KBC Group NV increased its position in shares of Kimco Realty Corp (NYSE:KIM - Free Report) by 408.7% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 669,923 shares of the real estate investment trust's stock after acquiring an additional 538,232 shares during the period. KBC Group NV owned about 0.10% of Kimco Realty worth $15,556,000 at the end of the most recent quarter.

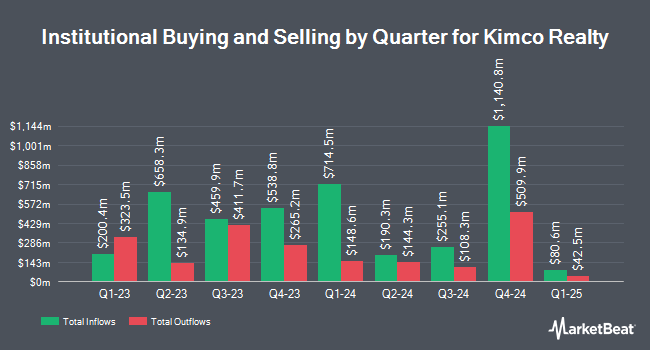

A number of other hedge funds and other institutional investors also recently bought and sold shares of the company. ProShare Advisors LLC lifted its holdings in Kimco Realty by 71.0% during the 1st quarter. ProShare Advisors LLC now owns 180,041 shares of the real estate investment trust's stock worth $3,531,000 after buying an additional 74,729 shares during the last quarter. Vanguard Group Inc. increased its stake in Kimco Realty by 7.7% in the first quarter. Vanguard Group Inc. now owns 110,267,579 shares of the real estate investment trust's stock valued at $2,162,347,000 after purchasing an additional 7,931,013 shares during the last quarter. Sumitomo Mitsui Trust Holdings Inc. raised its holdings in Kimco Realty by 2.8% during the second quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 3,761,309 shares of the real estate investment trust's stock worth $73,195,000 after purchasing an additional 103,861 shares in the last quarter. CANADA LIFE ASSURANCE Co lifted its position in shares of Kimco Realty by 11.0% during the 1st quarter. CANADA LIFE ASSURANCE Co now owns 1,107,569 shares of the real estate investment trust's stock worth $21,720,000 after buying an additional 109,758 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD boosted its holdings in shares of Kimco Realty by 30.9% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 5,846,943 shares of the real estate investment trust's stock valued at $114,659,000 after buying an additional 1,381,490 shares in the last quarter. 89.25% of the stock is currently owned by hedge funds and other institutional investors.

Kimco Realty Stock Up 0.7 %

KIM stock traded up $0.17 during mid-day trading on Friday, reaching $24.89. 3,144,817 shares of the company traded hands, compared to its average volume of 4,577,456. The stock has a market cap of $16.78 billion, a price-to-earnings ratio of 45.25, a P/E/G ratio of 3.28 and a beta of 1.50. The company has a quick ratio of 3.59, a current ratio of 3.59 and a debt-to-equity ratio of 0.78. Kimco Realty Corp has a fifty-two week low of $17.57 and a fifty-two week high of $25.19. The firm's 50 day moving average price is $23.77 and its 200 day moving average price is $21.53.

Kimco Realty (NYSE:KIM - Get Free Report) last released its earnings results on Thursday, October 31st. The real estate investment trust reported $0.19 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.41 by ($0.22). The business had revenue of $507.63 million during the quarter, compared to the consensus estimate of $502.78 million. Kimco Realty had a net margin of 19.58% and a return on equity of 3.68%. The business's revenue was up 13.8% on a year-over-year basis. During the same period in the prior year, the company earned $0.40 earnings per share. As a group, equities research analysts predict that Kimco Realty Corp will post 1.64 EPS for the current fiscal year.

Kimco Realty Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be issued a $0.25 dividend. The ex-dividend date is Thursday, December 5th. This represents a $1.00 annualized dividend and a dividend yield of 4.02%. This is an increase from Kimco Realty's previous quarterly dividend of $0.24. Kimco Realty's payout ratio is currently 181.82%.

Analyst Ratings Changes

A number of research analysts recently issued reports on KIM shares. Compass Point raised their price target on Kimco Realty from $25.00 to $28.00 and gave the stock a "buy" rating in a research note on Tuesday, September 10th. Evercore ISI increased their price target on shares of Kimco Realty from $22.00 to $23.00 and gave the stock an "in-line" rating in a research note on Monday, September 16th. Raymond James upgraded shares of Kimco Realty from a "market perform" rating to a "strong-buy" rating and set a $25.00 price objective on the stock in a research note on Friday, August 16th. Piper Sandler reiterated an "overweight" rating and set a $29.00 target price (up previously from $26.00) on shares of Kimco Realty in a research note on Friday, August 2nd. Finally, UBS Group upped their price objective on Kimco Realty from $25.00 to $30.00 and gave the company a "buy" rating in a research note on Friday, November 8th. Nine research analysts have rated the stock with a hold rating, six have issued a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat, Kimco Realty currently has a consensus rating of "Moderate Buy" and a consensus price target of $24.14.

Check Out Our Latest Stock Analysis on Kimco Realty

About Kimco Realty

(

Free Report)

Kimco Realty Corp. is a real estate investment trust (REIT) headquartered in New Hyde Park, N.Y., that is one of North America's largest publicly traded owners and operators of open-air shopping centers. As of December 31, 2018, the company owned interests in 437 U.S. shopping centers comprising 76 million square feet of leasable space primarily concentrated in the top major metropolitan markets.

See Also

Before you consider Kimco Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimco Realty wasn't on the list.

While Kimco Realty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.