Pembina Pipeline (TSE:PPL - Get Free Report) NYSE: PBA had its price objective boosted by JPMorgan Chase & Co. from C$60.00 to C$62.00 in a report released on Monday,BayStreet.CA reports. The brokerage currently has a "neutral" rating on the stock. JPMorgan Chase & Co.'s price objective would suggest a potential upside of 17.25% from the stock's previous close.

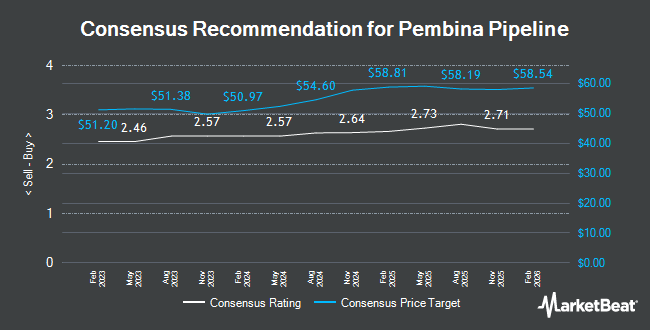

Several other brokerages have also issued reports on PPL. UBS Group decreased their price target on shares of Pembina Pipeline from C$62.00 to C$57.00 in a report on Wednesday, March 5th. Raymond James increased their price target on Pembina Pipeline from C$62.00 to C$63.00 in a research note on Monday, March 3rd. Barclays set a C$63.00 price objective on Pembina Pipeline and gave the stock an "overweight" rating in a research report on Thursday, December 12th. TD Securities set a C$66.00 target price on Pembina Pipeline and gave the company a "buy" rating in a research report on Wednesday, January 15th. Finally, Wells Fargo & Company lowered shares of Pembina Pipeline from an "overweight" rating to an "equal weight" rating and reduced their target price for the stock from C$63.00 to C$57.00 in a report on Wednesday, December 18th. Five equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, Pembina Pipeline currently has an average rating of "Moderate Buy" and an average target price of C$59.31.

Get Our Latest Analysis on PPL

Pembina Pipeline Price Performance

Shares of PPL traded down C$4.05 during midday trading on Monday, hitting C$52.88. The company's stock had a trading volume of 6,421,704 shares, compared to its average volume of 3,239,336. The company has a quick ratio of 0.50, a current ratio of 0.65 and a debt-to-equity ratio of 78.68. Pembina Pipeline has a one year low of C$46.71 and a one year high of C$60.72. The stock has a market capitalization of C$30.57 billion, a price-to-earnings ratio of 15.35, a price-to-earnings-growth ratio of 1.58 and a beta of 1.48. The company's fifty day simple moving average is C$54.23 and its two-hundred day simple moving average is C$55.40.

Insider Buying and Selling

In other news, Senior Officer Chris Scherman acquired 797 shares of the firm's stock in a transaction on Friday, March 21st. The stock was purchased at an average price of C$54.05 per share, for a total transaction of C$43,077.85. Also, Senior Officer J. Scott Burrows sold 18,106 shares of the business's stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of C$55.43, for a total value of C$1,003,615.58. Over the last 90 days, insiders purchased 13,984 shares of company stock worth $755,351. 0.05% of the stock is owned by corporate insiders.

Pembina Pipeline Company Profile

(

Get Free Report)

Pembina Pipeline is midstream company serving the Canadian and North American ( primarily Bakken) markets with an integrated product portfolio. The firms' assets include pipelines and gas gathering, as well as assets across fractionation, storage, and propane exports.

See Also

Before you consider Pembina Pipeline, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pembina Pipeline wasn't on the list.

While Pembina Pipeline currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.