recent SEC filing.

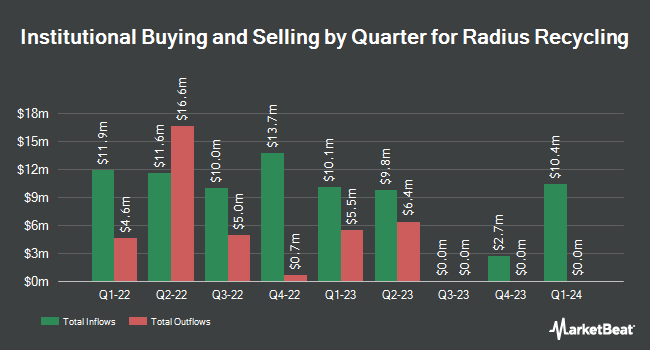

Other large investors have also recently added to or reduced their stakes in the company. Stifel Financial Corp increased its position in Radius Recycling by 28.6% in the 3rd quarter. Stifel Financial Corp now owns 20,052 shares of the basic materials company's stock valued at $372,000 after acquiring an additional 4,455 shares during the period. Jane Street Group LLC lifted its stake in shares of Radius Recycling by 62.9% in the 3rd quarter. Jane Street Group LLC now owns 90,813 shares of the basic materials company's stock worth $1,684,000 after acquiring an additional 35,073 shares during the period. Barclays PLC boosted its holdings in shares of Radius Recycling by 156.2% in the third quarter. Barclays PLC now owns 58,337 shares of the basic materials company's stock valued at $1,081,000 after acquiring an additional 35,568 shares in the last quarter. Geode Capital Management LLC increased its stake in shares of Radius Recycling by 6.0% during the third quarter. Geode Capital Management LLC now owns 643,674 shares of the basic materials company's stock valued at $11,936,000 after acquiring an additional 36,618 shares during the period. Finally, Trium Capital LLP raised its holdings in Radius Recycling by 41.8% during the fourth quarter. Trium Capital LLP now owns 13,320 shares of the basic materials company's stock worth $203,000 after purchasing an additional 3,925 shares in the last quarter. 78.11% of the stock is owned by institutional investors and hedge funds.

Radius Recycling Price Performance

NASDAQ:RDUS traded up $0.05 during trading hours on Friday, reaching $29.24. 552,528 shares of the company's stock were exchanged, compared to its average volume of 386,403. The company has a quick ratio of 0.97, a current ratio of 2.02 and a debt-to-equity ratio of 0.75. The company has a market capitalization of $824.63 million, a P/E ratio of -2.92 and a beta of 1.07. Radius Recycling, Inc. has a 12 month low of $10.57 and a 12 month high of $29.29. The business's 50-day simple moving average is $23.68 and its two-hundred day simple moving average is $18.63.

Radius Recycling (NASDAQ:RDUS - Get Free Report) last announced its quarterly earnings data on Friday, April 4th. The basic materials company reported ($0.99) EPS for the quarter, beating analysts' consensus estimates of ($1.08) by $0.09. The company had revenue of $642.51 million during the quarter, compared to the consensus estimate of $635.94 million. Radius Recycling had a negative return on equity of 14.16% and a negative net margin of 10.49%. Sell-side analysts expect that Radius Recycling, Inc. will post -3.84 EPS for the current fiscal year.

Radius Recycling Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, May 5th. Stockholders of record on Monday, April 21st will be given a $0.1875 dividend. This represents a $0.75 annualized dividend and a dividend yield of 2.56%. The ex-dividend date of this dividend is Monday, April 21st. Radius Recycling's dividend payout ratio (DPR) is currently -7.52%.

Analyst Upgrades and Downgrades

Separately, StockNews.com began coverage on Radius Recycling in a research report on Saturday. They set a "sell" rating on the stock.

Read Our Latest Analysis on Radius Recycling

Radius Recycling Company Profile

(

Free Report)

Radius Recycling, Inc recycles ferrous and nonferrous metal, and manufactures finished steel products worldwide. The company acquires, processes, and recycles salvaged vehicles, rail cars, home appliances, industrial machinery, manufacturing scrap, and construction and demolition scrap. It offers recycled ferrous metal, a feedstock used in the production of finished steel products; and nonferrous products, including mixed metal joint products recovered from the shredding process, such as zorba, zurik, aluminum, copper, stainless steel, nickel, brass, titanium, lead, and high temperature alloys.

Recommended Stories

Before you consider Radius Recycling, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Radius Recycling wasn't on the list.

While Radius Recycling currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.