KCM Investment Advisors LLC trimmed its position in U.S. Bancorp (NYSE:USB - Free Report) by 24.0% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 81,234 shares of the financial services provider's stock after selling 25,693 shares during the period. KCM Investment Advisors LLC's holdings in U.S. Bancorp were worth $3,715,000 as of its most recent SEC filing.

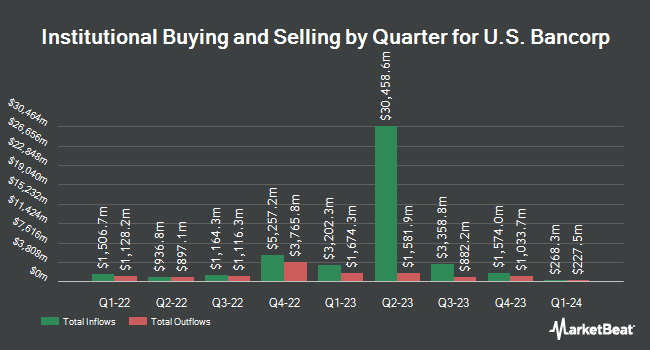

Several other large investors have also bought and sold shares of USB. Vanguard Group Inc. increased its stake in U.S. Bancorp by 0.4% in the 1st quarter. Vanguard Group Inc. now owns 135,371,282 shares of the financial services provider's stock valued at $6,051,096,000 after buying an additional 502,776 shares during the period. Davis Selected Advisers grew its stake in shares of U.S. Bancorp by 0.3% in the second quarter. Davis Selected Advisers now owns 14,228,444 shares of the financial services provider's stock worth $564,869,000 after acquiring an additional 43,437 shares during the last quarter. Bank of New York Mellon Corp increased its stake in U.S. Bancorp by 0.7% during the second quarter. Bank of New York Mellon Corp now owns 13,312,930 shares of the financial services provider's stock valued at $528,523,000 after acquiring an additional 94,841 shares during the period. Legal & General Group Plc lifted its position in U.S. Bancorp by 2.7% in the second quarter. Legal & General Group Plc now owns 12,376,977 shares of the financial services provider's stock worth $491,364,000 after purchasing an additional 325,374 shares during the period. Finally, Van ECK Associates Corp lifted its stake in U.S. Bancorp by 3.9% during the third quarter. Van ECK Associates Corp now owns 9,852,013 shares of the financial services provider's stock worth $478,118,000 after purchasing an additional 373,559 shares during the period. Institutional investors own 77.60% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts have recently weighed in on the stock. Wells Fargo & Company raised their price objective on shares of U.S. Bancorp from $60.00 to $62.00 and gave the stock an "overweight" rating in a report on Friday. Evercore ISI upped their price target on U.S. Bancorp from $51.00 to $54.00 and gave the company an "in-line" rating in a research note on Wednesday, October 30th. Barclays raised their target price on shares of U.S. Bancorp from $52.00 to $57.00 and gave the stock an "overweight" rating in a report on Thursday, October 17th. Citigroup lifted their price target on shares of U.S. Bancorp from $45.00 to $49.00 and gave the company a "neutral" rating in a research note on Thursday, July 18th. Finally, Royal Bank of Canada set a $53.00 price objective on shares of U.S. Bancorp in a report on Thursday, October 17th. Thirteen analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $51.22.

Read Our Latest Stock Report on U.S. Bancorp

U.S. Bancorp Stock Performance

USB stock traded down $0.41 during trading on Friday, hitting $49.90. 13,145,858 shares of the company's stock traded hands, compared to its average volume of 8,373,090. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 1.04. The stock has a market capitalization of $77.85 billion, a price-to-earnings ratio of 15.26, a price-to-earnings-growth ratio of 3.02 and a beta of 1.02. U.S. Bancorp has a 52 week low of $36.49 and a 52 week high of $51.76. The stock has a fifty day moving average price of $46.88 and a two-hundred day moving average price of $43.63.

U.S. Bancorp (NYSE:USB - Get Free Report) last announced its quarterly earnings data on Wednesday, October 16th. The financial services provider reported $1.03 EPS for the quarter, topping analysts' consensus estimates of $0.99 by $0.04. The firm had revenue of $6.86 billion during the quarter, compared to analyst estimates of $6.90 billion. U.S. Bancorp had a return on equity of 12.91% and a net margin of 12.92%. The business's quarterly revenue was down 2.4% compared to the same quarter last year. During the same period last year, the company posted $1.05 EPS. As a group, equities analysts anticipate that U.S. Bancorp will post 3.93 EPS for the current fiscal year.

U.S. Bancorp Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Stockholders of record on Monday, September 30th were given a dividend of $0.50 per share. The ex-dividend date was Monday, September 30th. This represents a $2.00 dividend on an annualized basis and a dividend yield of 4.01%. This is an increase from U.S. Bancorp's previous quarterly dividend of $0.49. U.S. Bancorp's payout ratio is presently 61.16%.

U.S. Bancorp announced that its Board of Directors has approved a share buyback plan on Thursday, September 12th that permits the company to buyback $5.00 billion in outstanding shares. This buyback authorization permits the financial services provider to buy up to 7% of its shares through open market purchases. Shares buyback plans are typically a sign that the company's management believes its stock is undervalued.

Insider Activity at U.S. Bancorp

In other U.S. Bancorp news, insider Jodi L. Richard sold 25,000 shares of the firm's stock in a transaction on Friday, October 18th. The stock was sold at an average price of $49.03, for a total transaction of $1,225,750.00. Following the completion of the sale, the insider now owns 129,790 shares of the company's stock, valued at $6,363,603.70. This trade represents a 16.15 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 0.23% of the stock is currently owned by corporate insiders.

U.S. Bancorp Company Profile

(

Free Report)

U.S. Bancorp, a financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States. It operates through Wealth, Corporate, Commercial and Institutional Banking; Consumer and Business Banking; Payment Services; and Treasury and Corporate Support segments.

Further Reading

Before you consider U.S. Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and U.S. Bancorp wasn't on the list.

While U.S. Bancorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.