Kayne Anderson Capital Advisors LP grew its stake in Mplx Lp (NYSE:MPLX - Free Report) by 0.8% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 5,735,562 shares of the pipeline company's stock after acquiring an additional 45,271 shares during the quarter. Mplx accounts for 6.5% of Kayne Anderson Capital Advisors LP's holdings, making the stock its 6th biggest position. Kayne Anderson Capital Advisors LP owned 0.56% of Mplx worth $255,003,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

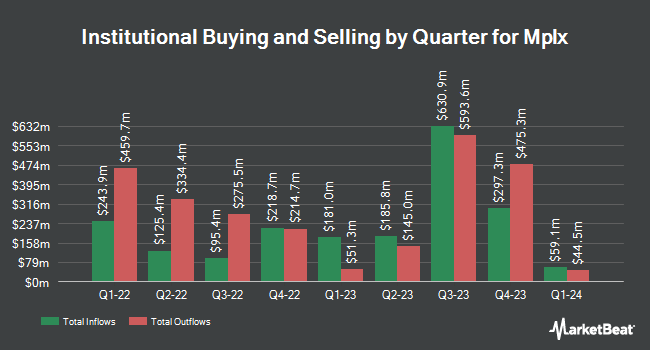

Other large investors have also bought and sold shares of the company. Sei Investments Co. lifted its holdings in Mplx by 47.4% during the 1st quarter. Sei Investments Co. now owns 51,740 shares of the pipeline company's stock valued at $2,150,000 after purchasing an additional 16,637 shares during the last quarter. Acadian Asset Management LLC increased its holdings in shares of Mplx by 79.7% during the first quarter. Acadian Asset Management LLC now owns 252,194 shares of the pipeline company's stock valued at $10,477,000 after acquiring an additional 111,826 shares in the last quarter. Bahl & Gaynor Inc. grew its holdings in Mplx by 11.6% during the first quarter. Bahl & Gaynor Inc. now owns 10,600 shares of the pipeline company's stock worth $441,000 after buying an additional 1,100 shares in the last quarter. Clearbridge Investments LLC boosted its position in Mplx by 4.0% in the first quarter. Clearbridge Investments LLC now owns 5,200,759 shares of the pipeline company's stock worth $216,144,000 after purchasing an additional 201,500 shares during the last quarter. Finally, Lake Street Advisors Group LLC purchased a new position in shares of Mplx during the 1st quarter valued at $301,000. 24.25% of the stock is owned by institutional investors.

Analysts Set New Price Targets

MPLX has been the topic of a number of recent research reports. StockNews.com raised Mplx from a "buy" rating to a "strong-buy" rating in a report on Thursday. Bank of America started coverage on Mplx in a research note on Thursday, October 17th. They issued an "underperform" rating and a $43.00 target price for the company. Wells Fargo & Company boosted their price target on Mplx from $50.00 to $53.00 and gave the stock an "overweight" rating in a research note on Thursday, November 7th. Royal Bank of Canada boosted their price target on Mplx from $50.00 to $52.00 and gave the company an "outperform" rating in a report on Monday. Finally, UBS Group upped their price objective on Mplx from $51.00 to $55.00 and gave the stock a "buy" rating in a research note on Friday. One research analyst has rated the stock with a sell rating, eight have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $48.67.

Read Our Latest Research Report on Mplx

Mplx Stock Up 0.9 %

NYSE MPLX traded up $0.44 during midday trading on Monday, hitting $47.46. 1,864,693 shares of the company traded hands, compared to its average volume of 1,861,702. The company has a debt-to-equity ratio of 1.40, a current ratio of 0.99 and a quick ratio of 0.95. The company has a market cap of $48.44 billion, a PE ratio of 11.19, a price-to-earnings-growth ratio of 1.28 and a beta of 1.37. Mplx Lp has a 52 week low of $35.51 and a 52 week high of $47.62. The company's 50-day simple moving average is $44.51 and its 200-day simple moving average is $42.73.

Mplx (NYSE:MPLX - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The pipeline company reported $1.01 earnings per share for the quarter, missing analysts' consensus estimates of $1.05 by ($0.04). Mplx had a net margin of 36.77% and a return on equity of 32.70%. The company had revenue of $2.97 billion for the quarter, compared to analysts' expectations of $3.09 billion. During the same quarter in the previous year, the business posted $0.89 EPS. The business's quarterly revenue was up 2.1% on a year-over-year basis. As a group, equities research analysts forecast that Mplx Lp will post 4.31 earnings per share for the current year.

Mplx Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, November 15th. Stockholders of record on Friday, November 8th were issued a dividend of $0.9565 per share. This is a boost from Mplx's previous quarterly dividend of $0.85. This represents a $3.83 annualized dividend and a dividend yield of 8.06%. The ex-dividend date of this dividend was Friday, November 8th. Mplx's payout ratio is currently 90.33%.

Mplx Company Profile

(

Free Report)

MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, storage, and marketing of natural gas liquids; gathering, storage, transportation, and distribution of crude oil and refined products, as well as other hydrocarbon-based products and renewables; and sale of residue gas and condensate.

Featured Stories

Before you consider Mplx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mplx wasn't on the list.

While Mplx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.