KBC Group NV lowered its stake in Lantheus Holdings, Inc. (NASDAQ:LNTH - Free Report) by 99.1% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 1,898 shares of the medical equipment provider's stock after selling 199,751 shares during the period. KBC Group NV's holdings in Lantheus were worth $208,000 at the end of the most recent quarter.

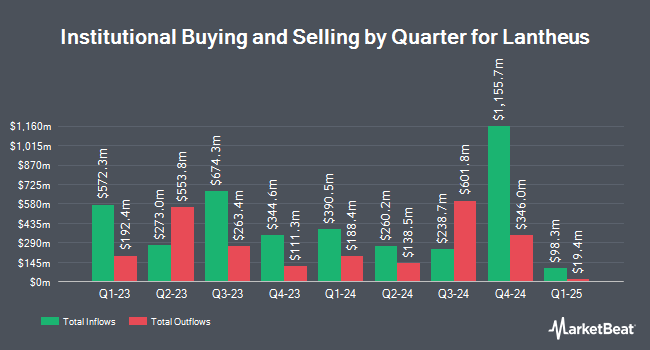

Several other institutional investors have also recently bought and sold shares of LNTH. GAMMA Investing LLC grew its position in shares of Lantheus by 184.1% during the 2nd quarter. GAMMA Investing LLC now owns 321 shares of the medical equipment provider's stock worth $26,000 after buying an additional 208 shares during the period. Signaturefd LLC grew its holdings in Lantheus by 40.5% during the 3rd quarter. Signaturefd LLC now owns 319 shares of the medical equipment provider's stock worth $35,000 after acquiring an additional 92 shares during the period. Nkcfo LLC bought a new stake in shares of Lantheus during the 2nd quarter valued at $47,000. UMB Bank n.a. raised its position in shares of Lantheus by 42.1% during the 3rd quarter. UMB Bank n.a. now owns 425 shares of the medical equipment provider's stock valued at $47,000 after acquiring an additional 126 shares during the last quarter. Finally, Kathleen S. Wright Associates Inc. bought a new position in shares of Lantheus in the 3rd quarter worth $51,000. Institutional investors own 99.06% of the company's stock.

Lantheus Stock Performance

Lantheus stock traded up $0.87 during mid-day trading on Thursday, reaching $87.32. The company's stock had a trading volume of 1,460,023 shares, compared to its average volume of 1,016,292. The business's 50 day simple moving average is $103.76 and its 200 day simple moving average is $96.59. Lantheus Holdings, Inc. has a 12 month low of $50.20 and a 12 month high of $126.89. The company has a market capitalization of $6.07 billion, a price-to-earnings ratio of 14.59 and a beta of 0.51.

Analyst Ratings Changes

A number of equities analysts have issued reports on the company. Truist Financial restated a "buy" rating and set a $120.00 target price (down previously from $135.00) on shares of Lantheus in a report on Friday, November 8th. B. Riley lifted their price target on shares of Lantheus from $105.00 to $146.00 and gave the stock a "buy" rating in a research report on Thursday, July 25th. StockNews.com raised Lantheus from a "hold" rating to a "buy" rating in a research note on Friday, November 8th. Redburn Atlantic assumed coverage on Lantheus in a research note on Tuesday, September 3rd. They issued a "buy" rating and a $175.00 target price for the company. Finally, JMP Securities dropped their price target on Lantheus from $125.00 to $112.00 and set a "market outperform" rating on the stock in a research report on Thursday, November 7th. One research analyst has rated the stock with a hold rating and nine have given a buy rating to the stock. Based on data from MarketBeat.com, Lantheus currently has an average rating of "Moderate Buy" and an average price target of $122.50.

Get Our Latest Stock Analysis on Lantheus

Lantheus Company Profile

(

Free Report)

Lantheus Holdings, Inc develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases worldwide. It provides DEFINITY, an injectable ultrasound enhancing agent used in echocardiography exams; TechneLite, a technetium generator for nuclear medicine procedures; Xenon-133, a radiopharmaceutical gas to assess pulmonary function; Neurolite, an injectable imaging agent to identify the area within the brain where blood flow has been blocked or reduced due to stroke; Cardiolite, an injectable Tc-99m-labeled imaging agent to assess blood flow to the muscle of the heart; and PYLARIFY, an F 18-labelled PSMA-targeted PET imaging agent used for imaging of PSMA positive-lesions in men with prostate cancer.

See Also

Before you consider Lantheus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lantheus wasn't on the list.

While Lantheus currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.