Timken (NYSE:TKR - Get Free Report) had its price objective dropped by stock analysts at KeyCorp from $104.00 to $90.00 in a report released on Wednesday, Benzinga reports. The brokerage currently has an "overweight" rating on the industrial products company's stock. KeyCorp's target price indicates a potential upside of 13.62% from the stock's current price.

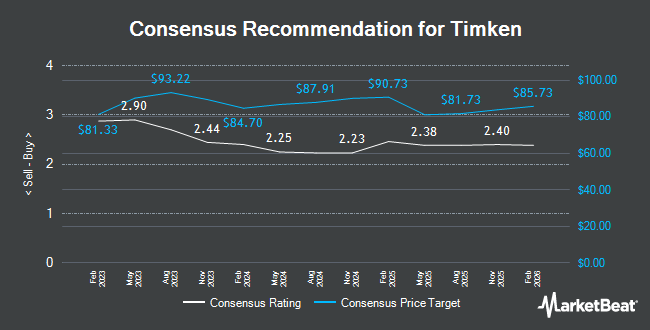

TKR has been the subject of several other research reports. DA Davidson restated a "buy" rating and set a $103.00 price objective on shares of Timken in a report on Tuesday, September 17th. Citigroup assumed coverage on shares of Timken in a report on Monday, October 14th. They set a "neutral" rating and a $90.00 price objective on the stock. Oppenheimer reduced their price objective on shares of Timken from $102.00 to $97.00 and set an "outperform" rating for the company in a report on Wednesday. Finally, Evercore ISI decreased their target price on shares of Timken from $94.00 to $87.00 and set an "in-line" rating for the company in a research report on Monday, August 19th. Eight research analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, Timken presently has a consensus rating of "Hold" and a consensus price target of $89.60.

Check Out Our Latest Research Report on TKR

Timken Trading Up 9.1 %

TKR traded up $6.61 during trading on Wednesday, reaching $79.21. 1,851,190 shares of the stock traded hands, compared to its average volume of 482,972. The company has a quick ratio of 1.64, a current ratio of 2.95 and a debt-to-equity ratio of 0.72. The stock's 50-day moving average is $82.77 and its 200 day moving average is $83.91. Timken has a 12 month low of $70.15 and a 12 month high of $94.71. The stock has a market capitalization of $5.56 billion, a PE ratio of 16.17, a P/E/G ratio of 1.90 and a beta of 1.43.

Timken (NYSE:TKR - Get Free Report) last announced its earnings results on Tuesday, November 5th. The industrial products company reported $1.23 EPS for the quarter, missing the consensus estimate of $1.38 by ($0.15). Timken had a net margin of 7.52% and a return on equity of 16.36%. The business had revenue of $1.13 billion for the quarter, compared to the consensus estimate of $1.12 billion. During the same quarter in the previous year, the company earned $1.55 EPS. The firm's revenue for the quarter was down 1.4% on a year-over-year basis. Equities analysts anticipate that Timken will post 6.05 earnings per share for the current year.

Insider Activity at Timken

In other Timken news, CEO Richard G. Kyle sold 30,000 shares of Timken stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $80.46, for a total value of $2,413,800.00. Following the sale, the chief executive officer now owns 244,485 shares of the company's stock, valued at approximately $19,671,263.10. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. 8.70% of the stock is owned by company insiders.

Institutional Trading of Timken

Several hedge funds have recently made changes to their positions in TKR. Vanguard Group Inc. grew its stake in shares of Timken by 5.6% during the 1st quarter. Vanguard Group Inc. now owns 6,515,972 shares of the industrial products company's stock worth $569,691,000 after acquiring an additional 347,794 shares during the period. American Century Companies Inc. increased its stake in shares of Timken by 4.8% in the second quarter. American Century Companies Inc. now owns 2,817,294 shares of the industrial products company's stock worth $225,750,000 after purchasing an additional 128,791 shares in the last quarter. Dimensional Fund Advisors LP increased its stake in shares of Timken by 4.9% in the second quarter. Dimensional Fund Advisors LP now owns 2,104,910 shares of the industrial products company's stock worth $168,667,000 after purchasing an additional 97,550 shares in the last quarter. Earnest Partners LLC raised its position in shares of Timken by 2.1% in the second quarter. Earnest Partners LLC now owns 1,322,312 shares of the industrial products company's stock valued at $105,957,000 after purchasing an additional 26,671 shares during the period. Finally, The Manufacturers Life Insurance Company lifted its stake in shares of Timken by 0.7% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 529,161 shares of the industrial products company's stock valued at $42,402,000 after buying an additional 3,462 shares in the last quarter. 89.08% of the stock is currently owned by institutional investors.

About Timken

(

Get Free Report)

The Timken Company designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally. The company's Engineered Bearings segment provides various bearing products, including tapered, spherical, and cylindrical roller bearings; plain bearings, metal-polymer bearings, and rod end bearings; radial, angular, and precision ball bearings; thrust and specialty ball bearings; journal bearings; and housed or mounted bearings.

Further Reading

Before you consider Timken, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Timken wasn't on the list.

While Timken currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.