Kennebec Savings Bank purchased a new stake in Quest Diagnostics Incorporated (NYSE:DGX - Free Report) in the 3rd quarter, according to its most recent filing with the SEC. The fund purchased 3,823 shares of the medical research company's stock, valued at approximately $594,000.

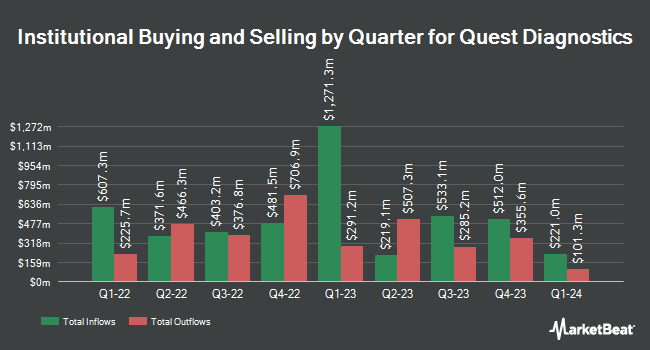

Other institutional investors have also recently bought and sold shares of the company. Mitsubishi UFJ Asset Management Co. Ltd. lifted its stake in Quest Diagnostics by 16.5% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 131,329 shares of the medical research company's stock valued at $17,481,000 after buying an additional 18,642 shares during the last quarter. Vanguard Group Inc. increased its holdings in Quest Diagnostics by 2.5% in the first quarter. Vanguard Group Inc. now owns 13,921,955 shares of the medical research company's stock worth $1,853,151,000 after buying an additional 345,754 shares during the last quarter. Seven Eight Capital LP bought a new position in Quest Diagnostics during the first quarter worth $729,000. Janus Henderson Group PLC grew its holdings in shares of Quest Diagnostics by 126.0% during the 1st quarter. Janus Henderson Group PLC now owns 37,305 shares of the medical research company's stock worth $4,966,000 after purchasing an additional 20,800 shares in the last quarter. Finally, Empowered Funds LLC increased its stake in Quest Diagnostics by 892.8% in the first quarter. Empowered Funds LLC now owns 21,177 shares of the medical research company's stock valued at $2,819,000 after acquiring an additional 19,044 shares during the period. 88.06% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on DGX. Citigroup upped their target price on shares of Quest Diagnostics from $165.00 to $185.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Piper Sandler raised their target price on shares of Quest Diagnostics from $150.00 to $165.00 and gave the company a "neutral" rating in a research report on Monday, October 28th. Barclays raised their target price on shares of Quest Diagnostics from $154.00 to $168.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 23rd. Robert W. Baird raised shares of Quest Diagnostics from a "neutral" rating to an "outperform" rating and raised their target price for the company from $157.00 to $182.00 in a research report on Wednesday, October 23rd. Finally, Baird R W raised shares of Quest Diagnostics from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, October 23rd. Nine research analysts have rated the stock with a hold rating, five have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $164.58.

Get Our Latest Stock Report on DGX

Insider Activity at Quest Diagnostics

In other Quest Diagnostics news, SVP Karthik Kuppusamy sold 1,990 shares of the firm's stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $153.26, for a total transaction of $304,987.40. Following the completion of the sale, the senior vice president now owns 11,459 shares in the company, valued at $1,756,206.34. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. In related news, CAO Michael J. Deppe sold 18,755 shares of the company's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $154.05, for a total value of $2,889,207.75. Following the completion of the transaction, the chief accounting officer now directly owns 34,941 shares in the company, valued at approximately $5,382,661.05. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, SVP Karthik Kuppusamy sold 1,990 shares of the company's stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $153.26, for a total transaction of $304,987.40. Following the transaction, the senior vice president now owns 11,459 shares in the company, valued at approximately $1,756,206.34. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 22,520 shares of company stock worth $3,472,728. 0.79% of the stock is owned by insiders.

Quest Diagnostics Trading Up 1.2 %

Shares of NYSE DGX traded up $1.96 during trading on Monday, hitting $161.33. 213,766 shares of the company were exchanged, compared to its average volume of 913,397. Quest Diagnostics Incorporated has a 12-month low of $123.04 and a 12-month high of $162.48. The company has a debt-to-equity ratio of 0.83, a quick ratio of 1.17 and a current ratio of 1.25. The company has a fifty day moving average price of $153.52 and a 200-day moving average price of $146.73. The firm has a market capitalization of $18.01 billion, a PE ratio of 21.75, a P/E/G ratio of 2.75 and a beta of 0.89.

Quest Diagnostics (NYSE:DGX - Get Free Report) last posted its earnings results on Tuesday, October 22nd. The medical research company reported $2.30 earnings per share for the quarter, beating the consensus estimate of $2.26 by $0.04. Quest Diagnostics had a return on equity of 15.25% and a net margin of 8.82%. The business had revenue of $2.49 billion during the quarter, compared to the consensus estimate of $2.43 billion. During the same period in the previous year, the business earned $2.22 EPS. The business's quarterly revenue was up 8.5% on a year-over-year basis. As a group, equities research analysts expect that Quest Diagnostics Incorporated will post 8.9 EPS for the current year.

Quest Diagnostics Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, October 21st. Shareholders of record on Friday, October 4th were paid a dividend of $0.75 per share. This represents a $3.00 dividend on an annualized basis and a dividend yield of 1.86%. The ex-dividend date of this dividend was Friday, October 4th. Quest Diagnostics's dividend payout ratio is presently 40.32%.

Quest Diagnostics Company Profile

(

Free Report)

Quest Diagnostics Incorporated provides diagnostic testing and services in the United States and internationally. The company develops and delivers diagnostic information services, such as routine, non-routine and advanced clinical testing, anatomic pathology testing, and other diagnostic information services.

Read More

Before you consider Quest Diagnostics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quest Diagnostics wasn't on the list.

While Quest Diagnostics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report