Cooper Companies (NASDAQ:COO - Free Report) had its price target lowered by JPMorgan Chase & Co. from $120.00 to $110.00 in a report released on Friday,Benzinga reports. The brokerage currently has an overweight rating on the medical device company's stock.

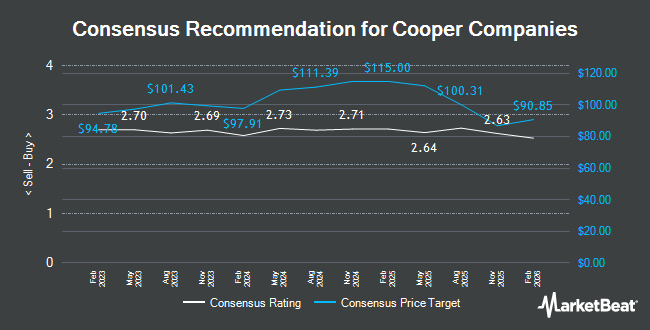

Several other research firms also recently weighed in on COO. Morgan Stanley decreased their price objective on Cooper Companies from $104.00 to $102.00 and set an "equal weight" rating for the company in a report on Friday, December 6th. Needham & Company LLC reiterated a "hold" rating on shares of Cooper Companies in a report on Friday. StockNews.com cut shares of Cooper Companies from a "buy" rating to a "hold" rating in a research note on Wednesday, December 11th. Citigroup cut their price objective on Cooper Companies from $115.00 to $110.00 and set a "buy" rating on the stock in a report on Friday. Finally, Robert W. Baird dropped their price objective on shares of Cooper Companies from $117.00 to $107.00 and set an "outperform" rating on the stock in a report on Friday. Three analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $111.89.

Check Out Our Latest Stock Report on Cooper Companies

Cooper Companies Trading Up 1.4 %

Shares of NASDAQ:COO traded up $1.14 on Friday, hitting $81.03. 3,370,815 shares of the company's stock were exchanged, compared to its average volume of 1,725,305. The stock has a market capitalization of $16.17 billion, a price-to-earnings ratio of 41.55, a price-to-earnings-growth ratio of 2.25 and a beta of 1.02. Cooper Companies has a 12 month low of $78.43 and a 12 month high of $112.38. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.91 and a quick ratio of 1.12. The business's 50 day simple moving average is $91.93 and its two-hundred day simple moving average is $99.25.

Cooper Companies (NASDAQ:COO - Get Free Report) last announced its quarterly earnings data on Thursday, March 6th. The medical device company reported $0.92 earnings per share for the quarter, meeting analysts' consensus estimates of $0.92. The company had revenue of $964.70 million during the quarter, compared to analyst estimates of $981.25 million. Cooper Companies had a net margin of 10.07% and a return on equity of 9.38%. Analysts anticipate that Cooper Companies will post 3.98 EPS for the current fiscal year.

Institutional Trading of Cooper Companies

Hedge funds have recently made changes to their positions in the company. Ashton Thomas Securities LLC purchased a new stake in shares of Cooper Companies during the 3rd quarter valued at approximately $25,000. Byrne Asset Management LLC acquired a new stake in Cooper Companies during the fourth quarter worth $33,000. OFI Invest Asset Management acquired a new position in shares of Cooper Companies in the 4th quarter valued at $34,000. Covestor Ltd lifted its stake in shares of Cooper Companies by 144.9% in the 3rd quarter. Covestor Ltd now owns 338 shares of the medical device company's stock valued at $37,000 after purchasing an additional 200 shares during the last quarter. Finally, New Age Alpha Advisors LLC purchased a new position in shares of Cooper Companies during the 4th quarter worth $38,000. Hedge funds and other institutional investors own 24.39% of the company's stock.

Cooper Companies Company Profile

(

Get Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Further Reading

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.