Orion Portfolio Solutions LLC lessened its stake in shares of KBR, Inc. (NYSE:KBR - Free Report) by 20.5% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 21,427 shares of the construction company's stock after selling 5,534 shares during the quarter. Orion Portfolio Solutions LLC's holdings in KBR were worth $1,241,000 as of its most recent filing with the Securities and Exchange Commission.

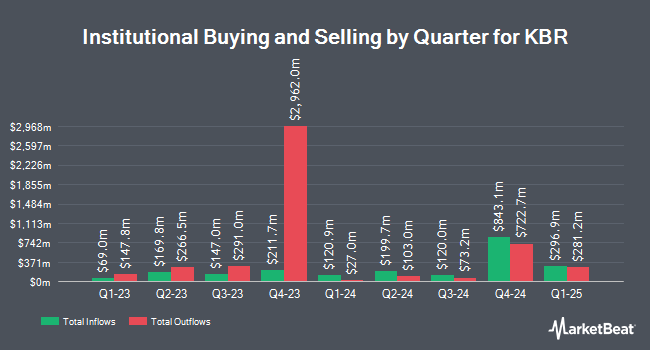

Other institutional investors have also recently added to or reduced their stakes in the company. UMB Bank n.a. boosted its holdings in shares of KBR by 49.2% during the fourth quarter. UMB Bank n.a. now owns 531 shares of the construction company's stock worth $31,000 after purchasing an additional 175 shares during the last quarter. First Horizon Advisors Inc. acquired a new stake in KBR in the 4th quarter worth about $32,000. Wilmington Savings Fund Society FSB purchased a new stake in KBR in the 4th quarter valued at about $68,000. Venturi Wealth Management LLC increased its stake in shares of KBR by 507.2% during the 4th quarter. Venturi Wealth Management LLC now owns 1,603 shares of the construction company's stock valued at $93,000 after acquiring an additional 1,339 shares during the last quarter. Finally, R Squared Ltd purchased a new position in shares of KBR during the 4th quarter worth about $104,000. Institutional investors and hedge funds own 97.02% of the company's stock.

Insiders Place Their Bets

In other news, insider Gregory Sean Conlon sold 19,000 shares of the company's stock in a transaction dated Friday, March 14th. The shares were sold at an average price of $50.59, for a total value of $961,210.00. Following the sale, the insider now owns 63,533 shares in the company, valued at approximately $3,214,134.47. This represents a 23.02 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 1.08% of the stock is owned by company insiders.

Analysts Set New Price Targets

KBR has been the subject of a number of research reports. TD Cowen lowered their price target on KBR from $72.00 to $64.00 and set a "hold" rating for the company in a research report on Wednesday, January 8th. The Goldman Sachs Group dropped their target price on shares of KBR from $75.00 to $64.00 and set a "buy" rating for the company in a research report on Wednesday, February 26th. Citigroup reduced their price target on shares of KBR from $82.00 to $76.00 and set a "buy" rating on the stock in a research report on Wednesday, January 29th. Finally, KeyCorp dropped their price objective on shares of KBR from $70.00 to $67.00 and set an "overweight" rating for the company in a research report on Tuesday, February 25th. One analyst has rated the stock with a hold rating and eight have given a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $75.88.

Get Our Latest Stock Report on KBR

KBR Stock Up 8.1 %

Shares of NYSE KBR traded up $3.80 during trading on Wednesday, reaching $50.55. 2,226,830 shares of the stock were exchanged, compared to its average volume of 1,307,911. The company has a market capitalization of $6.56 billion, a price-to-earnings ratio of 21.24, a price-to-earnings-growth ratio of 0.86 and a beta of 0.73. The business's 50-day moving average price is $50.83 and its 200 day moving average price is $58.29. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 1.69. KBR, Inc. has a twelve month low of $43.89 and a twelve month high of $72.60.

KBR (NYSE:KBR - Get Free Report) last issued its quarterly earnings data on Monday, February 24th. The construction company reported $0.91 EPS for the quarter, topping analysts' consensus estimates of $0.83 by $0.08. The firm had revenue of $2.12 billion for the quarter, compared to analyst estimates of $2 billion. KBR had a net margin of 4.35% and a return on equity of 28.87%. As a group, equities analysts forecast that KBR, Inc. will post 3.26 EPS for the current fiscal year.

KBR Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Shareholders of record on Friday, March 14th will be paid a dividend of $0.165 per share. This represents a $0.66 dividend on an annualized basis and a yield of 1.31%. The ex-dividend date is Friday, March 14th. This is a positive change from KBR's previous quarterly dividend of $0.15. KBR's dividend payout ratio (DPR) is 23.57%.

KBR Profile

(

Free Report)

KBR, Inc provides scientific, technology, and engineering solutions to governments and commercial customers worldwide. It operates through Government Solutions and Sustainable Technology Solutions segments. The Government Solutions segment offers life-cycle support solutions to defense, intelligence, space, aviation, and other programs and missions for military and other government agencies in the United States, the United Kingdom, and Australia.

Featured Articles

Before you consider KBR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KBR wasn't on the list.

While KBR currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn how options trading can help you navigate market volatility, manage risk, and maximize returns with MarketBeat's "Unlock the Potential in Options Trading." Click the link below to have this special report delivered to your inbox.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.