KBC Group NV grew its stake in Mid-America Apartment Communities, Inc. (NYSE:MAA - Free Report) by 830.8% during the third quarter, according to its most recent 13F filing with the SEC. The firm owned 125,785 shares of the real estate investment trust's stock after acquiring an additional 112,271 shares during the period. KBC Group NV owned about 0.11% of Mid-America Apartment Communities worth $19,987,000 as of its most recent filing with the SEC.

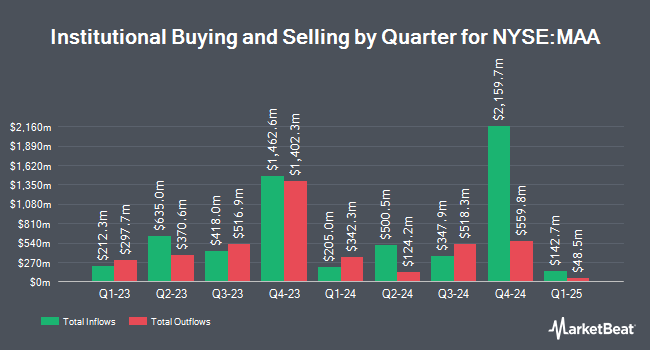

Several other large investors have also recently made changes to their positions in MAA. Duquesne Family Office LLC purchased a new stake in shares of Mid-America Apartment Communities in the 2nd quarter valued at $91,868,000. Long Pond Capital LP boosted its stake in shares of Mid-America Apartment Communities by 550.9% in the second quarter. Long Pond Capital LP now owns 647,011 shares of the real estate investment trust's stock valued at $92,270,000 after purchasing an additional 547,607 shares during the period. Massachusetts Financial Services Co. MA increased its stake in Mid-America Apartment Communities by 17.5% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 2,633,160 shares of the real estate investment trust's stock worth $375,515,000 after buying an additional 393,067 shares during the period. Ceredex Value Advisors LLC increased its stake in Mid-America Apartment Communities by 107.1% during the 2nd quarter. Ceredex Value Advisors LLC now owns 662,110 shares of the real estate investment trust's stock worth $94,424,000 after buying an additional 342,335 shares during the period. Finally, Allspring Global Investments Holdings LLC boosted its position in Mid-America Apartment Communities by 176.9% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 339,081 shares of the real estate investment trust's stock valued at $48,356,000 after buying an additional 216,610 shares during the period. 93.60% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

MAA has been the topic of several recent research reports. StockNews.com downgraded Mid-America Apartment Communities from a "hold" rating to a "sell" rating in a report on Tuesday, November 5th. BNP Paribas assumed coverage on shares of Mid-America Apartment Communities in a report on Wednesday, September 11th. They issued a "neutral" rating and a $169.00 target price for the company. Truist Financial lifted their target price on Mid-America Apartment Communities from $156.00 to $167.00 and gave the stock a "buy" rating in a research report on Monday, August 26th. JMP Securities lifted their price objective on shares of Mid-America Apartment Communities from $145.00 to $160.00 and gave the company a "market outperform" rating in a research note on Friday, August 2nd. Finally, Wedbush increased their price target on Mid-America Apartment Communities from $154.00 to $184.00 and gave the stock an "outperform" rating in a report on Monday, August 5th. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $161.64.

Check Out Our Latest Research Report on Mid-America Apartment Communities

Mid-America Apartment Communities Price Performance

MAA traded up $0.72 during midday trading on Friday, reaching $158.09. 553,097 shares of the company's stock were exchanged, compared to its average volume of 752,468. The business's 50-day moving average price is $157.27 and its 200 day moving average price is $148.15. The stock has a market capitalization of $18.48 billion, a PE ratio of 35.69, a P/E/G ratio of 2.60 and a beta of 0.88. Mid-America Apartment Communities, Inc. has a 1-year low of $120.32 and a 1-year high of $167.39. The company has a debt-to-equity ratio of 0.80, a current ratio of 0.09 and a quick ratio of 0.09.

Mid-America Apartment Communities (NYSE:MAA - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The real estate investment trust reported $0.98 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.18 by ($1.20). The company had revenue of $551.13 million during the quarter, compared to analysts' expectations of $548.53 million. Mid-America Apartment Communities had a net margin of 23.84% and a return on equity of 8.38%. The firm's revenue was up 1.7% compared to the same quarter last year. During the same quarter in the prior year, the company earned $2.29 earnings per share. As a group, equities analysts anticipate that Mid-America Apartment Communities, Inc. will post 8.88 EPS for the current fiscal year.

Mid-America Apartment Communities Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Tuesday, October 15th were given a $1.47 dividend. This represents a $5.88 dividend on an annualized basis and a dividend yield of 3.72%. The ex-dividend date of this dividend was Tuesday, October 15th. Mid-America Apartment Communities's dividend payout ratio is presently 132.73%.

Mid-America Apartment Communities Company Profile

(

Free Report)

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Read More

Before you consider Mid-America Apartment Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid-America Apartment Communities wasn't on the list.

While Mid-America Apartment Communities currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.