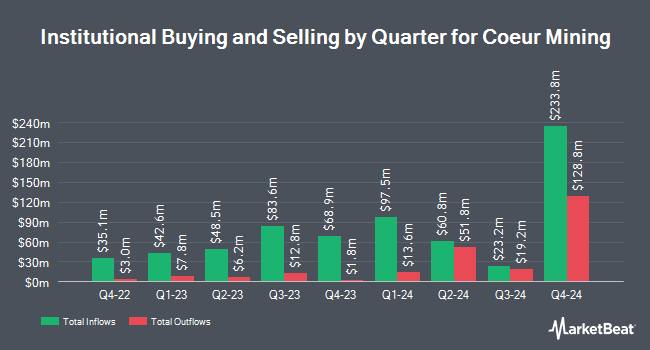

Jupiter Asset Management Ltd. reduced its position in shares of Coeur Mining, Inc. (NYSE:CDE - Free Report) by 14.8% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,307,914 shares of the basic materials company's stock after selling 922,835 shares during the period. Jupiter Asset Management Ltd. owned approximately 1.33% of Coeur Mining worth $30,361,000 at the end of the most recent quarter.

A number of other hedge funds have also recently made changes to their positions in CDE. JPMorgan Chase & Co. grew its position in shares of Coeur Mining by 88.3% during the 3rd quarter. JPMorgan Chase & Co. now owns 1,418,716 shares of the basic materials company's stock valued at $9,761,000 after purchasing an additional 665,452 shares in the last quarter. Raymond James Financial Inc. purchased a new position in shares of Coeur Mining during the 4th quarter valued at $3,738,000. Barclays PLC grew its position in shares of Coeur Mining by 59.2% during the 3rd quarter. Barclays PLC now owns 962,652 shares of the basic materials company's stock valued at $6,624,000 after purchasing an additional 358,097 shares in the last quarter. Jackson Creek Investment Advisors LLC purchased a new position in Coeur Mining in the fourth quarter worth $1,378,000. Finally, BNP Paribas Financial Markets grew its position in Coeur Mining by 180.7% in the third quarter. BNP Paribas Financial Markets now owns 310,577 shares of the basic materials company's stock worth $2,137,000 after acquiring an additional 199,919 shares in the last quarter. 63.01% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

CDE has been the subject of several research reports. TD Cowen upgraded shares of Coeur Mining to a "strong-buy" rating in a research report on Tuesday. Raymond James upgraded shares of Coeur Mining from a "market perform" rating to an "outperform" rating and cut their target price for the stock from $8.75 to $8.25 in a research report on Friday, February 21st. Roth Mkm cut their target price on shares of Coeur Mining from $8.50 to $8.25 and set a "buy" rating for the company in a research report on Friday, February 21st. Cormark upgraded shares of Coeur Mining to a "moderate buy" rating in a research report on Thursday, February 20th. Finally, TD Securities initiated coverage on shares of Coeur Mining in a research report on Tuesday. They issued a "buy" rating and a $7.00 target price for the company. One equities research analyst has rated the stock with a hold rating, six have given a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Buy" and an average price target of $8.05.

Read Our Latest Stock Report on Coeur Mining

Coeur Mining Stock Performance

NYSE CDE opened at $5.72 on Thursday. The company has a 50-day simple moving average of $6.16 and a two-hundred day simple moving average of $6.35. The company has a quick ratio of 0.39, a current ratio of 0.83 and a debt-to-equity ratio of 0.50. Coeur Mining, Inc. has a 12-month low of $2.98 and a 12-month high of $7.72. The firm has a market cap of $3.65 billion, a price-to-earnings ratio of 47.63 and a beta of 1.51.

Coeur Mining (NYSE:CDE - Get Free Report) last posted its quarterly earnings results on Wednesday, February 19th. The basic materials company reported $0.11 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.11. The business had revenue of $305.40 million during the quarter, compared to analyst estimates of $314.32 million. Coeur Mining had a net margin of 5.59% and a return on equity of 6.59%. On average, equities analysts forecast that Coeur Mining, Inc. will post 0.58 EPS for the current year.

Insider Activity

In other news, CFO Thomas S. Whelan acquired 10,000 shares of the stock in a transaction dated Wednesday, February 26th. The stock was purchased at an average cost of $5.25 per share, with a total value of $52,500.00. Following the completion of the purchase, the chief financial officer now owns 668,450 shares in the company, valued at approximately $3,509,362.50. The trade was a 1.52 % increase in their position. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Insiders own 1.56% of the company's stock.

About Coeur Mining

(

Free Report)

Coeur Mining, Inc explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc in May 2013.

Read More

Want to see what other hedge funds are holding CDE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Coeur Mining, Inc. (NYSE:CDE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Coeur Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coeur Mining wasn't on the list.

While Coeur Mining currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.