Cushman & Wakefield (NYSE:CWK - Free Report) had its price objective hoisted by JPMorgan Chase & Co. from $14.00 to $17.00 in a report released on Monday,Benzinga reports. The firm currently has a neutral rating on the stock.

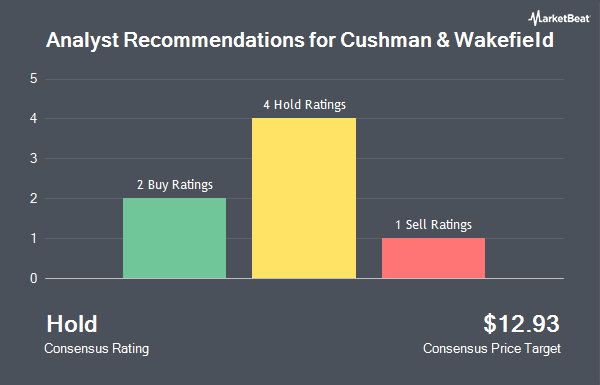

Separately, The Goldman Sachs Group started coverage on shares of Cushman & Wakefield in a research note on Friday, December 6th. They issued a "sell" rating and a $15.00 price objective for the company. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and two have issued a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $15.25.

Get Our Latest Research Report on Cushman & Wakefield

Cushman & Wakefield Trading Up 1.0 %

Shares of Cushman & Wakefield stock traded up $0.15 on Monday, hitting $15.02. 1,461,637 shares of the company's stock traded hands, compared to its average volume of 2,136,564. The company has a debt-to-equity ratio of 1.76, a current ratio of 1.18 and a quick ratio of 1.18. The company has a market capitalization of $3.45 billion, a price-to-earnings ratio of 40.59 and a beta of 1.32. The company has a fifty day moving average of $14.07 and a two-hundred day moving average of $12.80. Cushman & Wakefield has a one year low of $9.24 and a one year high of $16.11.

Cushman & Wakefield (NYSE:CWK - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The company reported $0.23 EPS for the quarter, beating analysts' consensus estimates of $0.21 by $0.02. The company had revenue of $2.34 billion during the quarter, compared to the consensus estimate of $1.61 billion. Cushman & Wakefield had a return on equity of 12.10% and a net margin of 0.94%. Cushman & Wakefield's revenue was up 2.5% on a year-over-year basis. During the same period last year, the business posted $0.21 earnings per share. As a group, sell-side analysts expect that Cushman & Wakefield will post 0.88 earnings per share for the current year.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the business. Blue Trust Inc. boosted its stake in shares of Cushman & Wakefield by 137.5% in the third quarter. Blue Trust Inc. now owns 3,501 shares of the company's stock worth $48,000 after acquiring an additional 2,027 shares during the period. GAMMA Investing LLC grew its stake in Cushman & Wakefield by 45.8% in the third quarter. GAMMA Investing LLC now owns 5,186 shares of the company's stock worth $71,000 after purchasing an additional 1,629 shares in the last quarter. CWM LLC increased its position in Cushman & Wakefield by 61.4% during the 2nd quarter. CWM LLC now owns 5,468 shares of the company's stock valued at $57,000 after purchasing an additional 2,080 shares during the period. KBC Group NV lifted its holdings in Cushman & Wakefield by 31.7% during the third quarter. KBC Group NV now owns 7,961 shares of the company's stock worth $109,000 after buying an additional 1,915 shares during the period. Finally, Profund Advisors LLC bought a new stake in Cushman & Wakefield during the second quarter valued at about $105,000. 95.56% of the stock is currently owned by institutional investors.

About Cushman & Wakefield

(

Get Free Report)

Cushman & Wakefield plc, together with its subsidiaries, provides commercial real estate services under the Cushman & Wakefield brand in the United States, Australia, the United Kingdom, and internationally. The company operates through Americas; Europe, Middle East and Africa; and Asia Pacific segments.

Featured Stories

Before you consider Cushman & Wakefield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cushman & Wakefield wasn't on the list.

While Cushman & Wakefield currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.