Kestra Investment Management LLC bought a new position in shares of Bruker Co. (NASDAQ:BRKR - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 8,996 shares of the medical research company's stock, valued at approximately $621,000.

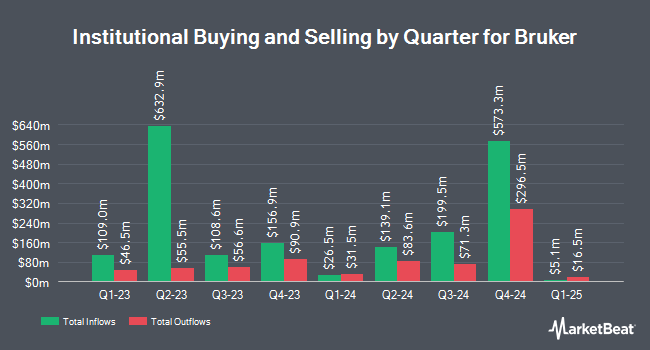

A number of other institutional investors have also added to or reduced their stakes in the company. FMR LLC grew its position in Bruker by 21.4% during the third quarter. FMR LLC now owns 14,306,122 shares of the medical research company's stock worth $987,981,000 after buying an additional 2,521,904 shares in the last quarter. Marshall Wace LLP boosted its holdings in Bruker by 127.8% during the second quarter. Marshall Wace LLP now owns 1,389,537 shares of the medical research company's stock valued at $88,666,000 after purchasing an additional 779,549 shares in the last quarter. Dimensional Fund Advisors LP boosted its holdings in Bruker by 8.6% during the second quarter. Dimensional Fund Advisors LP now owns 1,277,273 shares of the medical research company's stock valued at $81,508,000 after purchasing an additional 101,539 shares in the last quarter. Bank of New York Mellon Corp boosted its holdings in Bruker by 3.0% during the second quarter. Bank of New York Mellon Corp now owns 966,069 shares of the medical research company's stock valued at $61,645,000 after purchasing an additional 27,870 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its holdings in Bruker by 11.8% during the third quarter. Charles Schwab Investment Management Inc. now owns 899,638 shares of the medical research company's stock valued at $62,129,000 after purchasing an additional 94,612 shares in the last quarter. 79.52% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Bruker news, CEO Frank H. Laukien bought 100,000 shares of the stock in a transaction on Monday, November 18th. The stock was purchased at an average price of $50.14 per share, with a total value of $5,014,000.00. Following the acquisition, the chief executive officer now owns 38,439,563 shares of the company's stock, valued at approximately $1,927,359,688.82. The trade was a 0.26 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Company insiders own 28.30% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on the company. Barclays decreased their price objective on Bruker from $75.00 to $69.00 and set an "overweight" rating on the stock in a report on Wednesday, November 6th. TD Cowen cut their target price on shares of Bruker from $72.00 to $70.00 and set a "hold" rating for the company in a research note on Wednesday, November 6th. Wells Fargo & Company cut their target price on shares of Bruker from $78.00 to $75.00 and set an "overweight" rating for the company in a research note on Wednesday, November 6th. Wolfe Research cut shares of Bruker from an "outperform" rating to a "peer perform" rating in a research note on Monday, September 30th. Finally, Citigroup cut their target price on shares of Bruker from $80.00 to $75.00 and set a "buy" rating for the company in a research note on Wednesday, November 6th. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat.com, Bruker currently has a consensus rating of "Moderate Buy" and a consensus price target of $79.36.

Get Our Latest Stock Report on Bruker

Bruker Trading Down 0.2 %

BRKR stock traded down $0.10 during trading on Monday, hitting $57.80. The company had a trading volume of 287,135 shares, compared to its average volume of 1,110,573. The firm has a 50-day moving average price of $60.63 and a 200-day moving average price of $63.91. The company has a quick ratio of 0.73, a current ratio of 1.66 and a debt-to-equity ratio of 1.24. Bruker Co. has a 12 month low of $48.07 and a 12 month high of $94.86. The stock has a market cap of $8.76 billion, a price-to-earnings ratio of 27.86, a PEG ratio of 3.89 and a beta of 1.20.

Bruker (NASDAQ:BRKR - Get Free Report) last released its earnings results on Tuesday, November 5th. The medical research company reported $0.60 EPS for the quarter, missing analysts' consensus estimates of $0.61 by ($0.01). Bruker had a return on equity of 21.52% and a net margin of 9.41%. The business had revenue of $864.40 million for the quarter, compared to analyst estimates of $866.46 million. During the same period in the prior year, the firm posted $0.74 EPS. Bruker's revenue was up 16.4% on a year-over-year basis. As a group, analysts predict that Bruker Co. will post 2.4 earnings per share for the current year.

Bruker Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be issued a dividend of $0.05 per share. This represents a $0.20 dividend on an annualized basis and a yield of 0.35%. The ex-dividend date is Monday, December 2nd. Bruker's dividend payout ratio is presently 9.62%.

About Bruker

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

Featured Stories

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.