KBC Group NV increased its holdings in shares of State Street Co. (NYSE:STT - Free Report) by 20.5% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 74,680 shares of the asset manager's stock after purchasing an additional 12,707 shares during the period. KBC Group NV's holdings in State Street were worth $6,607,000 at the end of the most recent quarter.

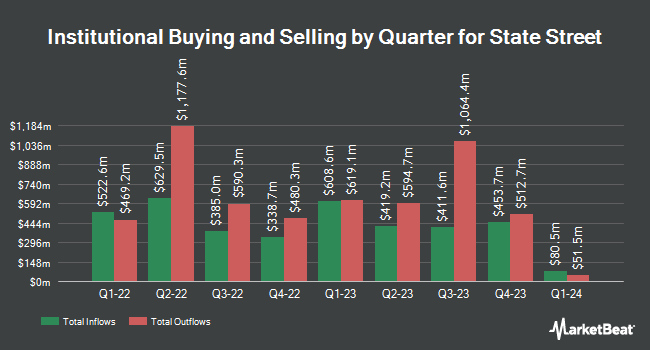

A number of other hedge funds have also added to or reduced their stakes in the business. LRI Investments LLC acquired a new stake in shares of State Street during the 1st quarter worth approximately $25,000. Ashton Thomas Private Wealth LLC bought a new stake in State Street in the second quarter valued at $27,000. Versant Capital Management Inc raised its holdings in shares of State Street by 411.9% during the second quarter. Versant Capital Management Inc now owns 517 shares of the asset manager's stock valued at $38,000 after purchasing an additional 416 shares during the period. Trust Co. of Vermont boosted its position in shares of State Street by 44.4% during the 2nd quarter. Trust Co. of Vermont now owns 650 shares of the asset manager's stock worth $48,000 after purchasing an additional 200 shares in the last quarter. Finally, Capital Performance Advisors LLP bought a new stake in State Street in the 3rd quarter valued at about $54,000. 87.44% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on the company. Barclays boosted their price objective on State Street from $103.00 to $108.00 and gave the company an "overweight" rating in a report on Wednesday, October 16th. Evercore ISI boosted their price target on shares of State Street from $89.00 to $94.00 and gave the company an "outperform" rating in a research note on Wednesday, October 16th. Citigroup raised their price target on shares of State Street from $85.00 to $90.00 and gave the company a "neutral" rating in a research report on Monday, July 22nd. Morgan Stanley upped their target price on shares of State Street from $100.00 to $102.00 and gave the stock an "equal weight" rating in a research note on Wednesday, October 16th. Finally, StockNews.com raised shares of State Street from a "hold" rating to a "buy" rating in a research report on Wednesday, October 16th. Two investment analysts have rated the stock with a sell rating, six have given a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $92.11.

Read Our Latest Stock Report on STT

State Street Stock Performance

Shares of STT stock traded up $1.30 during trading on Friday, reaching $95.48. 2,354,445 shares of the company's stock traded hands, compared to its average volume of 1,954,447. State Street Co. has a 1 year low of $68.92 and a 1 year high of $98.45. The company has a market capitalization of $27.99 billion, a P/E ratio of 15.08, a PEG ratio of 1.18 and a beta of 1.46. The company has a current ratio of 0.56, a quick ratio of 0.56 and a debt-to-equity ratio of 0.91. The firm's 50-day moving average is $90.00 and its 200 day moving average is $82.20.

State Street (NYSE:STT - Get Free Report) last posted its earnings results on Tuesday, October 15th. The asset manager reported $2.26 earnings per share for the quarter, topping analysts' consensus estimates of $2.12 by $0.14. The business had revenue of $3.26 billion for the quarter, compared to analyst estimates of $3.19 billion. State Street had a net margin of 9.87% and a return on equity of 12.02%. State Street's revenue was up 21.1% on a year-over-year basis. During the same quarter in the prior year, the firm posted $1.93 EPS. Equities research analysts expect that State Street Co. will post 8.42 EPS for the current year.

Insider Buying and Selling

In other State Street news, EVP John Plansky sold 13,859 shares of the business's stock in a transaction that occurred on Friday, October 18th. The shares were sold at an average price of $91.32, for a total value of $1,265,603.88. Following the completion of the transaction, the executive vice president now owns 55,108 shares of the company's stock, valued at $5,032,462.56. The trade was a 20.10 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.31% of the stock is owned by company insiders.

About State Street

(

Free Report)

State Street Corporation, through its subsidiaries, provides a range of financial products and services to institutional investors worldwide. The company offers investment servicing products and services, including custody, accounting, regulatory reporting, investor, and performance and analytics; middle office products, such as IBOR, transaction management, loans, cash, derivatives and collateral, record keeping, and client reporting and investment analytics; finance leasing; foreign exchange, and brokerage and other trading services; securities finance and enhanced custody products; deposit and short-term investment facilities; investment manager and alternative investment manager operations outsourcing; performance, risk, and compliance analytics; and financial data management to support institutional investors.

Read More

Before you consider State Street, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and State Street wasn't on the list.

While State Street currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.