KBC Group NV lessened its position in shares of SEI Investments (NASDAQ:SEIC - Free Report) by 5.7% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 365,808 shares of the asset manager's stock after selling 21,932 shares during the quarter. KBC Group NV owned approximately 0.28% of SEI Investments worth $25,311,000 at the end of the most recent reporting period.

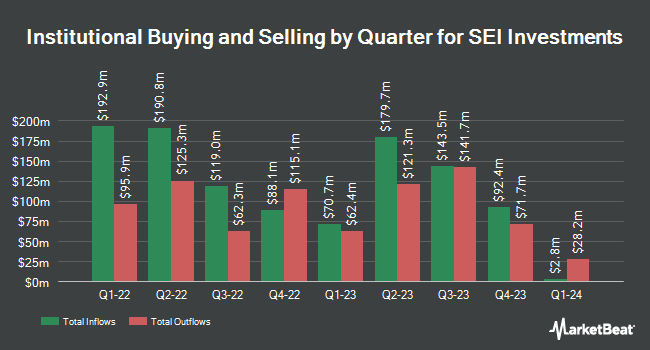

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. SG Americas Securities LLC acquired a new stake in SEI Investments in the 2nd quarter valued at $1,434,000. Mitsubishi UFJ Asset Management Co. Ltd. increased its stake in shares of SEI Investments by 20.6% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 62,518 shares of the asset manager's stock worth $4,495,000 after purchasing an additional 10,670 shares in the last quarter. Russell Investments Group Ltd. raised its position in shares of SEI Investments by 21.7% during the 1st quarter. Russell Investments Group Ltd. now owns 115,367 shares of the asset manager's stock worth $8,296,000 after purchasing an additional 20,533 shares during the last quarter. O Shaughnessy Asset Management LLC raised its position in shares of SEI Investments by 400.7% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 22,919 shares of the asset manager's stock worth $1,648,000 after purchasing an additional 18,342 shares during the last quarter. Finally, Railway Pension Investments Ltd acquired a new stake in SEI Investments in the 1st quarter worth about $949,000. Hedge funds and other institutional investors own 70.59% of the company's stock.

SEI Investments Stock Down 1.6 %

Shares of SEIC traded down $1.29 during midday trading on Friday, reaching $80.23. The company had a trading volume of 536,065 shares, compared to its average volume of 590,796. SEI Investments has a 1-year low of $57.43 and a 1-year high of $81.97. The firm has a 50 day simple moving average of $72.36 and a 200-day simple moving average of $68.59. The stock has a market cap of $10.34 billion, a PE ratio of 19.38, a price-to-earnings-growth ratio of 1.54 and a beta of 0.97.

SEI Investments (NASDAQ:SEIC - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The asset manager reported $1.19 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.07 by $0.12. The firm had revenue of $537.40 million during the quarter, compared to analysts' expectations of $534.08 million. SEI Investments had a net margin of 26.60% and a return on equity of 24.29%. SEI Investments's revenue was up 12.7% compared to the same quarter last year. During the same period last year, the business earned $0.87 earnings per share. As a group, sell-side analysts anticipate that SEI Investments will post 4.38 earnings per share for the current fiscal year.

SEI Investments announced that its Board of Directors has initiated a share repurchase plan on Tuesday, October 22nd that permits the company to repurchase $400.00 million in outstanding shares. This repurchase authorization permits the asset manager to buy up to 4.3% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company's leadership believes its shares are undervalued.

Insider Transactions at SEI Investments

In other SEI Investments news, CEO Ryan Hicke sold 10,000 shares of the company's stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $74.90, for a total value of $749,000.00. Following the transaction, the chief executive officer now owns 147,609 shares of the company's stock, valued at $11,055,914.10. This represents a 6.34 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Chairman Alfred P. West, Jr. sold 44,163 shares of SEI Investments stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $67.55, for a total transaction of $2,983,210.65. Following the sale, the chairman now owns 7,605,414 shares of the company's stock, valued at approximately $513,745,715.70. This represents a 0.58 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 200,646 shares of company stock worth $14,115,934 in the last 90 days. Insiders own 14.30% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages have commented on SEIC. Piper Sandler increased their target price on SEI Investments from $74.00 to $77.00 and gave the company a "neutral" rating in a report on Thursday, October 24th. Keefe, Bruyette & Woods reaffirmed a "market perform" rating and set a $73.00 target price (down previously from $74.00) on shares of SEI Investments in a research note on Thursday, July 25th. Oppenheimer increased their target price on shares of SEI Investments from $81.00 to $85.00 and gave the company an "outperform" rating in a research report on Thursday, October 24th. Finally, Morgan Stanley boosted their price target on shares of SEI Investments from $70.00 to $75.00 and gave the stock an "underweight" rating in a research report on Thursday, October 24th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, SEI Investments currently has a consensus rating of "Hold" and a consensus price target of $77.50.

Read Our Latest Research Report on SEIC

SEI Investments Profile

(

Free Report)

SEI Investments Company is a publicly owned asset management holding company. Through its subsidiaries, the firm provides wealth management, retirement and investment solutions, asset management, asset administration, investment processing outsourcing solutions, financial services, and investment advisory services to its clients.

Read More

Before you consider SEI Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SEI Investments wasn't on the list.

While SEI Investments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.