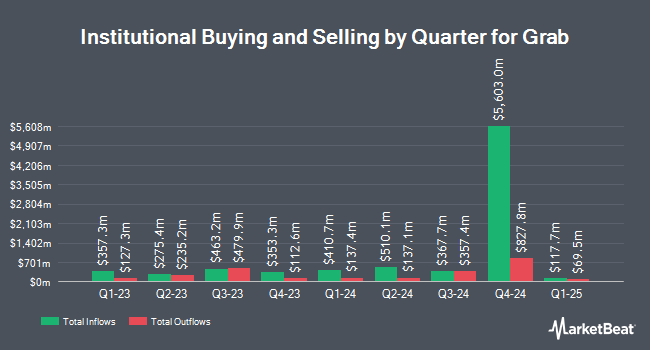

Jupiter Asset Management Ltd. acquired a new stake in shares of Grab Holdings Limited (NASDAQ:GRAB - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 3,731,852 shares of the company's stock, valued at approximately $17,614,000. Jupiter Asset Management Ltd. owned 0.09% of Grab as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors have also recently bought and sold shares of GRAB. State of New Jersey Common Pension Fund D boosted its holdings in shares of Grab by 7.5% in the third quarter. State of New Jersey Common Pension Fund D now owns 815,740 shares of the company's stock valued at $3,100,000 after buying an additional 57,000 shares during the period. Metis Global Partners LLC boosted its holdings in shares of Grab by 10.9% in the third quarter. Metis Global Partners LLC now owns 53,262 shares of the company's stock valued at $202,000 after buying an additional 5,221 shares during the period. CIBC Asset Management Inc boosted its holdings in shares of Grab by 4.9% in the third quarter. CIBC Asset Management Inc now owns 203,901 shares of the company's stock valued at $775,000 after buying an additional 9,466 shares during the period. Empowered Funds LLC boosted its holdings in shares of Grab by 7.7% in the third quarter. Empowered Funds LLC now owns 43,788 shares of the company's stock valued at $166,000 after buying an additional 3,147 shares during the period. Finally, Swiss National Bank boosted its holdings in shares of Grab by 0.9% in the third quarter. Swiss National Bank now owns 6,274,800 shares of the company's stock valued at $23,844,000 after buying an additional 55,100 shares during the period. Institutional investors and hedge funds own 55.52% of the company's stock.

Analysts Set New Price Targets

Several research analysts recently commented on the stock. Citigroup restated a "buy" rating on shares of Grab in a report on Tuesday, February 4th. Mizuho increased their target price on shares of Grab from $5.00 to $6.00 and gave the stock an "outperform" rating in a report on Wednesday, November 13th. Hsbc Global Res upgraded shares of Grab from a "hold" rating to a "strong-buy" rating in a report on Tuesday, February 4th. China Renaissance cut shares of Grab from a "buy" rating to a "hold" rating and set a $5.40 target price for the company. in a report on Thursday, November 21st. Finally, HSBC upgraded shares of Grab from a "hold" rating to a "buy" rating and reduced their target price for the stock from $5.50 to $5.45 in a report on Tuesday, February 4th. Two equities research analysts have rated the stock with a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, Grab has an average rating of "Moderate Buy" and an average price target of $5.62.

Check Out Our Latest Stock Report on GRAB

Grab Price Performance

Shares of NASDAQ:GRAB opened at $4.22 on Thursday. The company has a quick ratio of 2.67, a current ratio of 2.70 and a debt-to-equity ratio of 0.04. Grab Holdings Limited has a twelve month low of $2.98 and a twelve month high of $5.72. The stock's 50 day moving average is $4.69 and its 200-day moving average is $4.41. The firm has a market capitalization of $16.99 billion, a price-to-earnings ratio of -211.00, a PEG ratio of 2.26 and a beta of 0.88.

Grab (NASDAQ:GRAB - Get Free Report) last issued its earnings results on Thursday, February 20th. The company reported $0.01 earnings per share for the quarter, hitting analysts' consensus estimates of $0.01. Grab had a negative return on equity of 1.63% and a negative net margin of 3.72%. The company had revenue of $764.00 million for the quarter, compared to analyst estimates of $762.57 million. Sell-side analysts forecast that Grab Holdings Limited will post 0.05 EPS for the current fiscal year.

Grab Company Profile

(

Free Report)

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.