Planet Fitness (NYSE:PLNT - Free Report) had its target price boosted by JPMorgan Chase & Co. from $80.00 to $90.00 in a report released on Friday morning,Benzinga reports. JPMorgan Chase & Co. currently has an overweight rating on the stock.

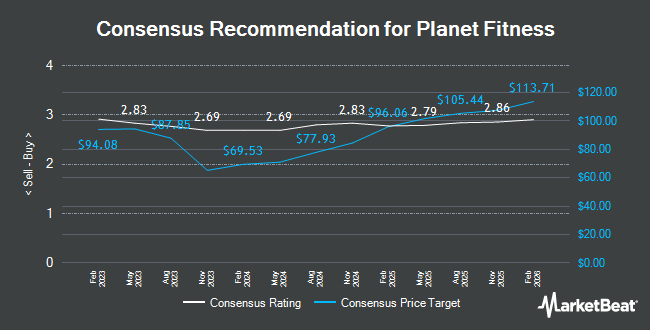

PLNT has been the topic of a number of other reports. Morgan Stanley raised their price objective on Planet Fitness from $84.00 to $89.00 and gave the company an "overweight" rating in a research note on Tuesday, October 29th. BMO Capital Markets restated an "outperform" rating and set a $87.00 price target (up from $80.00) on shares of Planet Fitness in a research report on Wednesday, August 7th. Piper Sandler lifted their price target on Planet Fitness from $80.00 to $89.00 and gave the stock an "overweight" rating in a research note on Thursday, July 11th. Roth Mkm increased their price objective on Planet Fitness from $73.00 to $88.00 and gave the company a "buy" rating in a research note on Wednesday, August 7th. Finally, Macquarie restated a "neutral" rating and issued a $99.00 target price (up previously from $91.00) on shares of Planet Fitness in a report on Friday. Five analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, Planet Fitness currently has a consensus rating of "Moderate Buy" and an average target price of $91.81.

Get Our Latest Report on Planet Fitness

Planet Fitness Stock Performance

PLNT traded up $1.13 during trading on Friday, reaching $95.30. The stock had a trading volume of 1,981,655 shares, compared to its average volume of 1,555,188. The business has a 50-day moving average of $81.47 and a 200-day moving average of $74.53. Planet Fitness has a one year low of $54.35 and a one year high of $98.59. The stock has a market cap of $8.12 billion, a PE ratio of 52.29, a PEG ratio of 2.84 and a beta of 1.49.

Planet Fitness (NYSE:PLNT - Get Free Report) last released its earnings results on Thursday, November 7th. The company reported $0.64 earnings per share for the quarter, topping analysts' consensus estimates of $0.57 by $0.07. Planet Fitness had a negative return on equity of 121.99% and a net margin of 14.16%. The company had revenue of $292.20 million during the quarter, compared to the consensus estimate of $283.79 million. During the same quarter in the previous year, the company posted $0.59 EPS. Planet Fitness's quarterly revenue was up 5.3% compared to the same quarter last year. Equities research analysts forecast that Planet Fitness will post 2.43 EPS for the current fiscal year.

Institutional Investors Weigh In On Planet Fitness

Hedge funds have recently modified their holdings of the business. William Blair Investment Management LLC purchased a new stake in Planet Fitness in the 2nd quarter worth approximately $166,978,000. Anomaly Capital Management LP bought a new stake in shares of Planet Fitness during the 2nd quarter valued at $106,795,000. Point72 Asset Management L.P. lifted its stake in shares of Planet Fitness by 169.8% during the 2nd quarter. Point72 Asset Management L.P. now owns 1,317,909 shares of the company's stock valued at $96,985,000 after buying an additional 829,509 shares in the last quarter. Steadfast Capital Management LP lifted its stake in shares of Planet Fitness by 97.7% during the 1st quarter. Steadfast Capital Management LP now owns 1,381,860 shares of the company's stock valued at $86,546,000 after buying an additional 682,863 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD increased its stake in Planet Fitness by 35.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,859,366 shares of the company's stock worth $116,453,000 after buying an additional 483,586 shares in the last quarter. Institutional investors own 95.53% of the company's stock.

Planet Fitness Company Profile

(

Get Free Report)

Planet Fitness, Inc, together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand. The company operates through three segments: Franchise, Corporate-Owned Stores, and Equipment. The company is involved in franchising business in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia.

Read More

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.