Dynamic Technology Lab Private Ltd lessened its holdings in shares of Juniper Networks, Inc. (NYSE:JNPR - Free Report) by 14.3% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 191,667 shares of the network equipment provider's stock after selling 32,109 shares during the period. Juniper Networks accounts for approximately 0.8% of Dynamic Technology Lab Private Ltd's holdings, making the stock its 2nd biggest position. Dynamic Technology Lab Private Ltd owned 0.06% of Juniper Networks worth $7,471,000 at the end of the most recent quarter.

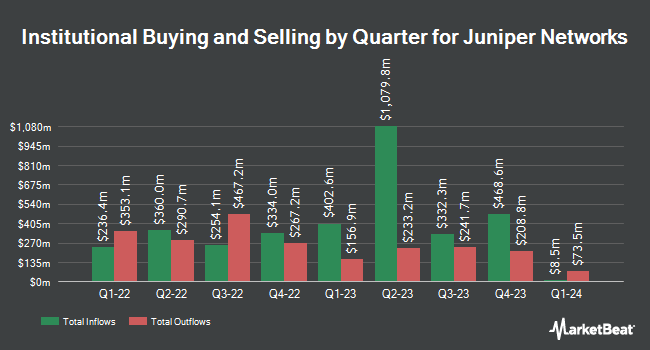

A number of other hedge funds have also recently modified their holdings of the business. Pacer Advisors Inc. boosted its holdings in shares of Juniper Networks by 14,314.7% during the 2nd quarter. Pacer Advisors Inc. now owns 4,832,105 shares of the network equipment provider's stock valued at $176,179,000 after buying an additional 4,798,583 shares in the last quarter. Bank of New York Mellon Corp grew its position in Juniper Networks by 3.8% during the 2nd quarter. Bank of New York Mellon Corp now owns 3,157,579 shares of the network equipment provider's stock valued at $115,125,000 after purchasing an additional 114,795 shares during the last quarter. Charles Schwab Investment Management Inc. grew its position in Juniper Networks by 1.1% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,957,317 shares of the network equipment provider's stock valued at $115,276,000 after purchasing an additional 33,016 shares during the last quarter. Alpine Associates Management Inc. boosted its holdings in shares of Juniper Networks by 12.7% during the 3rd quarter. Alpine Associates Management Inc. now owns 2,676,064 shares of the network equipment provider's stock valued at $104,313,000 after acquiring an additional 301,900 shares during the last quarter. Finally, Hsbc Holdings PLC boosted its holdings in shares of Juniper Networks by 14.4% during the 2nd quarter. Hsbc Holdings PLC now owns 1,911,855 shares of the network equipment provider's stock valued at $69,716,000 after acquiring an additional 240,385 shares during the last quarter. Institutional investors own 91.95% of the company's stock.

Wall Street Analysts Forecast Growth

JNPR has been the topic of a number of recent analyst reports. Barclays dropped their price target on shares of Juniper Networks from $40.00 to $37.00 and set an "equal weight" rating on the stock in a report on Friday, November 1st. StockNews.com initiated coverage on shares of Juniper Networks in a research note on Monday, September 16th. They set a "hold" rating on the stock. Citigroup reiterated a "neutral" rating and set a $40.00 price objective on shares of Juniper Networks in a research report on Monday, September 23rd. Finally, Rosenblatt Securities reiterated a "neutral" rating and set a $40.00 price objective on shares of Juniper Networks in a research report on Friday, November 1st. Eight equities research analysts have rated the stock with a hold rating and one has assigned a buy rating to the stock. According to MarketBeat.com, Juniper Networks currently has a consensus rating of "Hold" and a consensus price target of $39.50.

View Our Latest Stock Analysis on Juniper Networks

Juniper Networks Stock Performance

Juniper Networks stock traded up $0.15 during mid-day trading on Monday, hitting $36.06. The company had a trading volume of 1,429,547 shares, compared to its average volume of 3,760,304. The company has a current ratio of 1.72, a quick ratio of 1.30 and a debt-to-equity ratio of 0.35. Juniper Networks, Inc. has a 12-month low of $27.10 and a 12-month high of $39.79. The company's fifty day moving average is $38.53 and its 200-day moving average is $37.45. The company has a market capitalization of $11.94 billion, a price-to-earnings ratio of 47.49, a P/E/G ratio of 11.33 and a beta of 0.93.

Juniper Networks Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Monday, December 2nd will be paid a $0.22 dividend. This represents a $0.88 dividend on an annualized basis and a dividend yield of 2.44%. The ex-dividend date of this dividend is Monday, December 2nd. Juniper Networks's dividend payout ratio (DPR) is presently 115.79%.

Juniper Networks Company Profile

(

Free Report)

Juniper Networks, Inc designs, develops, and sells network products and services worldwide. The company offers routing products, such as ACX series universal access routers to deploy high-bandwidth services; MX series Ethernet routers that function as a universal edge platform; PTX series packet transport routers; wide-area network SDN controllers; and session smart routers.

Read More

Before you consider Juniper Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Juniper Networks wasn't on the list.

While Juniper Networks currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.