Kennedy Capital Management LLC trimmed its position in Catalyst Pharmaceuticals, Inc. (NASDAQ:CPRX - Free Report) by 2.3% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 1,017,666 shares of the biopharmaceutical company's stock after selling 23,750 shares during the quarter. Kennedy Capital Management LLC owned 0.85% of Catalyst Pharmaceuticals worth $21,239,000 at the end of the most recent reporting period.

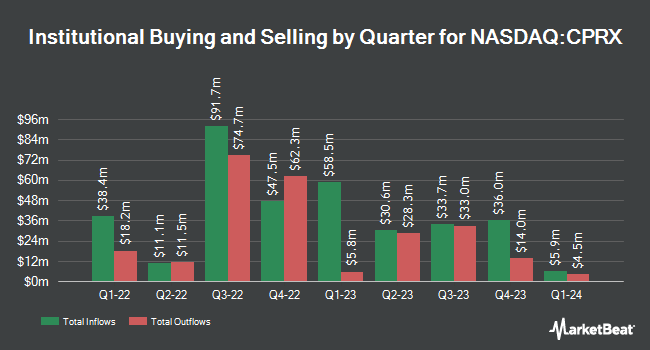

Other hedge funds have also added to or reduced their stakes in the company. Steward Partners Investment Advisory LLC acquired a new position in shares of Catalyst Pharmaceuticals during the 4th quarter worth $27,000. Farther Finance Advisors LLC raised its stake in Catalyst Pharmaceuticals by 125.1% during the fourth quarter. Farther Finance Advisors LLC now owns 2,690 shares of the biopharmaceutical company's stock worth $56,000 after acquiring an additional 1,495 shares in the last quarter. Wilmington Savings Fund Society FSB acquired a new stake in shares of Catalyst Pharmaceuticals in the 4th quarter valued at approximately $65,000. KBC Group NV grew its holdings in shares of Catalyst Pharmaceuticals by 48.8% during the 4th quarter. KBC Group NV now owns 4,699 shares of the biopharmaceutical company's stock valued at $98,000 after purchasing an additional 1,542 shares during the last quarter. Finally, Thurston Springer Miller Herd & Titak Inc. acquired a new position in Catalyst Pharmaceuticals during the 4th quarter worth approximately $134,000. 79.22% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

CPRX has been the topic of a number of research reports. StockNews.com raised shares of Catalyst Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a research note on Friday, February 28th. Stephens reaffirmed an "overweight" rating and issued a $33.00 target price on shares of Catalyst Pharmaceuticals in a report on Thursday, February 27th. Bank of America restated a "buy" rating and set a $30.00 price target on shares of Catalyst Pharmaceuticals in a report on Thursday, January 9th. Robert W. Baird raised their price objective on shares of Catalyst Pharmaceuticals from $28.00 to $32.00 and gave the company an "outperform" rating in a report on Monday, March 3rd. Finally, Baird R W upgraded shares of Catalyst Pharmaceuticals to a "strong-buy" rating in a research report on Monday, February 3rd. Seven investment analysts have rated the stock with a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus target price of $32.29.

Get Our Latest Stock Analysis on Catalyst Pharmaceuticals

Insider Buying and Selling

In other Catalyst Pharmaceuticals news, insider Gary Ingenito sold 44,904 shares of the stock in a transaction dated Wednesday, March 5th. The stock was sold at an average price of $22.09, for a total transaction of $991,929.36. Following the completion of the sale, the insider now directly owns 68,873 shares in the company, valued at approximately $1,521,404.57. This trade represents a 39.47 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider Brian Elsbernd sold 62,975 shares of the business's stock in a transaction dated Monday, March 3rd. The shares were sold at an average price of $22.98, for a total value of $1,447,165.50. Following the completion of the transaction, the insider now directly owns 188,564 shares in the company, valued at $4,333,200.72. This represents a 25.04 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 11.00% of the stock is owned by insiders.

Catalyst Pharmaceuticals Stock Up 0.5 %

Catalyst Pharmaceuticals stock traded up $0.12 during mid-day trading on Tuesday, hitting $22.92. 330,158 shares of the stock were exchanged, compared to its average volume of 1,140,061. The stock has a market capitalization of $2.78 billion, a price-to-earnings ratio of 19.42, a PEG ratio of 3.31 and a beta of 0.79. Catalyst Pharmaceuticals, Inc. has a 12 month low of $14.47 and a 12 month high of $26.16. The firm's fifty day simple moving average is $22.62 and its two-hundred day simple moving average is $22.04.

About Catalyst Pharmaceuticals

(

Free Report)

Catalyst Pharmaceuticals, Inc, a commercial-stage biopharmaceutical company, focuses on developing and commercializing therapies for people with rare debilitating, chronic neuromuscular, and neurological diseases in the United States. It offers Firdapse, an amifampridine phosphate tablets for the treatment of patients with lambert-eaton myasthenic syndrome (LEMS); and Ruzurgi for the treatment of pediatric LEMS patients.

Further Reading

Before you consider Catalyst Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Catalyst Pharmaceuticals wasn't on the list.

While Catalyst Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.