JPMorgan Chase & Co. reaffirmed their neutral rating on shares of Angi (NASDAQ:ANGI - Free Report) in a report issued on Wednesday morning, Marketbeat reports.

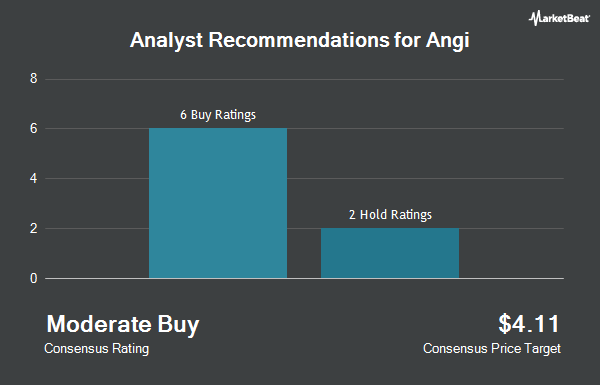

A number of other equities research analysts also recently weighed in on ANGI. KeyCorp lowered their target price on Angi from $3.00 to $2.00 and set an "overweight" rating for the company in a report on Wednesday, November 20th. The Goldman Sachs Group downgraded shares of Angi from a "buy" rating to a "neutral" rating and dropped their target price for the company from $3.25 to $2.50 in a research report on Wednesday, November 13th. JMP Securities restated a "market outperform" rating and issued a $3.00 price target on shares of Angi in a report on Monday. UBS Group raised shares of Angi to a "hold" rating in a research note on Monday, October 28th. Finally, Benchmark cut their price objective on shares of Angi from $7.00 to $6.00 and set a "buy" rating on the stock in a research report on Wednesday, November 13th. Five equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $3.11.

Get Our Latest Analysis on ANGI

Angi Trading Down 5.2 %

Shares of NASDAQ:ANGI traded down $0.09 during trading on Wednesday, reaching $1.64. The stock had a trading volume of 1,429,391 shares, compared to its average volume of 783,408. Angi has a 52 week low of $1.62 and a 52 week high of $3.10. The firm's fifty day moving average is $2.16 and its 200 day moving average is $2.26. The stock has a market cap of $815.52 million, a price-to-earnings ratio of 23.43 and a beta of 1.86. The company has a debt-to-equity ratio of 0.46, a quick ratio of 2.05 and a current ratio of 2.05.

Angi (NASDAQ:ANGI - Get Free Report) last issued its quarterly earnings results on Monday, November 11th. The technology company reported $0.07 EPS for the quarter. Angi had a net margin of 2.61% and a return on equity of 3.79%. The business had revenue of $296.72 million for the quarter, compared to analysts' expectations of $295.90 million. During the same quarter in the prior year, the firm posted ($0.01) earnings per share. As a group, equities analysts forecast that Angi will post 0.08 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the business. Headlands Technologies LLC bought a new position in Angi in the 2nd quarter valued at about $26,000. Barclays PLC raised its stake in shares of Angi by 1,255.5% in the third quarter. Barclays PLC now owns 16,401 shares of the technology company's stock worth $42,000 after purchasing an additional 15,191 shares during the last quarter. Centiva Capital LP bought a new position in shares of Angi in the third quarter valued at approximately $46,000. Susquehanna Fundamental Investments LLC purchased a new position in shares of Angi during the second quarter valued at approximately $85,000. Finally, Verition Fund Management LLC purchased a new position in shares of Angi during the third quarter valued at approximately $116,000. 12.84% of the stock is currently owned by institutional investors and hedge funds.

About Angi

(

Get Free Report)

Angi Inc connects home service professionals with consumers in the United States and internationally. The company operates through three segments: Ads and Leads, Services, and International. It provides consumers with tools and resources to help them find local, pre-screened and customer-rated service professionals, matches consumers with independently established home services professionals.

Featured Articles

Before you consider Angi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Angi wasn't on the list.

While Angi currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.