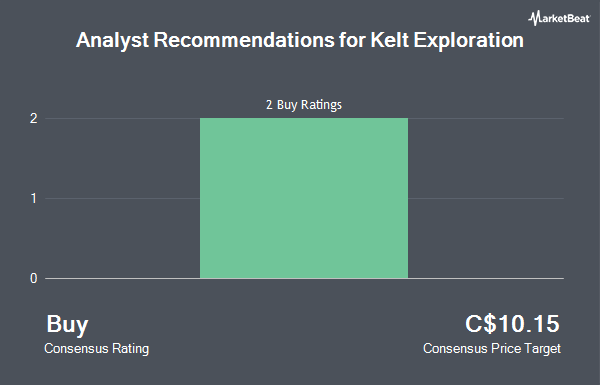

Kelt Exploration Ltd. (TSE:KEL - Get Free Report) has been assigned a consensus recommendation of "Buy" from the seven analysts that are covering the company, Marketbeat reports. Seven equities research analysts have rated the stock with a buy recommendation. The average 12 month target price among brokers that have covered the stock in the last year is C$9.06.

A number of equities analysts have commented on the stock. Scotiabank boosted their target price on shares of Kelt Exploration from C$10.00 to C$10.50 and gave the stock an "outperform" rating in a report on Wednesday, October 16th. National Bankshares raised their price objective on Kelt Exploration from C$8.75 to C$9.00 and gave the stock an "outperform" rating in a research report on Thursday. Finally, BMO Capital Markets boosted their price target on Kelt Exploration from C$8.50 to C$9.00 in a research note on Friday, December 13th.

View Our Latest Stock Report on Kelt Exploration

Insider Activity

In other Kelt Exploration news, Director David John Wilson purchased 656,900 shares of the firm's stock in a transaction that occurred on Tuesday, December 17th. The shares were purchased at an average cost of C$6.05 per share, for a total transaction of C$3,974,245.00. Also, Senior Officer Douglas Owen Macarthur sold 4,700 shares of the business's stock in a transaction on Monday, November 18th. The stock was sold at an average price of C$6.88, for a total transaction of C$32,336.00. In the last three months, insiders sold 43,270 shares of company stock valued at $299,207. Insiders own 15.87% of the company's stock.

Kelt Exploration Trading Up 1.0 %

Shares of KEL traded up C$0.06 during trading hours on Friday, reaching C$6.24. 209,754 shares of the company traded hands, compared to its average volume of 309,155. The stock's fifty day moving average price is C$6.55 and its 200 day moving average price is C$6.27. The company has a current ratio of 0.50, a quick ratio of 0.61 and a debt-to-equity ratio of 1.43. The firm has a market cap of C$1.22 billion, a price-to-earnings ratio of 18.91 and a beta of 1.93. Kelt Exploration has a 12-month low of C$5.01 and a 12-month high of C$7.20.

Kelt Exploration (TSE:KEL - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The oil and gas exploration company reported C$0.04 earnings per share for the quarter. Kelt Exploration had a net margin of 16.02% and a return on equity of 6.72%. The firm had revenue of C$107.88 million during the quarter. Sell-side analysts forecast that Kelt Exploration will post 0.5224359 earnings per share for the current year.

Kelt Exploration Company Profile

(

Get Free ReportKelt Exploration Ltd., an oil and gas company, engages in the exploration, development, and production of crude oil and natural gas resources primarily in Western Canada. The company markets its crude oil and natural gas liquids primarily to third party. Kelt Exploration Ltd. was incorporated in 2012 and is headquartered in Calgary, Canada.

Read More

Before you consider Kelt Exploration, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kelt Exploration wasn't on the list.

While Kelt Exploration currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.