Kanzhun (NASDAQ:BZ - Get Free Report) had its price objective decreased by Citigroup from $17.00 to $16.00 in a research report issued on Friday,Benzinga reports. The brokerage currently has a "buy" rating on the stock. Citigroup's price objective points to a potential upside of 18.52% from the stock's previous close.

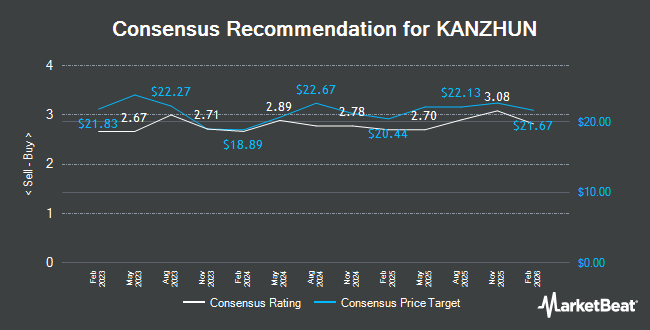

A number of other research firms also recently commented on BZ. Barclays dropped their price objective on Kanzhun from $27.00 to $14.00 and set an "overweight" rating on the stock in a report on Friday, August 30th. CLSA assumed coverage on shares of Kanzhun in a research note on Monday, November 18th. They set an "outperform" rating and a $18.00 price target on the stock. Three analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat, Kanzhun currently has an average rating of "Moderate Buy" and an average target price of $21.57.

Check Out Our Latest Stock Analysis on BZ

Kanzhun Stock Up 7.3 %

Shares of BZ traded up $0.92 during mid-day trading on Friday, reaching $13.50. 4,276,800 shares of the stock traded hands, compared to its average volume of 4,136,780. The firm has a market cap of $5.12 billion, a price-to-earnings ratio of 31.40 and a beta of 0.55. The stock has a fifty day simple moving average of $15.06 and a 200 day simple moving average of $16.21. Kanzhun has a 12-month low of $10.57 and a 12-month high of $22.74.

Kanzhun (NASDAQ:BZ - Get Free Report) last posted its quarterly earnings results on Wednesday, August 28th. The company reported $0.13 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.12 by $0.01. The company had revenue of $263.75 million for the quarter, compared to analysts' expectations of $264.38 million. Kanzhun had a return on equity of 10.19% and a net margin of 20.90%. On average, equities research analysts expect that Kanzhun will post 0.47 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Kanzhun

Hedge funds have recently made changes to their positions in the company. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in shares of Kanzhun by 812.5% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 7,120,232 shares of the company's stock worth $123,607,000 after purchasing an additional 6,339,911 shares during the last quarter. RWC Asset Advisors US LLC grew its holdings in Kanzhun by 79.8% during the 2nd quarter. RWC Asset Advisors US LLC now owns 5,700,186 shares of the company's stock worth $107,220,000 after acquiring an additional 2,529,725 shares during the last quarter. Federated Hermes Inc. increased its position in Kanzhun by 10.4% in the 2nd quarter. Federated Hermes Inc. now owns 5,368,870 shares of the company's stock valued at $100,988,000 after acquiring an additional 507,337 shares in the last quarter. State Street Corp raised its stake in shares of Kanzhun by 2.8% in the third quarter. State Street Corp now owns 5,084,631 shares of the company's stock worth $88,269,000 after acquiring an additional 138,804 shares during the last quarter. Finally, Assenagon Asset Management S.A. acquired a new position in shares of Kanzhun during the third quarter worth approximately $64,220,000. Institutional investors and hedge funds own 60.67% of the company's stock.

Kanzhun Company Profile

(

Get Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

Further Reading

Before you consider Kanzhun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kanzhun wasn't on the list.

While Kanzhun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.