JPMorgan Chase & Co. trimmed its position in American Public Education, Inc. (NASDAQ:APEI - Free Report) by 87.2% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 7,021 shares of the company's stock after selling 48,036 shares during the quarter. JPMorgan Chase & Co.'s holdings in American Public Education were worth $104,000 at the end of the most recent quarter.

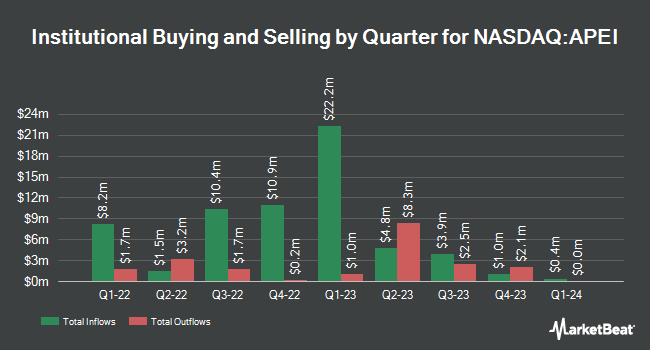

Other hedge funds and other institutional investors have also modified their holdings of the company. Geode Capital Management LLC increased its stake in American Public Education by 0.6% during the 3rd quarter. Geode Capital Management LLC now owns 404,168 shares of the company's stock worth $5,963,000 after buying an additional 2,573 shares during the period. State Street Corp increased its position in shares of American Public Education by 27.2% during the third quarter. State Street Corp now owns 275,889 shares of the company's stock worth $4,069,000 after acquiring an additional 58,984 shares during the last quarter. Segall Bryant & Hamill LLC acquired a new position in shares of American Public Education in the third quarter worth about $1,691,000. FMR LLC boosted its holdings in American Public Education by 350.3% in the third quarter. FMR LLC now owns 11,658 shares of the company's stock valued at $172,000 after purchasing an additional 9,069 shares during the last quarter. Finally, Barclays PLC grew its stake in American Public Education by 17.4% during the 3rd quarter. Barclays PLC now owns 28,078 shares of the company's stock valued at $414,000 after purchasing an additional 4,167 shares in the last quarter. 79.62% of the stock is owned by institutional investors and hedge funds.

American Public Education Stock Performance

APEI traded down $0.42 during trading hours on Thursday, hitting $21.97. 103,260 shares of the stock were exchanged, compared to its average volume of 85,373. The stock has a market cap of $389.09 million, a price-to-earnings ratio of 39.23, a price-to-earnings-growth ratio of 1.10 and a beta of 1.27. The stock has a 50-day simple moving average of $21.44 and a 200-day simple moving average of $17.92. The company has a debt-to-equity ratio of 0.37, a current ratio of 2.65 and a quick ratio of 2.65. American Public Education, Inc. has a 12 month low of $10.30 and a 12 month high of $23.84.

Analyst Upgrades and Downgrades

APEI has been the subject of several research analyst reports. B. Riley increased their target price on American Public Education from $22.00 to $25.00 and gave the company a "buy" rating in a research note on Thursday, November 7th. Truist Financial increased their price objective on shares of American Public Education from $15.00 to $20.00 and gave the company a "hold" rating in a research note on Thursday, November 14th. StockNews.com raised shares of American Public Education from a "hold" rating to a "buy" rating in a research report on Thursday, January 2nd. Finally, Barrington Research increased their price target on shares of American Public Education from $18.00 to $24.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th.

Check Out Our Latest Analysis on American Public Education

American Public Education Company Profile

(

Free Report)

American Public Education, Inc, together with its subsidiaries, provides online and campus-based postsecondary education and career learning in the United States. It operates through three segments: American Public University System, Rasmussen University, and Hondros College of Nursing. The company offers 184 degree programs and 134 certificate programs in various fields of study, including nursing, national security, military studies, intelligence, homeland security, business, health science, information technology, justice studies, education, and liberal arts; and career learning opportunities in leadership, finance, human resources, and other fields of study critical to the federal government workforce.

Further Reading

Before you consider American Public Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Public Education wasn't on the list.

While American Public Education currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.