KBC Group NV boosted its holdings in The Cooper Companies, Inc. (NASDAQ:COO - Free Report) by 5.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 258,460 shares of the medical device company's stock after buying an additional 12,435 shares during the quarter. KBC Group NV owned approximately 0.13% of Cooper Companies worth $28,519,000 at the end of the most recent reporting period.

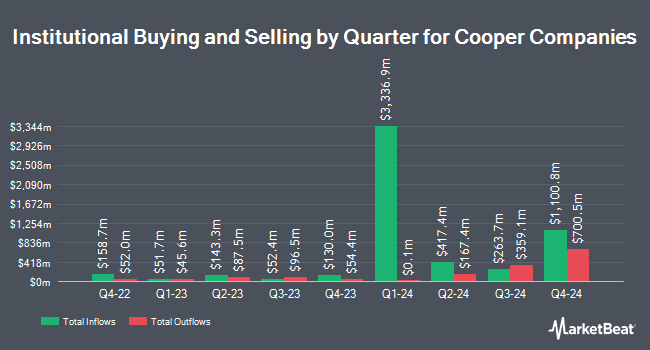

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Vanguard Group Inc. raised its stake in shares of Cooper Companies by 303.0% in the first quarter. Vanguard Group Inc. now owns 23,099,975 shares of the medical device company's stock worth $2,343,723,000 after purchasing an additional 17,367,502 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC boosted its stake in Cooper Companies by 3.0% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 7,820,590 shares of the medical device company's stock worth $682,738,000 after purchasing an additional 231,155 shares during the period. Capital World Investors grew its stake in Cooper Companies by 301.7% during the first quarter. Capital World Investors now owns 5,654,023 shares of the medical device company's stock valued at $573,657,000 after acquiring an additional 4,246,519 shares in the last quarter. Victory Capital Management Inc. increased its holdings in shares of Cooper Companies by 23.0% in the third quarter. Victory Capital Management Inc. now owns 3,950,119 shares of the medical device company's stock worth $435,856,000 after purchasing an additional 737,726 shares during the period. Finally, Janus Henderson Group PLC increased its stake in Cooper Companies by 279.8% in the 1st quarter. Janus Henderson Group PLC now owns 3,437,064 shares of the medical device company's stock worth $348,723,000 after acquiring an additional 2,532,186 shares during the last quarter. 24.39% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on COO shares. Piper Sandler raised their price target on Cooper Companies from $115.00 to $120.00 and gave the company an "overweight" rating in a research report on Thursday, August 29th. Wells Fargo & Company lifted their price objective on Cooper Companies from $110.00 to $115.00 and gave the stock an "overweight" rating in a research report on Thursday, August 29th. Needham & Company LLC reissued a "hold" rating on shares of Cooper Companies in a research note on Thursday, August 29th. StockNews.com raised shares of Cooper Companies from a "hold" rating to a "buy" rating in a research report on Thursday. Finally, Robert W. Baird upped their target price on shares of Cooper Companies from $118.00 to $125.00 and gave the stock an "outperform" rating in a research note on Thursday, August 29th. Three investment analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $117.00.

View Our Latest Analysis on COO

Cooper Companies Stock Performance

Shares of Cooper Companies stock traded down $0.23 during trading hours on Friday, hitting $99.63. 1,415,083 shares of the company were exchanged, compared to its average volume of 1,126,768. The stock has a market capitalization of $19.84 billion, a price-to-earnings ratio of 55.50, a P/E/G ratio of 2.20 and a beta of 0.99. The business has a 50-day moving average of $106.83 and a 200-day moving average of $98.00. The company has a current ratio of 1.99, a quick ratio of 1.18 and a debt-to-equity ratio of 0.33. The Cooper Companies, Inc. has a 1 year low of $82.21 and a 1 year high of $112.38.

Cooper Companies (NASDAQ:COO - Get Free Report) last released its quarterly earnings results on Wednesday, August 28th. The medical device company reported $0.96 EPS for the quarter, beating the consensus estimate of $0.91 by $0.05. The business had revenue of $1 billion for the quarter, compared to analyst estimates of $997.30 million. Cooper Companies had a net margin of 9.45% and a return on equity of 9.08%. The company's quarterly revenue was up 7.8% on a year-over-year basis. During the same period in the prior year, the business earned $0.84 earnings per share. As a group, analysts expect that The Cooper Companies, Inc. will post 3.65 EPS for the current fiscal year.

Insider Buying and Selling

In other Cooper Companies news, CAO Agostino Ricupati sold 1,601 shares of Cooper Companies stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $108.03, for a total transaction of $172,956.03. Following the sale, the chief accounting officer now directly owns 4,818 shares in the company, valued at $520,488.54. The trade was a 24.94 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Daniel G. Mcbride sold 114,992 shares of the stock in a transaction on Wednesday, September 4th. The shares were sold at an average price of $105.48, for a total transaction of $12,129,356.16. Following the transaction, the chief operating officer now owns 44,696 shares in the company, valued at $4,714,534.08. This trade represents a 72.01 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 256,373 shares of company stock valued at $27,637,427. Company insiders own 2.00% of the company's stock.

Cooper Companies Company Profile

(

Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Featured Articles

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report