Penske Automotive Group (NYSE:PAG - Get Free Report) had its price objective lowered by investment analysts at JPMorgan Chase & Co. from $165.00 to $140.00 in a research report issued on Thursday,Benzinga reports. The firm presently has an "underweight" rating on the stock. JPMorgan Chase & Co.'s target price suggests a potential downside of 1.70% from the stock's current price.

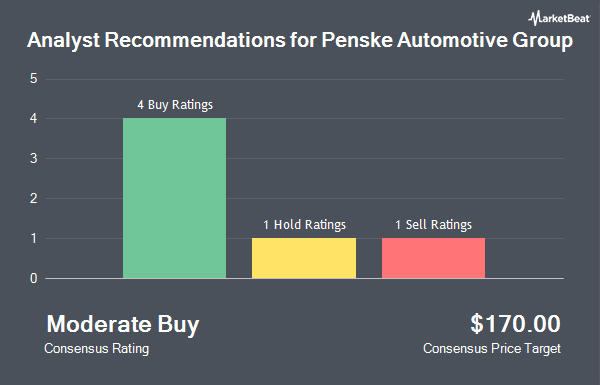

Several other research analysts have also issued reports on the company. Benchmark initiated coverage on Penske Automotive Group in a research report on Thursday, December 12th. They set a "buy" rating for the company. StockNews.com raised Penske Automotive Group from a "hold" rating to a "buy" rating in a research report on Monday, February 24th. Finally, Stephens reiterated an "equal weight" rating and issued a $165.00 target price on shares of Penske Automotive Group in a research note on Tuesday, February 18th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and four have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $166.25.

Get Our Latest Research Report on Penske Automotive Group

Penske Automotive Group Trading Up 0.8 %

Shares of Penske Automotive Group stock traded up $1.12 on Thursday, reaching $142.43. The company had a trading volume of 191,168 shares, compared to its average volume of 215,485. The firm has a market cap of $9.51 billion, a price-to-earnings ratio of 10.36 and a beta of 1.24. The company has a debt-to-equity ratio of 0.22, a current ratio of 0.91 and a quick ratio of 0.20. The firm's 50-day moving average price is $162.15 and its two-hundred day moving average price is $159.40. Penske Automotive Group has a 1 year low of $139.56 and a 1 year high of $180.12.

Penske Automotive Group (NYSE:PAG - Get Free Report) last posted its quarterly earnings data on Thursday, February 13th. The company reported $3.54 earnings per share for the quarter, beating analysts' consensus estimates of $3.37 by $0.17. The business had revenue of $7.72 billion for the quarter, compared to analysts' expectations of $7.56 billion. Penske Automotive Group had a net margin of 3.02% and a return on equity of 18.05%. As a group, research analysts predict that Penske Automotive Group will post 13.86 earnings per share for the current fiscal year.

Insider Buying and Selling at Penske Automotive Group

In other news, EVP Claude H. Denker III sold 8,746 shares of the company's stock in a transaction that occurred on Friday, February 14th. The shares were sold at an average price of $173.03, for a total value of $1,513,320.38. Following the completion of the sale, the executive vice president now owns 28,917 shares of the company's stock, valued at approximately $5,003,508.51. This represents a 23.22 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director John Barr sold 1,529 shares of Penske Automotive Group stock in a transaction that occurred on Thursday, March 13th. The shares were sold at an average price of $155.45, for a total transaction of $237,683.05. The disclosure for this sale can be found here. 51.70% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Penske Automotive Group

A number of institutional investors have recently added to or reduced their stakes in the stock. Janus Henderson Group PLC lifted its position in shares of Penske Automotive Group by 36.9% during the third quarter. Janus Henderson Group PLC now owns 39,569 shares of the company's stock valued at $6,426,000 after buying an additional 10,663 shares during the last quarter. Highland Capital Management LLC purchased a new stake in Penske Automotive Group during the fourth quarter valued at approximately $240,000. Cerity Partners LLC boosted its stake in Penske Automotive Group by 176.1% in the third quarter. Cerity Partners LLC now owns 13,333 shares of the company's stock valued at $2,166,000 after acquiring an additional 8,504 shares in the last quarter. Blue Trust Inc. grew its holdings in Penske Automotive Group by 28.3% in the fourth quarter. Blue Trust Inc. now owns 1,221 shares of the company's stock worth $198,000 after purchasing an additional 269 shares during the last quarter. Finally, Merit Financial Group LLC acquired a new position in shares of Penske Automotive Group during the fourth quarter worth $287,000. Institutional investors own 77.08% of the company's stock.

Penske Automotive Group Company Profile

(

Get Free Report)

Penske Automotive Group, Inc, a diversified transportation services company, operates automotive and commercial truck dealerships worldwide. The company operates through four segments: Retail Automotive, Retail Commercial Truck, Other, and Non-Automotive Investments. It operates dealerships under franchise agreements with various automotive manufacturers and distributors.

See Also

Before you consider Penske Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penske Automotive Group wasn't on the list.

While Penske Automotive Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.