KBC Group NV lowered its holdings in shares of Healthpeak Properties, Inc. (NYSE:DOC - Free Report) by 75.5% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 187,069 shares of the real estate investment trust's stock after selling 575,402 shares during the period. KBC Group NV's holdings in Healthpeak Properties were worth $3,792,000 at the end of the most recent quarter.

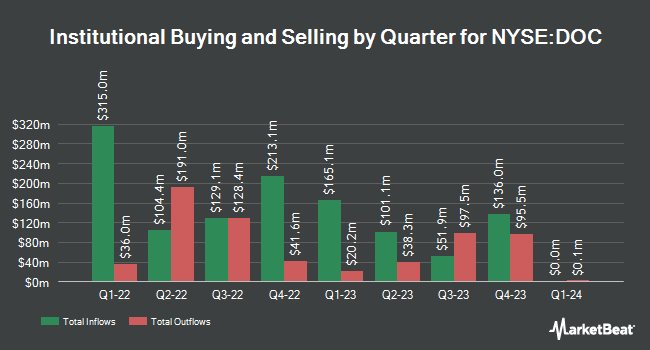

A number of other hedge funds have also added to or reduced their stakes in DOC. Point72 Asia Singapore Pte. Ltd. bought a new position in shares of Healthpeak Properties during the 2nd quarter worth approximately $66,000. Healthcare of Ontario Pension Plan Trust Fund bought a new position in Healthpeak Properties during the second quarter worth $9,024,000. Centaurus Financial Inc. acquired a new stake in Healthpeak Properties in the second quarter worth $227,000. Massmutual Trust Co. FSB ADV bought a new stake in Healthpeak Properties in the third quarter valued at $108,000. Finally, AMF Tjanstepension AB bought a new stake in Healthpeak Properties in the third quarter valued at $15,548,000. 93.57% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several analysts have recently commented on DOC shares. Royal Bank of Canada raised their target price on Healthpeak Properties from $25.00 to $26.00 and gave the company an "outperform" rating in a research note on Monday, November 4th. Morgan Stanley raised Healthpeak Properties from an "equal weight" rating to an "overweight" rating and set a $25.00 price objective for the company in a research note on Wednesday, January 15th. Robert W. Baird boosted their price objective on Healthpeak Properties from $24.00 to $25.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. StockNews.com cut Healthpeak Properties from a "hold" rating to a "sell" rating in a report on Wednesday, October 30th. Finally, Mizuho reduced their price target on shares of Healthpeak Properties from $25.00 to $24.00 and set an "outperform" rating for the company in a research report on Thursday, December 5th. One analyst has rated the stock with a sell rating, three have issued a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $24.15.

Read Our Latest Stock Report on DOC

Healthpeak Properties Stock Down 1.6 %

Shares of NYSE DOC traded down $0.34 during trading on Tuesday, hitting $20.05. The stock had a trading volume of 8,689,489 shares, compared to its average volume of 4,566,750. The company has a debt-to-equity ratio of 0.93, a current ratio of 1.31 and a quick ratio of 1.31. The firm has a fifty day moving average of $20.67 and a two-hundred day moving average of $21.54. Healthpeak Properties, Inc. has a 12 month low of $16.01 and a 12 month high of $23.26. The company has a market capitalization of $14.02 billion, a PE ratio of 42.65, a PEG ratio of 2.22 and a beta of 1.15.

Healthpeak Properties Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, February 26th. Shareholders of record on Friday, February 14th will be paid a $0.305 dividend. This is a positive change from Healthpeak Properties's previous quarterly dividend of $0.30. The ex-dividend date is Friday, February 14th. This represents a $1.22 annualized dividend and a yield of 6.09%. Healthpeak Properties's dividend payout ratio (DPR) is 255.32%.

About Healthpeak Properties

(

Free Report)

Healthpeak Properties, Inc is a fully integrated real estate investment trust (REIT) and S&P 500 company. Healthpeak owns, operates, and develops high-quality real estate for healthcare discovery and delivery.

Further Reading

Before you consider Healthpeak Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthpeak Properties wasn't on the list.

While Healthpeak Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.