Kennametal (NYSE:KMT - Get Free Report) issued an update on its FY 2025 earnings guidance on Wednesday morning. The company provided earnings per share (EPS) guidance of 1.300-1.700 for the period, compared to the consensus estimate of 1.430. The company issued revenue guidance of $2.0 billion-$2.1 billion, compared to the consensus revenue estimate of $2.0 billion. Kennametal also updated its Q2 guidance to $0.20-$0.30 EPS.

Kennametal Stock Performance

Shares of NYSE KMT traded up $4.65 during trading hours on Wednesday, hitting $31.23. 3,517,677 shares of the stock were exchanged, compared to its average volume of 792,140. The company has a debt-to-equity ratio of 0.46, a current ratio of 2.41 and a quick ratio of 1.17. The company's 50 day moving average is $25.54 and its 200 day moving average is $24.96. The firm has a market capitalization of $2.43 billion, a P/E ratio of 22.80, a P/E/G ratio of 2.88 and a beta of 1.64. Kennametal has a one year low of $22.38 and a one year high of $32.18.

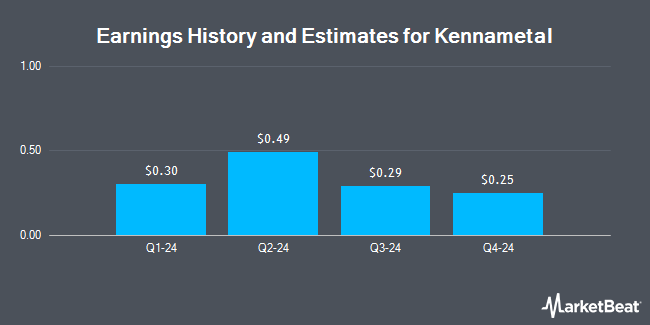

Kennametal (NYSE:KMT - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The industrial products company reported $0.49 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.44 by $0.05. The business had revenue of $543.31 million during the quarter, compared to the consensus estimate of $532.72 million. Kennametal had a net margin of 5.34% and a return on equity of 9.17%. Kennametal's quarterly revenue was down 1.3% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.51 EPS. On average, research analysts expect that Kennametal will post 1.43 EPS for the current year.

Kennametal Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Tuesday, November 26th. Investors of record on Tuesday, November 12th will be paid a dividend of $0.20 per share. This represents a $0.80 annualized dividend and a yield of 2.56%. The ex-dividend date is Tuesday, November 12th. Kennametal's payout ratio is currently 58.39%.

Analyst Ratings Changes

Several equities analysts recently commented on KMT shares. StockNews.com upgraded shares of Kennametal from a "hold" rating to a "buy" rating in a research note on Friday, October 18th. Barclays upped their target price on shares of Kennametal from $24.00 to $25.00 and gave the company an "equal weight" rating in a research note on Friday, August 9th. Loop Capital upped their target price on shares of Kennametal from $22.00 to $24.00 and gave the company a "hold" rating in a research note on Thursday, August 22nd. Finally, Bank of America cut shares of Kennametal from a "neutral" rating to an "underperform" rating and set a $26.00 target price for the company. in a research note on Friday, October 18th. Two research analysts have rated the stock with a sell rating, three have given a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat.com, Kennametal currently has a consensus rating of "Hold" and a consensus target price of $24.60.

Check Out Our Latest Stock Analysis on KMT

About Kennametal

(

Get Free Report)

Kennametal Inc engages in development and application of tungsten carbides, ceramics, and super-hard materials and solutions for use in metal cutting and extreme wear applications to enable customers work against corrosion and high temperatures conditions worldwide. The company operates through two segments, Metal Cutting and Infrastructure.

Featured Stories

Before you consider Kennametal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kennametal wasn't on the list.

While Kennametal currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.