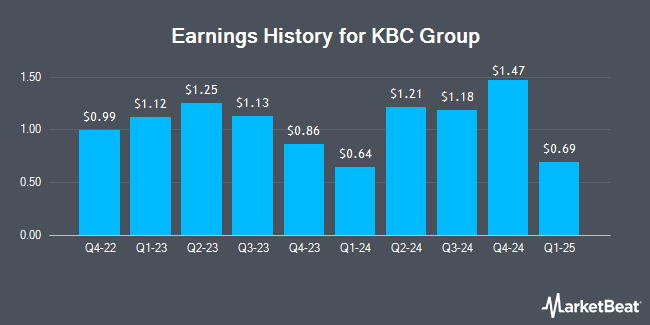

KBC Group (OTCMKTS:KBCSY - Get Free Report) is projected to announce its earnings results on Thursday, February 13th. Analysts expect the company to announce earnings of $1.26 per share for the quarter.

KBC Group (OTCMKTS:KBCSY - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported $1.18 earnings per share for the quarter. KBC Group had a net margin of 11.36% and a return on equity of 12.49%. The company had revenue of $6.92 billion during the quarter. On average, analysts expect KBC Group to post $4 EPS for the current fiscal year and $4 EPS for the next fiscal year.

KBC Group Stock Up 3.5 %

KBCSY traded up $1.33 during trading hours on Thursday, hitting $39.35. 27,987 shares of the company's stock were exchanged, compared to its average volume of 63,798. The stock has a market cap of $32.86 billion, a price-to-earnings ratio of 10.12, a PEG ratio of 1.57 and a beta of 1.12. KBC Group has a 1-year low of $30.13 and a 1-year high of $40.32. The stock's 50-day moving average is $37.94 and its two-hundred day moving average is $37.71.

KBC Group Company Profile

(

Get Free Report)

KBC Group NV, together with its subsidiaries, provides integrated bank-insurance services primarily for retail, private banking, small and medium sized enterprises, and mid-cap clients. The company offers demand deposits and savings accounts; home and mortgage loans; consumer finance and SME funding services; credit, investment fund and asset management, and life and non-life insurance; and cash management, payments, trade finance, lease, money market, capital market products, and stockbroking services.

Further Reading

Before you consider KBC Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KBC Group wasn't on the list.

While KBC Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.