Kennedy Capital Management LLC lifted its holdings in Green Brick Partners, Inc. (NASDAQ:GRBK - Free Report) by 22.9% in the 4th quarter, according to its most recent 13F filing with the SEC. The firm owned 118,469 shares of the financial services provider's stock after purchasing an additional 22,084 shares during the quarter. Kennedy Capital Management LLC owned about 0.27% of Green Brick Partners worth $6,692,000 as of its most recent SEC filing.

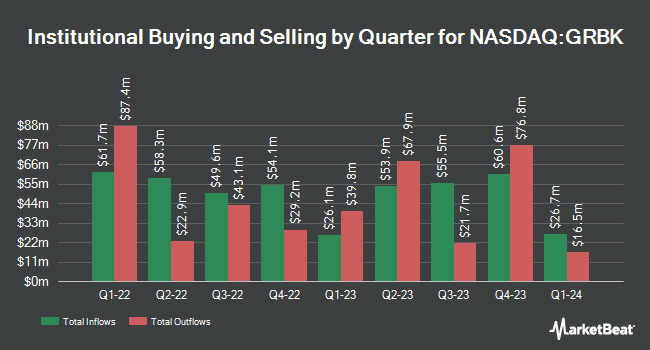

Several other institutional investors have also recently bought and sold shares of the company. Renaissance Group LLC lifted its holdings in shares of Green Brick Partners by 10.4% during the 4th quarter. Renaissance Group LLC now owns 64,802 shares of the financial services provider's stock worth $3,661,000 after acquiring an additional 6,091 shares during the period. Renaissance Technologies LLC increased its position in shares of Green Brick Partners by 118.1% during the 4th quarter. Renaissance Technologies LLC now owns 145,709 shares of the financial services provider's stock valued at $8,231,000 after purchasing an additional 78,900 shares during the last quarter. Bank of Montreal Can boosted its holdings in shares of Green Brick Partners by 8.3% in the fourth quarter. Bank of Montreal Can now owns 4,033 shares of the financial services provider's stock worth $228,000 after acquiring an additional 310 shares during the period. Cerity Partners LLC increased its position in shares of Green Brick Partners by 91.1% in the fourth quarter. Cerity Partners LLC now owns 6,048 shares of the financial services provider's stock worth $342,000 after purchasing an additional 2,883 shares during the last quarter. Finally, Envestnet Asset Management Inc. lifted its holdings in shares of Green Brick Partners by 48.1% in the 4th quarter. Envestnet Asset Management Inc. now owns 12,469 shares of the financial services provider's stock worth $704,000 after acquiring an additional 4,049 shares during the last quarter. Institutional investors own 78.24% of the company's stock.

Green Brick Partners Stock Up 2.1 %

NASDAQ:GRBK traded up $1.18 during midday trading on Thursday, reaching $56.11. The company had a trading volume of 141,434 shares, compared to its average volume of 379,323. The company has a current ratio of 7.57, a quick ratio of 0.63 and a debt-to-equity ratio of 0.20. Green Brick Partners, Inc. has a 12-month low of $50.57 and a 12-month high of $84.66. The stock's fifty day simple moving average is $58.46 and its 200-day simple moving average is $64.29. The firm has a market capitalization of $2.50 billion, a price-to-earnings ratio of 7.27 and a beta of 1.82.

Wall Street Analysts Forecast Growth

Separately, Wedbush restated a "neutral" rating and issued a $70.00 price objective on shares of Green Brick Partners in a report on Friday, February 28th.

Get Our Latest Research Report on Green Brick Partners

Green Brick Partners Company Profile

(

Free Report)

Green Brick Partners, Inc is a diversified homebuilding and land development company in the United States. The company operates through three segments: Builder operations Central, Builder operations Southeast, and Land Development. The Builder operations Central segment operates builders in Texas; and the closing and delivery of homes.

Featured Stories

Before you consider Green Brick Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Green Brick Partners wasn't on the list.

While Green Brick Partners currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.