Jupiter Asset Management Ltd. acquired a new stake in DoorDash, Inc. (NASDAQ:DASH - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 158,558 shares of the company's stock, valued at approximately $26,598,000.

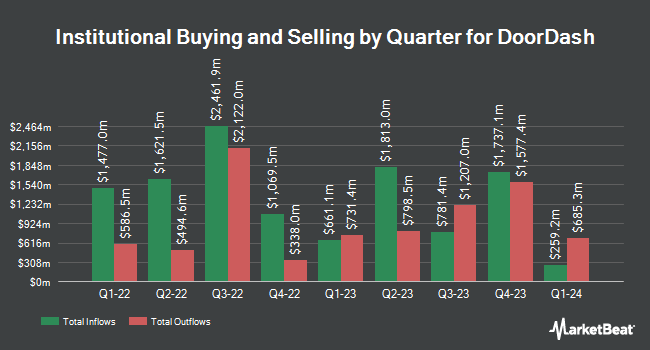

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Swedbank AB grew its holdings in DoorDash by 3.3% during the 4th quarter. Swedbank AB now owns 171,055 shares of the company's stock valued at $28,694,000 after purchasing an additional 5,539 shares during the last quarter. Sanctuary Advisors LLC boosted its position in shares of DoorDash by 48.8% during the third quarter. Sanctuary Advisors LLC now owns 10,663 shares of the company's stock valued at $1,522,000 after buying an additional 3,498 shares during the period. LVW Advisors LLC bought a new position in shares of DoorDash during the fourth quarter valued at approximately $236,000. Nordea Investment Management AB raised its holdings in shares of DoorDash by 37.5% in the fourth quarter. Nordea Investment Management AB now owns 1,746,379 shares of the company's stock worth $294,701,000 after buying an additional 476,360 shares during the period. Finally, Retireful LLC raised its holdings in shares of DoorDash by 121.4% in the fourth quarter. Retireful LLC now owns 9,621 shares of the company's stock worth $1,614,000 after buying an additional 5,275 shares during the period. Hedge funds and other institutional investors own 90.64% of the company's stock.

DoorDash Price Performance

Shares of DASH stock opened at $187.70 on Thursday. The stock's fifty day moving average price is $187.66 and its 200 day moving average price is $166.78. DoorDash, Inc. has a 1-year low of $99.32 and a 1-year high of $215.25. The company has a market cap of $78.85 billion, a price-to-earnings ratio of 695.19 and a beta of 1.70.

Insiders Place Their Bets

In related news, CEO Tony Xu sold 108,332 shares of the firm's stock in a transaction on Monday, December 16th. The stock was sold at an average price of $178.74, for a total value of $19,363,261.68. Following the completion of the transaction, the chief executive officer now owns 1,500 shares in the company, valued at $268,110. This trade represents a 98.63 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Andy Fang sold 50,000 shares of DoorDash stock in a transaction dated Monday, December 16th. The stock was sold at an average price of $178.66, for a total value of $8,933,000.00. Following the sale, the director now directly owns 16,176 shares of the company's stock, valued at approximately $2,890,004.16. This represents a 75.56 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 522,062 shares of company stock valued at $92,218,440. 7.92% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

DASH has been the topic of several research analyst reports. Roth Mkm upped their price objective on DoorDash from $165.00 to $193.00 and gave the company a "neutral" rating in a research report on Wednesday, February 12th. Needham & Company LLC restated a "buy" rating on shares of DoorDash in a report on Monday, March 3rd. Wolfe Research raised their price target on shares of DoorDash from $210.00 to $220.00 and gave the stock an "outperform" rating in a research note on Friday, January 3rd. Argus raised shares of DoorDash from a "hold" rating to a "buy" rating in a research report on Friday, December 20th. Finally, Truist Financial raised their target price on shares of DoorDash from $217.00 to $235.00 and gave the stock a "buy" rating in a research report on Wednesday, February 12th. Ten analysts have rated the stock with a hold rating and twenty-four have given a buy rating to the stock. According to data from MarketBeat.com, DoorDash has an average rating of "Moderate Buy" and an average price target of $206.52.

Get Our Latest Report on DoorDash

DoorDash Company Profile

(

Free Report)

DoorDash, Inc, together with its subsidiaries, operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally. The company operates DoorDash Marketplace and Wolt Marketplace, which provide various services, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider DoorDash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoorDash wasn't on the list.

While DoorDash currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.