HighTower Advisors LLC grew its holdings in shares of JPMorgan Chase & Co. (NYSE:JPM - Free Report) by 5.4% in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 2,881,451 shares of the financial services provider's stock after purchasing an additional 147,134 shares during the quarter. JPMorgan Chase & Co. comprises approximately 0.9% of HighTower Advisors LLC's portfolio, making the stock its 12th biggest holding. HighTower Advisors LLC owned 0.10% of JPMorgan Chase & Co. worth $690,713,000 at the end of the most recent quarter.

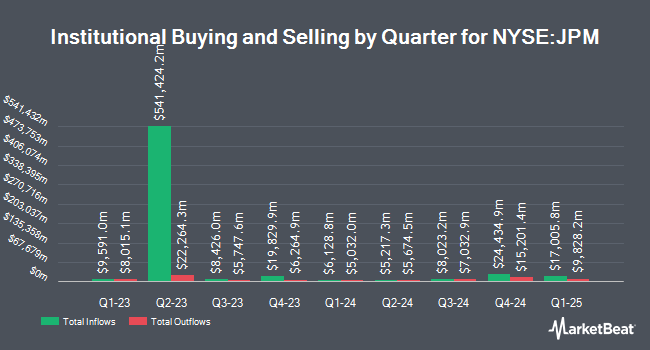

Other large investors have also recently modified their holdings of the company. DDD Partners LLC raised its position in JPMorgan Chase & Co. by 2.8% during the 4th quarter. DDD Partners LLC now owns 1,416 shares of the financial services provider's stock worth $339,000 after buying an additional 38 shares during the last quarter. Blue Bell Private Wealth Management LLC raised its position in JPMorgan Chase & Co. by 1.5% during the fourth quarter. Blue Bell Private Wealth Management LLC now owns 2,594 shares of the financial services provider's stock valued at $622,000 after acquiring an additional 38 shares in the last quarter. Rappaport Reiches Capital Management LLC lifted its holdings in JPMorgan Chase & Co. by 3.8% in the fourth quarter. Rappaport Reiches Capital Management LLC now owns 1,068 shares of the financial services provider's stock valued at $256,000 after acquiring an additional 39 shares during the period. Yoder Wealth Management Inc. boosted its position in JPMorgan Chase & Co. by 2.8% in the 4th quarter. Yoder Wealth Management Inc. now owns 1,436 shares of the financial services provider's stock worth $344,000 after purchasing an additional 39 shares in the last quarter. Finally, Almanack Investment Partners LLC. grew its stake in shares of JPMorgan Chase & Co. by 0.8% during the 4th quarter. Almanack Investment Partners LLC. now owns 5,143 shares of the financial services provider's stock worth $1,233,000 after purchasing an additional 39 shares during the period. Hedge funds and other institutional investors own 71.55% of the company's stock.

Insider Activity

In other JPMorgan Chase & Co. news, insider Robin Leopold sold 1,250 shares of the company's stock in a transaction dated Thursday, February 20th. The stock was sold at an average price of $270.09, for a total transaction of $337,612.50. Following the sale, the insider now owns 50,377 shares in the company, valued at $13,606,323.93. This represents a 2.42 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, COO Jennifer Piepszak sold 4,273 shares of JPMorgan Chase & Co. stock in a transaction dated Thursday, February 20th. The shares were sold at an average price of $269.85, for a total value of $1,153,069.05. Following the completion of the transaction, the chief operating officer now owns 54,469 shares of the company's stock, valued at $14,698,459.65. The trade was a 7.27 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 46,326 shares of company stock worth $12,448,445. Corporate insiders own 0.79% of the company's stock.

Wall Street Analyst Weigh In

JPM has been the subject of several analyst reports. Robert W. Baird raised shares of JPMorgan Chase & Co. from an "underperform" rating to a "neutral" rating and increased their price target for the stock from $215.00 to $220.00 in a report on Friday, March 7th. Truist Financial boosted their price objective on JPMorgan Chase & Co. from $260.00 to $268.00 and gave the stock a "hold" rating in a research note on Thursday, January 16th. Barclays raised their target price on JPMorgan Chase & Co. from $304.00 to $330.00 and gave the company an "overweight" rating in a research report on Thursday, January 16th. Baird R W upgraded JPMorgan Chase & Co. from a "strong sell" rating to a "hold" rating in a research report on Friday, March 7th. Finally, Wolfe Research upgraded JPMorgan Chase & Co. from a "peer perform" rating to an "outperform" rating and set a $269.00 price objective on the stock in a report on Friday, January 3rd. Ten equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $252.89.

Check Out Our Latest Research Report on JPMorgan Chase & Co.

JPMorgan Chase & Co. Trading Up 2.7 %

JPMorgan Chase & Co. stock traded up $6.60 during midday trading on Monday, reaching $248.23. 9,417,743 shares of the stock traded hands, compared to its average volume of 8,869,022. The firm has a market cap of $694.07 billion, a PE ratio of 12.57, a price-to-earnings-growth ratio of 2.83 and a beta of 1.10. The company has a current ratio of 0.88, a quick ratio of 0.89 and a debt-to-equity ratio of 1.24. The company has a 50-day simple moving average of $257.86 and a two-hundred day simple moving average of $239.50. JPMorgan Chase & Co. has a 12-month low of $179.20 and a 12-month high of $280.25.

JPMorgan Chase & Co. (NYSE:JPM - Get Free Report) last announced its quarterly earnings data on Wednesday, January 15th. The financial services provider reported $4.81 earnings per share for the quarter, beating analysts' consensus estimates of $4.03 by $0.78. JPMorgan Chase & Co. had a net margin of 20.96% and a return on equity of 16.99%. The firm had revenue of $42.77 billion during the quarter, compared to analysts' expectations of $41.90 billion. During the same quarter in the previous year, the business posted $3.04 earnings per share. The business's quarterly revenue was up 10.9% compared to the same quarter last year. Research analysts expect that JPMorgan Chase & Co. will post 18.1 earnings per share for the current fiscal year.

JPMorgan Chase & Co. Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 30th. Stockholders of record on Friday, April 4th will be given a dividend of $1.40 per share. The ex-dividend date is Friday, April 4th. This represents a $5.60 dividend on an annualized basis and a dividend yield of 2.26%. This is a positive change from JPMorgan Chase & Co.'s previous quarterly dividend of $1.25. JPMorgan Chase & Co.'s dividend payout ratio is currently 28.37%.

JPMorgan Chase & Co. Company Profile

(

Free Report)

JPMorgan Chase & Co is a financial holding company, which engages in the provision of financial and investment banking services. The firm offers a range of investment banking products and services in all capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, risk management, market making in cash securities and derivative instruments, and brokerage and research.

Further Reading

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.