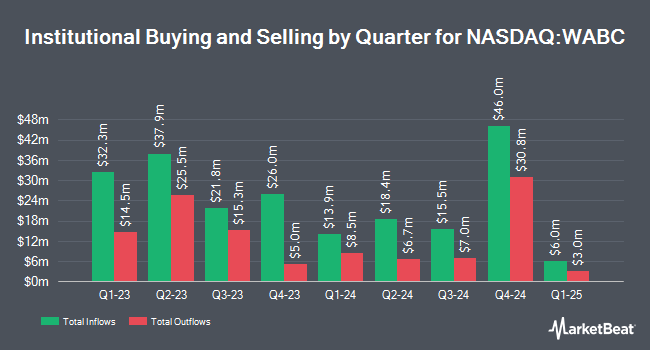

JPMorgan Chase & Co. raised its stake in shares of Westamerica Bancorporation (NASDAQ:WABC - Free Report) by 74.7% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 142,330 shares of the financial services provider's stock after purchasing an additional 60,871 shares during the quarter. JPMorgan Chase & Co. owned 0.53% of Westamerica Bancorporation worth $7,467,000 as of its most recent filing with the Securities and Exchange Commission.

Other large investors also recently modified their holdings of the company. Golden State Wealth Management LLC bought a new position in shares of Westamerica Bancorporation during the 4th quarter worth approximately $65,000. KBC Group NV lifted its holdings in shares of Westamerica Bancorporation by 71.4% during the fourth quarter. KBC Group NV now owns 1,974 shares of the financial services provider's stock valued at $104,000 after acquiring an additional 822 shares during the period. GAMMA Investing LLC lifted its holdings in shares of Westamerica Bancorporation by 14.1% during the fourth quarter. GAMMA Investing LLC now owns 2,166 shares of the financial services provider's stock valued at $114,000 after acquiring an additional 268 shares during the period. Gallacher Capital Management LLC acquired a new stake in shares of Westamerica Bancorporation in the 4th quarter valued at $205,000. Finally, One Capital Management LLC bought a new stake in shares of Westamerica Bancorporation in the 4th quarter worth about $210,000. 81.89% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of research firms have commented on WABC. Keefe, Bruyette & Woods reduced their price target on shares of Westamerica Bancorporation from $58.00 to $55.00 and set a "market perform" rating on the stock in a research report on Monday. Piper Sandler reduced their target price on Westamerica Bancorporation from $54.00 to $50.00 and set a "neutral" rating on the stock in a report on Monday.

Get Our Latest Stock Report on WABC

Westamerica Bancorporation Price Performance

NASDAQ WABC traded up $1.28 on Tuesday, hitting $47.18. 180,635 shares of the company were exchanged, compared to its average volume of 128,500. Westamerica Bancorporation has a 1-year low of $42.00 and a 1-year high of $59.97. The firm has a 50 day moving average of $48.95 and a two-hundred day moving average of $51.61. The company has a current ratio of 0.27, a quick ratio of 0.26 and a debt-to-equity ratio of 0.15. The company has a market cap of $1.26 billion, a P/E ratio of 9.07 and a beta of 0.63.

Westamerica Bancorporation (NASDAQ:WABC - Get Free Report) last announced its earnings results on Thursday, April 17th. The financial services provider reported $1.16 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.09 by $0.07. The company had revenue of $66.71 million for the quarter, compared to analyst estimates of $66.47 million. Westamerica Bancorporation had a net margin of 44.55% and a return on equity of 16.15%. On average, equities analysts predict that Westamerica Bancorporation will post 4.35 EPS for the current year.

Westamerica Bancorporation Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, February 14th. Shareholders of record on Monday, February 3rd were given a $0.44 dividend. The ex-dividend date of this dividend was Monday, February 3rd. This represents a $1.76 dividend on an annualized basis and a yield of 3.73%. Westamerica Bancorporation's payout ratio is 35.27%.

Westamerica Bancorporation Profile

(

Free Report)

Westamerica Bancorporation operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers. The company accepts various deposit products, including retail savings and checking accounts, as well as certificates of deposit.

See Also

Before you consider Westamerica Bancorporation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Westamerica Bancorporation wasn't on the list.

While Westamerica Bancorporation currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.