Molson Coors Beverage (NYSE:TAP - Get Free Report) had its price target lowered by equities research analysts at JPMorgan Chase & Co. from $59.00 to $58.00 in a research report issued on Thursday,Benzinga reports. The brokerage presently has a "neutral" rating on the stock. JPMorgan Chase & Co.'s price objective points to a potential upside of 4.40% from the company's previous close.

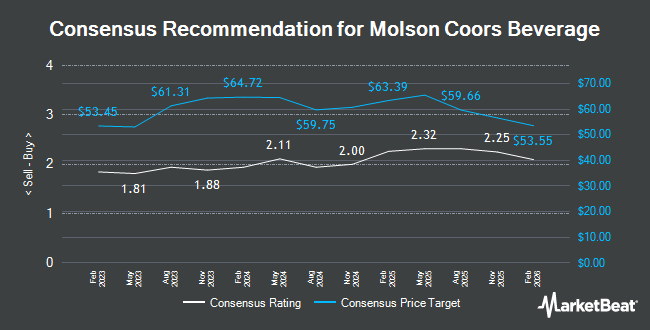

Other analysts have also recently issued reports about the stock. StockNews.com upgraded shares of Molson Coors Beverage from a "hold" rating to a "buy" rating in a research note on Saturday, January 25th. UBS Group lowered their target price on shares of Molson Coors Beverage from $60.00 to $58.00 and set a "neutral" rating for the company in a research note on Thursday, January 16th. BNP Paribas initiated coverage on shares of Molson Coors Beverage in a research report on Monday, November 25th. They set a "neutral" rating and a $64.00 price target for the company. Needham & Company LLC began coverage on shares of Molson Coors Beverage in a research report on Friday, December 6th. They set a "buy" rating and a $72.00 price target for the company. Finally, Hsbc Global Res lowered shares of Molson Coors Beverage from a "hold" rating to a "moderate sell" rating in a report on Friday, November 8th. Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $61.64.

View Our Latest Report on Molson Coors Beverage

Molson Coors Beverage Stock Up 1.1 %

Molson Coors Beverage stock traded up $0.61 during midday trading on Thursday, hitting $55.56. 135,609 shares of the company's stock were exchanged, compared to its average volume of 1,649,728. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.74 and a current ratio of 0.99. Molson Coors Beverage has a 12 month low of $49.19 and a 12 month high of $69.18. The firm has a 50-day moving average of $58.04 and a two-hundred day moving average of $56.19. The company has a market cap of $11.44 billion, a PE ratio of 12.51, a P/E/G ratio of 2.04 and a beta of 0.86.

Molson Coors Beverage (NYSE:TAP - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The company reported $1.80 earnings per share for the quarter, beating analysts' consensus estimates of $1.67 by $0.13. Molson Coors Beverage had a net margin of 6.78% and a return on equity of 9.24%. The business had revenue of $3.04 billion for the quarter, compared to analysts' expectations of $3.13 billion. During the same period last year, the business earned $1.92 EPS. The company's revenue was down 7.8% compared to the same quarter last year. As a group, analysts expect that Molson Coors Beverage will post 5.79 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the company. State Street Corp increased its stake in Molson Coors Beverage by 8.4% during the third quarter. State Street Corp now owns 8,792,196 shares of the company's stock worth $505,727,000 after purchasing an additional 681,757 shares during the period. River Road Asset Management LLC increased its stake in Molson Coors Beverage by 1.8% during the third quarter. River Road Asset Management LLC now owns 1,677,241 shares of the company's stock worth $96,475,000 after purchasing an additional 29,315 shares during the period. Thompson Siegel & Walmsley LLC purchased a new stake in Molson Coors Beverage during the third quarter worth about $48,202,000. FMR LLC increased its stake in Molson Coors Beverage by 23.2% during the third quarter. FMR LLC now owns 716,311 shares of the company's stock worth $41,202,000 after purchasing an additional 134,689 shares during the period. Finally, Private Management Group Inc. increased its stake in Molson Coors Beverage by 5.5% during the third quarter. Private Management Group Inc. now owns 557,742 shares of the company's stock worth $32,081,000 after purchasing an additional 29,294 shares during the period. Institutional investors and hedge funds own 78.46% of the company's stock.

About Molson Coors Beverage

(

Get Free Report)

Molson Coors Beverage Company manufactures, markets, and sells beer and other malt beverage products under various brands in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers flavored malt beverages including hard seltzers, craft, spirits and energy, and ready to drink beverages.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Molson Coors Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molson Coors Beverage wasn't on the list.

While Molson Coors Beverage currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.