Jump Financial LLC lifted its holdings in shares of TORM plc (NASDAQ:TRMD - Free Report) by 310.3% during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 24,173 shares of the company's stock after acquiring an additional 18,282 shares during the quarter. Jump Financial LLC's holdings in TORM were worth $470,000 as of its most recent filing with the Securities and Exchange Commission.

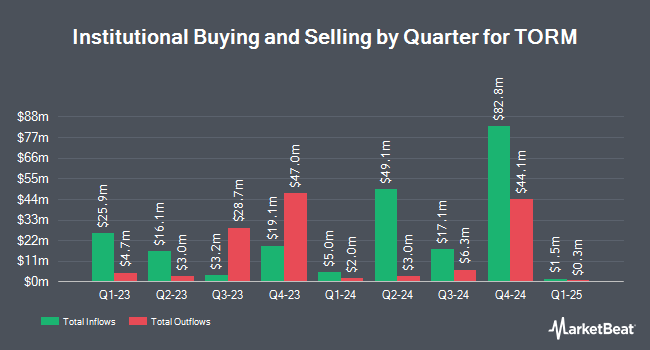

A number of other institutional investors have also recently added to or reduced their stakes in the business. Arrowstreet Capital Limited Partnership lifted its stake in shares of TORM by 94.0% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 4,366,769 shares of the company's stock worth $84,585,000 after purchasing an additional 2,115,672 shares in the last quarter. Vanguard Group Inc. lifted its position in TORM by 22.4% during the 4th quarter. Vanguard Group Inc. now owns 1,885,040 shares of the company's stock worth $36,417,000 after acquiring an additional 345,463 shares in the last quarter. Norges Bank purchased a new position in TORM in the 4th quarter worth approximately $21,273,000. Renaissance Technologies LLC grew its position in TORM by 24.3% in the fourth quarter. Renaissance Technologies LLC now owns 561,889 shares of the company's stock valued at $10,929,000 after acquiring an additional 109,916 shares in the last quarter. Finally, Barclays PLC lifted its position in shares of TORM by 65.4% during the third quarter. Barclays PLC now owns 384,308 shares of the company's stock worth $13,140,000 after purchasing an additional 151,942 shares in the last quarter. 73.89% of the stock is owned by hedge funds and other institutional investors.

TORM Stock Down 1.7 %

Shares of TRMD stock traded down $0.28 during mid-day trading on Monday, reaching $16.26. 481,561 shares of the company were exchanged, compared to its average volume of 970,930. The company has a market capitalization of $1.53 billion, a P/E ratio of 2.10 and a beta of 0.20. The business's 50 day simple moving average is $17.06 and its 200 day simple moving average is $20.32. The company has a debt-to-equity ratio of 0.51, a quick ratio of 2.24 and a current ratio of 2.47. TORM plc has a fifty-two week low of $13.60 and a fifty-two week high of $40.47.

TORM Cuts Dividend

The business also recently announced a quarterly dividend, which was paid on Wednesday, April 2nd. Stockholders of record on Thursday, March 20th were given a $0.60 dividend. This represents a $2.40 annualized dividend and a dividend yield of 14.76%. The ex-dividend date was Thursday, March 20th. TORM's payout ratio is currently 27.43%.

Wall Street Analysts Forecast Growth

Several research firms recently issued reports on TRMD. Kepler Capital Markets downgraded shares of TORM from a "hold" rating to a "strong sell" rating in a research note on Thursday, March 27th. Evercore ISI dropped their target price on TORM from $25.00 to $23.00 and set an "outperform" rating on the stock in a research report on Tuesday, April 22nd.

Read Our Latest Stock Analysis on TRMD

TORM Profile

(

Free Report)

TORM plc, a shipping company, owns and operates a fleet of product tankers in the United Kingdom. It operates in two operating segments, Tanker and Marine Exhaust. The Tanker segment transports refined oil products, such as gasoline, jet fuel, kerosene, naphtha, and gas oil, as well as dirty petroleum products, including fuel oil.

Featured Stories

Before you consider TORM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TORM wasn't on the list.

While TORM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.