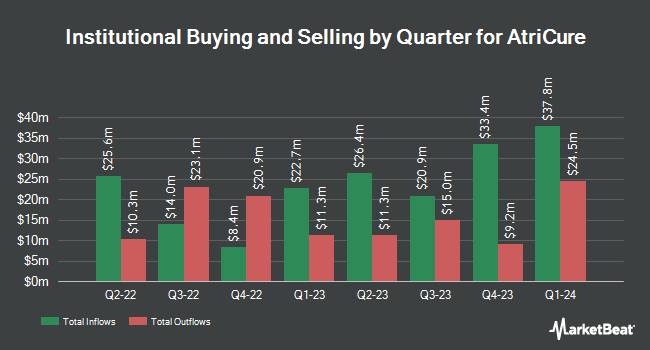

JPMorgan Chase & Co. boosted its stake in AtriCure, Inc. (NASDAQ:ATRC - Free Report) by 43.1% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 365,183 shares of the medical device company's stock after buying an additional 110,039 shares during the period. JPMorgan Chase & Co. owned 0.75% of AtriCure worth $11,160,000 as of its most recent SEC filing.

Other hedge funds also recently added to or reduced their stakes in the company. State Street Corp boosted its position in AtriCure by 4.9% during the 3rd quarter. State Street Corp now owns 1,344,856 shares of the medical device company's stock worth $37,710,000 after acquiring an additional 63,002 shares during the period. Geode Capital Management LLC raised its stake in shares of AtriCure by 2.9% during the third quarter. Geode Capital Management LLC now owns 1,152,628 shares of the medical device company's stock valued at $32,326,000 after purchasing an additional 32,676 shares in the last quarter. Charles Schwab Investment Management Inc. grew its position in AtriCure by 1.2% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 399,428 shares of the medical device company's stock valued at $12,207,000 after buying an additional 4,844 shares in the last quarter. Bank of New York Mellon Corp grew its position in AtriCure by 2.7% in the 4th quarter. Bank of New York Mellon Corp now owns 258,272 shares of the medical device company's stock valued at $7,893,000 after buying an additional 6,809 shares in the last quarter. Finally, Raymond James Financial Inc. acquired a new position in AtriCure during the 4th quarter valued at about $3,716,000. 99.11% of the stock is currently owned by institutional investors.

AtriCure Trading Down 0.8 %

NASDAQ ATRC traded down $0.26 on Tuesday, hitting $32.36. 398,359 shares of the stock were exchanged, compared to its average volume of 662,397. The company's 50-day moving average price is $35.84 and its two-hundred day moving average price is $34.34. The company has a market capitalization of $1.58 billion, a price-to-earnings ratio of -34.06 and a beta of 1.65. AtriCure, Inc. has a 52-week low of $18.94 and a 52-week high of $43.11. The company has a debt-to-equity ratio of 0.13, a current ratio of 3.65 and a quick ratio of 2.62.

Insider Activity at AtriCure

In other news, Director Karen Prange sold 6,100 shares of the company's stock in a transaction dated Wednesday, March 5th. The stock was sold at an average price of $38.12, for a total value of $232,532.00. Following the transaction, the director now owns 17,828 shares in the company, valued at $679,603.36. This represents a 25.49 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 3.20% of the stock is owned by insiders.

Analyst Upgrades and Downgrades

ATRC has been the subject of several recent analyst reports. JPMorgan Chase & Co. decreased their price objective on shares of AtriCure from $51.00 to $46.00 and set an "overweight" rating for the company in a report on Thursday, March 27th. BTIG Research reissued a "buy" rating on shares of AtriCure in a research note on Thursday, March 27th. Needham & Company LLC reaffirmed a "buy" rating and set a $51.00 target price on shares of AtriCure in a research note on Thursday, March 27th. JMP Securities reiterated a "market outperform" rating and issued a $60.00 price target on shares of AtriCure in a research report on Monday, February 10th. Finally, Piper Sandler raised their price objective on shares of AtriCure from $40.00 to $50.00 and gave the company an "overweight" rating in a research report on Thursday, February 13th. One equities research analyst has rated the stock with a hold rating and nine have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $49.44.

Check Out Our Latest Report on AtriCure

AtriCure Company Profile

(

Free Report)

AtriCure, Inc develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, Europe, the Asia-Pacific, and internationally. The company offers Isolator Synergy Clamps, single-use disposable radio frequency products; multifunctional pens and linear ablation devices, such as the MAX Pen device that enables surgeons to evaluate cardiac arrhythmias, perform temporary cardiac pacing, sensing, and stimulation, and ablate cardiac tissue with the same device; and the Coolrail device, which enables users to make longer linear lines of ablation.

Read More

Before you consider AtriCure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AtriCure wasn't on the list.

While AtriCure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.