KBC Group NV raised its stake in AvalonBay Communities, Inc. (NYSE:AVB - Free Report) by 284.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 146,429 shares of the real estate investment trust's stock after acquiring an additional 108,371 shares during the quarter. KBC Group NV owned about 0.10% of AvalonBay Communities worth $32,983,000 at the end of the most recent reporting period.

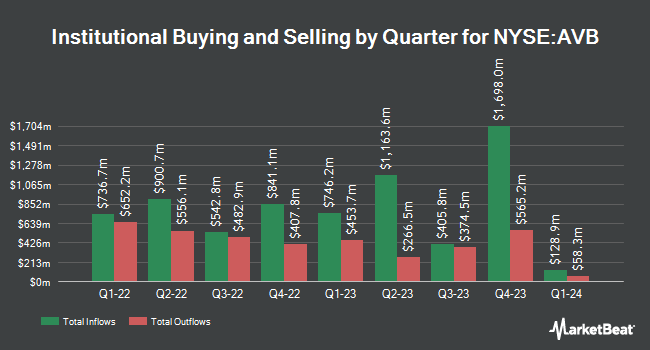

Several other large investors have also recently bought and sold shares of AVB. Opal Wealth Advisors LLC acquired a new stake in shares of AvalonBay Communities during the 2nd quarter worth approximately $32,000. Versant Capital Management Inc boosted its position in shares of AvalonBay Communities by 1,877.8% during the 2nd quarter. Versant Capital Management Inc now owns 178 shares of the real estate investment trust's stock worth $37,000 after acquiring an additional 169 shares in the last quarter. BROOKFIELD Corp ON acquired a new stake in shares of AvalonBay Communities during the 1st quarter worth approximately $39,000. Mather Group LLC. boosted its position in AvalonBay Communities by 38.6% in the third quarter. Mather Group LLC. now owns 201 shares of the real estate investment trust's stock valued at $45,000 after buying an additional 56 shares in the last quarter. Finally, Massmutual Trust Co. FSB ADV increased its holdings in AvalonBay Communities by 38.8% in the 2nd quarter. Massmutual Trust Co. FSB ADV now owns 261 shares of the real estate investment trust's stock worth $54,000 after purchasing an additional 73 shares in the last quarter. 92.61% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, Director Timothy J. Naughton sold 23,697 shares of the company's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $233.47, for a total value of $5,532,538.59. Following the sale, the director now directly owns 87,239 shares of the company's stock, valued at $20,367,689.33. This represents a 21.36 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.42% of the stock is currently owned by corporate insiders.

AvalonBay Communities Price Performance

Shares of AVB traded up $1.48 during midday trading on Friday, hitting $229.41. 645,274 shares of the company traded hands, compared to its average volume of 726,378. The stock has a market cap of $32.63 billion, a price-to-earnings ratio of 31.13, a PEG ratio of 3.40 and a beta of 0.97. The firm has a 50 day moving average of $226.26 and a 200-day moving average of $212.16. The company has a debt-to-equity ratio of 0.70, a quick ratio of 2.03 and a current ratio of 1.64. AvalonBay Communities, Inc. has a 52 week low of $166.60 and a 52 week high of $236.26.

AvalonBay Communities (NYSE:AVB - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The real estate investment trust reported $2.61 earnings per share for the quarter, missing analysts' consensus estimates of $2.71 by ($0.10). AvalonBay Communities had a return on equity of 8.84% and a net margin of 36.20%. The firm had revenue of $734.31 million during the quarter, compared to analysts' expectations of $731.67 million. During the same period last year, the company earned $2.66 earnings per share. On average, analysts forecast that AvalonBay Communities, Inc. will post 11.04 EPS for the current fiscal year.

AvalonBay Communities Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be paid a dividend of $1.70 per share. This represents a $6.80 dividend on an annualized basis and a dividend yield of 2.96%. The ex-dividend date is Tuesday, December 31st. AvalonBay Communities's dividend payout ratio (DPR) is currently 93.02%.

Analyst Ratings Changes

Several analysts recently weighed in on AVB shares. JPMorgan Chase & Co. boosted their price objective on shares of AvalonBay Communities from $212.00 to $247.00 and gave the stock a "neutral" rating in a research note on Monday, September 16th. Zelman & Associates raised shares of AvalonBay Communities to a "hold" rating in a research report on Thursday, September 5th. Evercore ISI lifted their price target on shares of AvalonBay Communities from $225.00 to $229.00 and gave the company an "in-line" rating in a research report on Monday, September 16th. UBS Group lifted their price objective on shares of AvalonBay Communities from $210.00 to $228.00 and gave the company a "neutral" rating in a report on Thursday, July 18th. Finally, Scotiabank cut their target price on AvalonBay Communities from $244.00 to $241.00 and set a "sector perform" rating on the stock in a research report on Thursday. Eleven analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $226.88.

Get Our Latest Research Report on AVB

AvalonBay Communities Profile

(

Free Report)

As of December 31, 2023, the Company owned or held a direct or indirect ownership interest in 299 apartment communities containing 90,669 apartment homes in 12 states and the District of Columbia, of which 18 communities were under development. The Company is an equity REIT in the business of developing, redeveloping, acquiring and managing apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

Featured Stories

Before you consider AvalonBay Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvalonBay Communities wasn't on the list.

While AvalonBay Communities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.