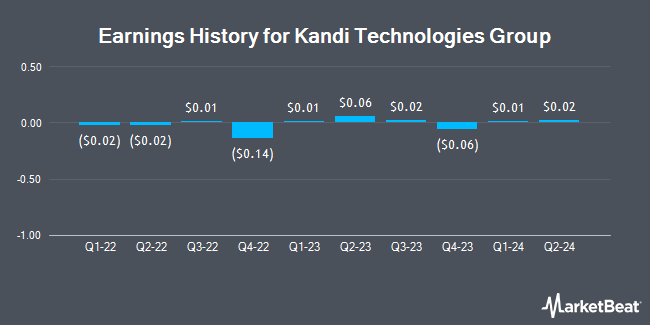

Kandi Technologies Group (NASDAQ:KNDI - Get Free Report) will likely be releasing its earnings data before the market opens on Friday, March 21st. Analysts expect Kandi Technologies Group to post earnings of ($0.02) per share and revenue of $41.00 million for the quarter.

Kandi Technologies Group Stock Performance

NASDAQ:KNDI remained flat at $1.44 during trading hours on Wednesday. The company's stock had a trading volume of 63,222 shares, compared to its average volume of 158,576. The firm has a market capitalization of $123.94 million, a P/E ratio of -18.00 and a beta of 1.37. Kandi Technologies Group has a 1 year low of $0.89 and a 1 year high of $2.98. The company has a 50-day moving average price of $1.31 and a 200-day moving average price of $1.33. The company has a debt-to-equity ratio of 0.02, a current ratio of 3.26 and a quick ratio of 2.55.

Wall Street Analyst Weigh In

Separately, StockNews.com downgraded shares of Kandi Technologies Group from a "hold" rating to a "sell" rating in a report on Tuesday, March 18th.

View Our Latest Analysis on Kandi Technologies Group

About Kandi Technologies Group

(

Get Free Report)

Kandi Technologies Group, Inc engages in designing, developing, manufacturing, and commercializing electric vehicle (EV) products and parts in the People's Republic of China and the United States. It offers also off-road vehicles, including all-terrain vehicles, utility vehicles, go-karts, electric scooters, and electric self-balancing scooters, as well as related parts; and battery packs and smart battery swap system.

Recommended Stories

Before you consider Kandi Technologies Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kandi Technologies Group wasn't on the list.

While Kandi Technologies Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.