Kearns & Associates LLC acquired a new stake in Royalty Pharma plc (NASDAQ:RPRX - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 17,685 shares of the biopharmaceutical company's stock, valued at approximately $451,000. Royalty Pharma makes up 0.3% of Kearns & Associates LLC's investment portfolio, making the stock its 29th largest holding.

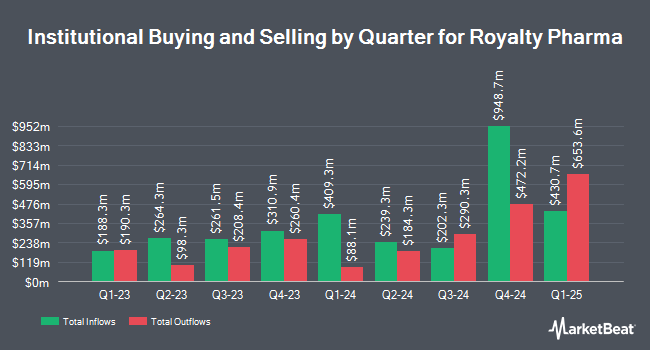

Other institutional investors have also recently made changes to their positions in the company. Brooklyn Investment Group boosted its stake in shares of Royalty Pharma by 1,006.9% in the 4th quarter. Brooklyn Investment Group now owns 963 shares of the biopharmaceutical company's stock valued at $25,000 after buying an additional 876 shares during the period. Blue Trust Inc. raised its holdings in Royalty Pharma by 362.7% in the third quarter. Blue Trust Inc. now owns 1,203 shares of the biopharmaceutical company's stock valued at $32,000 after acquiring an additional 943 shares in the last quarter. Fifth Third Bancorp raised its holdings in Royalty Pharma by 187.1% in the fourth quarter. Fifth Third Bancorp now owns 1,530 shares of the biopharmaceutical company's stock valued at $39,000 after acquiring an additional 997 shares in the last quarter. Wilmington Savings Fund Society FSB purchased a new position in Royalty Pharma in the third quarter worth approximately $61,000. Finally, GAMMA Investing LLC grew its holdings in Royalty Pharma by 31.4% during the 4th quarter. GAMMA Investing LLC now owns 2,471 shares of the biopharmaceutical company's stock worth $63,000 after acquiring an additional 590 shares in the last quarter. Institutional investors and hedge funds own 54.35% of the company's stock.

Royalty Pharma Stock Performance

Shares of RPRX stock traded down $0.01 during mid-day trading on Friday, hitting $31.58. 4,071,840 shares of the stock were exchanged, compared to its average volume of 3,915,189. The stock's fifty day simple moving average is $27.34 and its two-hundred day simple moving average is $27.53. The company has a debt-to-equity ratio of 0.64, a quick ratio of 1.54 and a current ratio of 1.54. Royalty Pharma plc has a 12-month low of $24.05 and a 12-month high of $32.21. The stock has a market capitalization of $18.61 billion, a price-to-earnings ratio of 16.36 and a beta of 0.47.

Royalty Pharma Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, March 10th. Investors of record on Friday, February 21st will be paid a dividend of $0.22 per share. This represents a $0.88 dividend on an annualized basis and a yield of 2.79%. The ex-dividend date is Friday, February 21st. This is an increase from Royalty Pharma's previous quarterly dividend of $0.21. Royalty Pharma's dividend payout ratio (DPR) is currently 43.52%.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on the stock. TD Cowen upgraded shares of Royalty Pharma to a "strong-buy" rating in a report on Tuesday, December 24th. StockNews.com upgraded Royalty Pharma from a "hold" rating to a "buy" rating in a research note on Tuesday, November 5th. Finally, Citigroup lowered their price objective on Royalty Pharma from $60.00 to $40.00 and set a "buy" rating for the company in a research report on Friday, October 25th. One analyst has rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus price target of $41.67.

Check Out Our Latest Stock Analysis on RPRX

About Royalty Pharma

(

Free Report)

Royalty Pharma plc operates as a buyer of biopharmaceutical royalties and a funder of innovations in the biopharmaceutical industry in the United States. It is also involved in the identification, evaluation, and acquisition of royalties on various biopharmaceutical therapies. In addition, the company collaborates with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

Featured Articles

Before you consider Royalty Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royalty Pharma wasn't on the list.

While Royalty Pharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.