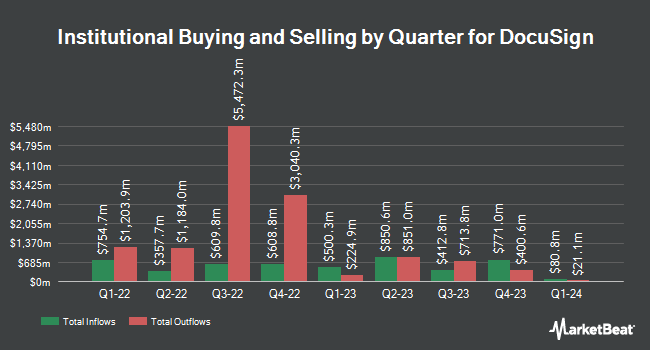

KBC Group NV lifted its stake in shares of DocuSign, Inc. (NASDAQ:DOCU - Free Report) by 209.8% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,156,874 shares of the company's stock after purchasing an additional 783,419 shares during the quarter. KBC Group NV owned about 0.57% of DocuSign worth $71,830,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Inspire Investing LLC bought a new stake in shares of DocuSign during the 3rd quarter worth about $911,000. Comerica Bank raised its holdings in DocuSign by 228.8% during the first quarter. Comerica Bank now owns 28,901 shares of the company's stock worth $1,721,000 after purchasing an additional 20,110 shares in the last quarter. International Assets Investment Management LLC raised its holdings in DocuSign by 5,660.8% during the third quarter. International Assets Investment Management LLC now owns 438,914 shares of the company's stock worth $27,252,000 after purchasing an additional 431,295 shares in the last quarter. Robeco Institutional Asset Management B.V. lifted its position in DocuSign by 7.1% in the third quarter. Robeco Institutional Asset Management B.V. now owns 1,296,517 shares of the company's stock worth $80,501,000 after purchasing an additional 85,987 shares during the period. Finally, PGGM Investments boosted its stake in DocuSign by 36.7% during the 2nd quarter. PGGM Investments now owns 49,812 shares of the company's stock valued at $2,665,000 after purchasing an additional 13,379 shares in the last quarter. 77.64% of the stock is currently owned by institutional investors.

DocuSign Stock Down 2.7 %

Shares of DOCU traded down $2.24 during mid-day trading on Thursday, reaching $79.57. The company's stock had a trading volume of 952,606 shares, compared to its average volume of 2,878,681. The company has a market cap of $16.15 billion, a price-to-earnings ratio of 17.26, a price-to-earnings-growth ratio of 8.73 and a beta of 0.90. The business has a fifty day moving average of $66.18 and a 200 day moving average of $59.18. DocuSign, Inc. has a 1 year low of $42.12 and a 1 year high of $83.68.

DocuSign (NASDAQ:DOCU - Get Free Report) last announced its quarterly earnings data on Thursday, September 5th. The company reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.80 by $0.17. DocuSign had a return on equity of 16.18% and a net margin of 34.56%. The firm had revenue of $736.03 million during the quarter, compared to the consensus estimate of $727.20 million. During the same period in the prior year, the business earned $0.09 EPS. The business's revenue for the quarter was up 7.0% on a year-over-year basis. On average, analysts predict that DocuSign, Inc. will post 1.01 earnings per share for the current year.

Analyst Upgrades and Downgrades

DOCU has been the topic of a number of research reports. Needham & Company LLC reissued a "hold" rating on shares of DocuSign in a research note on Friday, September 6th. Royal Bank of Canada raised their price objective on shares of DocuSign from $52.00 to $57.00 and gave the company a "sector perform" rating in a research report on Friday, September 6th. Bank of America boosted their target price on shares of DocuSign from $60.00 to $68.00 and gave the stock a "neutral" rating in a report on Friday, September 6th. Wells Fargo & Company raised their target price on shares of DocuSign from $48.00 to $50.00 and gave the stock an "underweight" rating in a report on Friday, September 6th. Finally, Citigroup lifted their price target on shares of DocuSign from $86.00 to $87.00 and gave the stock a "buy" rating in a research report on Friday, September 6th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating and two have given a buy rating to the company. Based on data from MarketBeat.com, DocuSign has a consensus rating of "Hold" and a consensus price target of $63.40.

Read Our Latest Stock Analysis on DOCU

Insider Buying and Selling

In other DocuSign news, Director Teresa Briggs sold 534 shares of the stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $56.56, for a total value of $30,203.04. Following the completion of the sale, the director now owns 7,202 shares in the company, valued at $407,345.12. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, CEO Allan C. Thygesen sold 7,725 shares of DocuSign stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $59.09, for a total transaction of $456,470.25. Following the completion of the sale, the chief executive officer now directly owns 102,193 shares in the company, valued at $6,038,584.37. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Teresa Briggs sold 534 shares of the stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $56.56, for a total value of $30,203.04. Following the completion of the transaction, the director now owns 7,202 shares in the company, valued at $407,345.12. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 69,558 shares of company stock worth $4,272,768. 1.66% of the stock is owned by company insiders.

DocuSign Company Profile

(

Free Report)

DocuSign, Inc provides electronic signature solution in the United States and internationally. The company provides e-signature solution that enables sending and signing of agreements on various devices; Contract Lifecycle Management (CLM), which automates workflows across the entire agreement process; Document Generation streamlines the process of generating new, custom agreements; and Gen for Salesforce, which allows sales representatives to automatically generate agreements with a few clicks from within Salesforce.

Further Reading

Before you consider DocuSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DocuSign wasn't on the list.

While DocuSign currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.