KBR (NYSE:KBR - Get Free Report) had its price objective raised by analysts at KeyCorp from $75.00 to $78.00 in a report released on Thursday,Benzinga reports. The firm currently has an "overweight" rating on the construction company's stock. KeyCorp's target price points to a potential upside of 10.91% from the company's current price.

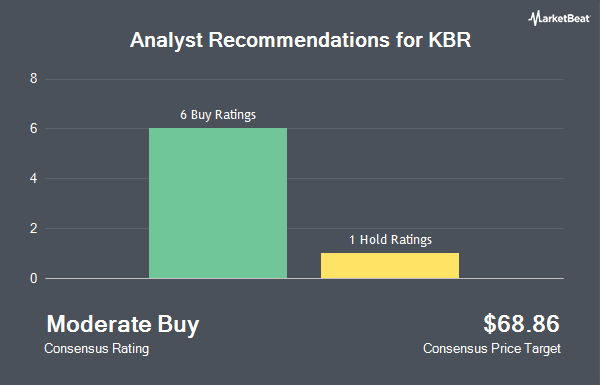

KBR has been the topic of a number of other reports. UBS Group raised their price objective on KBR from $77.00 to $78.00 and gave the company a "buy" rating in a research note on Wednesday, October 30th. DA Davidson raised their target price on KBR from $78.00 to $84.00 and gave the company a "buy" rating in a report on Friday, October 25th. TD Cowen lowered KBR from a "buy" rating to a "hold" rating and set a $72.00 target price on the stock. in a report on Friday, September 6th. StockNews.com lowered KBR from a "strong-buy" rating to a "buy" rating in a report on Sunday, October 6th. Finally, Citigroup raised their target price on KBR from $76.00 to $82.00 and gave the company a "buy" rating in a report on Tuesday, October 22nd. One equities research analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat.com, KBR has a consensus rating of "Moderate Buy" and a consensus price target of $81.14.

View Our Latest Report on KBR

KBR Stock Performance

Shares of KBR stock traded up $0.33 during trading on Thursday, reaching $70.33. The company had a trading volume of 546,286 shares, compared to its average volume of 1,107,422. The firm's 50 day simple moving average is $66.33 and its two-hundred day simple moving average is $65.66. The company has a debt-to-equity ratio of 1.69, a current ratio of 1.07 and a quick ratio of 1.07. KBR has a one year low of $50.45 and a one year high of $71.72. The company has a market capitalization of $9.37 billion, a PE ratio of 29.70, a PEG ratio of 1.34 and a beta of 0.89.

KBR (NYSE:KBR - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The construction company reported $0.84 earnings per share for the quarter, meeting analysts' consensus estimates of $0.84. KBR had a return on equity of 28.87% and a net margin of 4.35%. The business had revenue of $1.95 billion for the quarter, compared to the consensus estimate of $1.95 billion. During the same period last year, the business earned $0.75 EPS. The firm's revenue was up 10.0% compared to the same quarter last year. Sell-side analysts forecast that KBR will post 3.26 earnings per share for the current year.

Insider Transactions at KBR

In related news, insider Jalal Ibrahim sold 35,000 shares of KBR stock in a transaction on Monday, August 19th. The stock was sold at an average price of $66.56, for a total transaction of $2,329,600.00. Following the completion of the sale, the insider now directly owns 106,550 shares of the company's stock, valued at $7,091,968. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 1.08% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently modified their holdings of the company. Larson Financial Group LLC boosted its position in shares of KBR by 2,029.2% during the second quarter. Larson Financial Group LLC now owns 511 shares of the construction company's stock worth $33,000 after buying an additional 487 shares during the period. CWM LLC raised its holdings in KBR by 39.4% during the second quarter. CWM LLC now owns 817 shares of the construction company's stock worth $52,000 after acquiring an additional 231 shares in the last quarter. Quarry LP raised its holdings in KBR by 454.7% during the second quarter. Quarry LP now owns 821 shares of the construction company's stock worth $53,000 after acquiring an additional 673 shares in the last quarter. Eastern Bank bought a new stake in KBR during the third quarter worth about $65,000. Finally, Fifth Third Bancorp raised its holdings in KBR by 17.5% during the second quarter. Fifth Third Bancorp now owns 1,204 shares of the construction company's stock worth $77,000 after acquiring an additional 179 shares in the last quarter. 97.02% of the stock is owned by institutional investors and hedge funds.

KBR Company Profile

(

Get Free Report)

KBR, Inc provides scientific, technology, and engineering solutions to governments and commercial customers worldwide. It operates through Government Solutions and Sustainable Technology Solutions segments. The Government Solutions segment offers life-cycle support solutions to defense, intelligence, space, aviation, and other programs and missions for military and other government agencies in the United States, the United Kingdom, and Australia.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider KBR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KBR wasn't on the list.

While KBR currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.