JPMorgan Chase & Co. decreased its position in shares of Elbit Systems Ltd. (NASDAQ:ESLT - Free Report) by 25.8% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 126,687 shares of the aerospace company's stock after selling 44,016 shares during the period. JPMorgan Chase & Co. owned 0.28% of Elbit Systems worth $32,694,000 at the end of the most recent quarter.

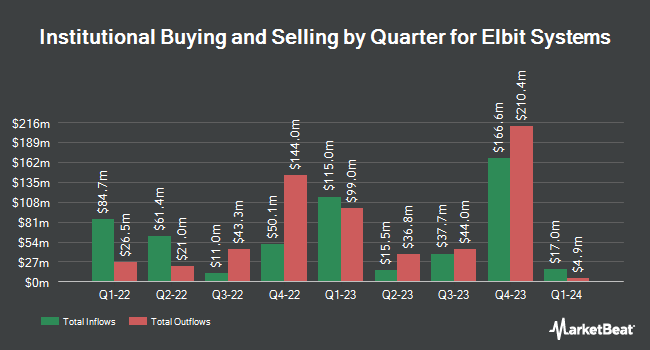

Other hedge funds also recently bought and sold shares of the company. Charles Schwab Investment Management Inc. increased its stake in shares of Elbit Systems by 57.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 2,179 shares of the aerospace company's stock worth $436,000 after purchasing an additional 796 shares during the period. BNP Paribas Financial Markets lifted its holdings in shares of Elbit Systems by 99.4% during the third quarter. BNP Paribas Financial Markets now owns 3,390 shares of the aerospace company's stock worth $678,000 after buying an additional 1,690 shares during the last quarter. Morse Asset Management Inc acquired a new position in shares of Elbit Systems during the third quarter worth approximately $40,000. Point72 Asset Management L.P. boosted its position in shares of Elbit Systems by 44.7% in the third quarter. Point72 Asset Management L.P. now owns 6,800 shares of the aerospace company's stock valued at $1,361,000 after acquiring an additional 2,100 shares during the period. Finally, Quantinno Capital Management LP grew its stake in shares of Elbit Systems by 17.8% in the third quarter. Quantinno Capital Management LP now owns 8,356 shares of the aerospace company's stock worth $1,668,000 after acquiring an additional 1,260 shares during the last quarter. 17.88% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

Separately, StockNews.com downgraded shares of Elbit Systems from a "strong-buy" rating to a "buy" rating in a report on Tuesday, February 25th.

Check Out Our Latest Report on Elbit Systems

Elbit Systems Stock Performance

ESLT traded up $9.95 on Friday, hitting $406.21. 85,863 shares of the stock traded hands, compared to its average volume of 37,872. The business has a fifty day moving average price of $350.90 and a two-hundred day moving average price of $283.94. The company has a current ratio of 1.15, a quick ratio of 0.64 and a debt-to-equity ratio of 0.10. The firm has a market capitalization of $18.06 billion, a PE ratio of 69.44 and a beta of 0.32. Elbit Systems Ltd. has a 52 week low of $175.30 and a 52 week high of $420.00.

Elbit Systems (NASDAQ:ESLT - Get Free Report) last released its quarterly earnings data on Tuesday, March 18th. The aerospace company reported $2.66 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.95 by $0.71. The business had revenue of $1.93 billion for the quarter, compared to analysts' expectations of $1.78 billion. Elbit Systems had a return on equity of 11.34% and a net margin of 4.00%. On average, research analysts predict that Elbit Systems Ltd. will post 8.05 EPS for the current fiscal year.

Elbit Systems Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, May 5th. Stockholders of record on Tuesday, April 22nd will be issued a dividend of $0.60 per share. This represents a $2.40 dividend on an annualized basis and a dividend yield of 0.59%. This is an increase from Elbit Systems's previous quarterly dividend of $0.50. The ex-dividend date is Tuesday, April 22nd. Elbit Systems's dividend payout ratio (DPR) is presently 27.72%.

About Elbit Systems

(

Free Report)

Elbit Systems Ltd. develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications primarily in Israel. The company operates through Aerospace, C4I and Cyber, ISTAR and EW, Land, and Elbit Systems of America segments.

Further Reading

Before you consider Elbit Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elbit Systems wasn't on the list.

While Elbit Systems currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.