PulteGroup (NYSE:PHM - Get Free Report) had its target price reduced by JPMorgan Chase & Co. from $162.00 to $155.00 in a report released on Friday,Benzinga reports. The firm currently has an "overweight" rating on the construction company's stock. JPMorgan Chase & Co.'s target price points to a potential upside of 30.87% from the company's current price.

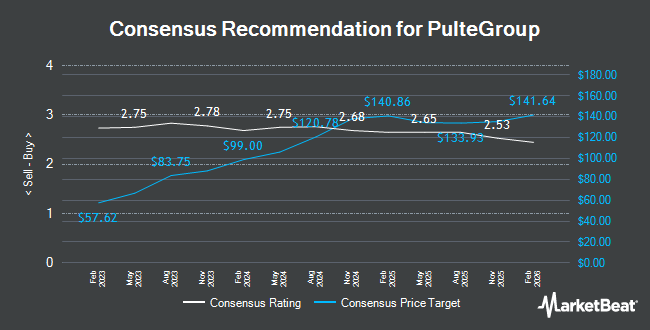

Several other brokerages also recently issued reports on PHM. Wedbush reiterated a "neutral" rating and issued a $115.00 price target on shares of PulteGroup in a report on Tuesday, October 22nd. BTIG Research boosted their price objective on PulteGroup from $139.00 to $156.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. StockNews.com cut PulteGroup from a "buy" rating to a "hold" rating in a research note on Wednesday. Barclays reaffirmed an "equal weight" rating and set a $140.00 price objective (down from $150.00) on shares of PulteGroup in a research note on Wednesday. Finally, UBS Group raised their price objective on shares of PulteGroup from $148.00 to $154.00 and gave the company a "neutral" rating in a research report on Wednesday, October 23rd. Eight investment analysts have rated the stock with a hold rating and nine have given a buy rating to the stock. According to MarketBeat, PulteGroup has a consensus rating of "Moderate Buy" and a consensus target price of $144.50.

Read Our Latest Analysis on PulteGroup

PulteGroup Stock Down 1.9 %

Shares of NYSE PHM traded down $2.25 during midday trading on Friday, hitting $118.44. 2,174,700 shares of the company's stock were exchanged, compared to its average volume of 1,826,453. The company has a debt-to-equity ratio of 0.14, a current ratio of 0.73 and a quick ratio of 0.73. The firm's fifty day simple moving average is $133.50 and its 200-day simple moving average is $127.11. The company has a market cap of $24.29 billion, a PE ratio of 8.72, a P/E/G ratio of 0.50 and a beta of 1.62. PulteGroup has a twelve month low of $99.03 and a twelve month high of $149.47.

PulteGroup (NYSE:PHM - Get Free Report) last released its quarterly earnings data on Tuesday, October 22nd. The construction company reported $3.35 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.10 by $0.25. PulteGroup had a return on equity of 25.30% and a net margin of 16.64%. The firm had revenue of $4.48 billion during the quarter, compared to analysts' expectations of $4.27 billion. During the same quarter in the prior year, the business posted $2.90 earnings per share. PulteGroup's revenue was up 11.8% compared to the same quarter last year. Research analysts predict that PulteGroup will post 12.94 EPS for the current fiscal year.

Institutional Trading of PulteGroup

Institutional investors and hedge funds have recently made changes to their positions in the company. Lord Abbett & CO. LLC increased its stake in PulteGroup by 3,118.4% in the 3rd quarter. Lord Abbett & CO. LLC now owns 376,717 shares of the construction company's stock worth $54,070,000 after acquiring an additional 365,012 shares during the last quarter. Logan Capital Management Inc. grew its stake in shares of PulteGroup by 67.7% during the third quarter. Logan Capital Management Inc. now owns 14,797 shares of the construction company's stock valued at $2,124,000 after buying an additional 5,976 shares during the last quarter. Oddo BHF Asset Management Sas bought a new position in PulteGroup during the 3rd quarter worth approximately $2,973,000. Franklin Resources Inc. grew its holdings in shares of PulteGroup by 5.5% in the third quarter. Franklin Resources Inc. now owns 11,254,274 shares of the construction company's stock worth $1,647,364,000 after purchasing an additional 585,735 shares during the last quarter. Finally, Peapack Gladstone Financial Corp increased its position in shares of PulteGroup by 50.9% in the third quarter. Peapack Gladstone Financial Corp now owns 5,336 shares of the construction company's stock valued at $766,000 after acquiring an additional 1,800 shares during the period. Hedge funds and other institutional investors own 89.90% of the company's stock.

About PulteGroup

(

Get Free Report)

PulteGroup, Inc, through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land. The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, John Wieland Homes and Neighborhoods, and American West brand names.

Featured Stories

Before you consider PulteGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PulteGroup wasn't on the list.

While PulteGroup currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.