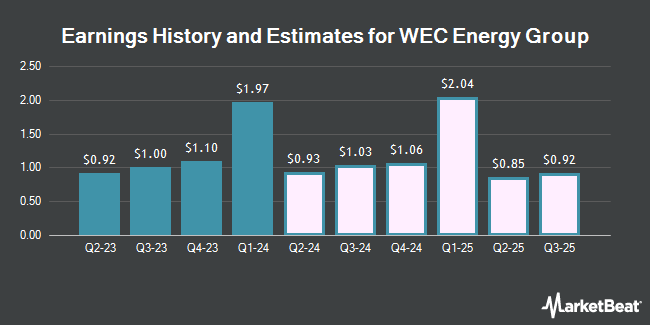

WEC Energy Group, Inc. (NYSE:WEC - Free Report) - Analysts at KeyCorp lifted their FY2024 earnings estimates for shares of WEC Energy Group in a research note issued to investors on Tuesday, December 3rd. KeyCorp analyst S. Karp now forecasts that the utilities provider will post earnings per share of $4.92 for the year, up from their previous estimate of $4.87. KeyCorp has a "Overweight" rating and a $109.00 price target on the stock. The consensus estimate for WEC Energy Group's current full-year earnings is $4.88 per share. KeyCorp also issued estimates for WEC Energy Group's Q4 2024 earnings at $1.47 EPS, FY2026 earnings at $5.58 EPS, FY2027 earnings at $6.00 EPS and FY2028 earnings at $6.40 EPS.

WEC has been the subject of several other research reports. Wells Fargo & Company lifted their price objective on WEC Energy Group from $103.00 to $106.00 and gave the company an "overweight" rating in a research note on Wednesday, October 16th. StockNews.com raised WEC Energy Group from a "sell" rating to a "hold" rating in a report on Friday, November 1st. Bank of America raised their target price on shares of WEC Energy Group from $88.00 to $90.00 and gave the company an "underperform" rating in a research note on Thursday, August 29th. Scotiabank boosted their price target on shares of WEC Energy Group from $90.00 to $103.00 and gave the stock a "sector outperform" rating in a research note on Tuesday, August 20th. Finally, Jefferies Financial Group assumed coverage on shares of WEC Energy Group in a report on Thursday, September 19th. They issued a "hold" rating and a $102.00 price target on the stock. Three research analysts have rated the stock with a sell rating, five have assigned a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat, WEC Energy Group has an average rating of "Hold" and an average target price of $95.55.

Check Out Our Latest Analysis on WEC Energy Group

WEC Energy Group Price Performance

Shares of WEC traded down $0.63 during mid-day trading on Friday, reaching $97.09. 1,468,642 shares of the stock traded hands, compared to its average volume of 1,706,763. The company has a market cap of $30.71 billion, a price-to-earnings ratio of 23.74, a price-to-earnings-growth ratio of 2.67 and a beta of 0.46. WEC Energy Group has a 1 year low of $75.13 and a 1 year high of $102.79. The firm has a fifty day moving average price of $97.63 and a 200 day moving average price of $89.80. The company has a current ratio of 0.65, a quick ratio of 0.46 and a debt-to-equity ratio of 1.37.

WEC Energy Group (NYSE:WEC - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The utilities provider reported $0.82 EPS for the quarter, beating analysts' consensus estimates of $0.70 by $0.12. The company had revenue of $1.86 billion during the quarter, compared to analyst estimates of $1.93 billion. WEC Energy Group had a net margin of 15.14% and a return on equity of 11.72%. WEC Energy Group's revenue was down 4.8% compared to the same quarter last year. During the same period last year, the business earned $1.00 earnings per share.

Institutional Trading of WEC Energy Group

Large investors have recently modified their holdings of the business. Mizuho Securities USA LLC raised its holdings in WEC Energy Group by 106,685.0% in the 3rd quarter. Mizuho Securities USA LLC now owns 26,000,000 shares of the utilities provider's stock worth $2,500,680,000 after purchasing an additional 25,975,652 shares in the last quarter. Geode Capital Management LLC increased its position in shares of WEC Energy Group by 1.3% during the third quarter. Geode Capital Management LLC now owns 7,952,851 shares of the utilities provider's stock valued at $762,453,000 after buying an additional 105,580 shares during the period. Wellington Management Group LLP raised its stake in WEC Energy Group by 17,270.5% in the third quarter. Wellington Management Group LLP now owns 4,718,179 shares of the utilities provider's stock worth $453,794,000 after buying an additional 4,691,017 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in WEC Energy Group by 102.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 3,776,071 shares of the utilities provider's stock worth $362,971,000 after buying an additional 1,912,223 shares during the period. Finally, American Century Companies Inc. boosted its position in WEC Energy Group by 36.7% during the 2nd quarter. American Century Companies Inc. now owns 2,566,001 shares of the utilities provider's stock valued at $201,328,000 after acquiring an additional 688,812 shares in the last quarter. 77.20% of the stock is owned by institutional investors.

Insider Activity

In other WEC Energy Group news, Director Gale E. Klappa sold 40,269 shares of the stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $99.56, for a total transaction of $4,009,181.64. Following the completion of the sale, the director now owns 273,248 shares of the company's stock, valued at $27,204,570.88. This represents a 12.84 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CEO Scott J. Lauber sold 6,720 shares of the business's stock in a transaction dated Thursday, November 21st. The shares were sold at an average price of $100.89, for a total transaction of $677,980.80. Following the completion of the transaction, the chief executive officer now owns 45,709 shares in the company, valued at $4,611,581.01. The trade was a 12.82 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 48,794 shares of company stock valued at $4,866,579. 0.34% of the stock is currently owned by insiders.

WEC Energy Group Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Saturday, March 1st. Shareholders of record on Friday, February 14th will be given a dividend of $0.8925 per share. This represents a $3.57 annualized dividend and a yield of 3.68%. This is a positive change from WEC Energy Group's previous quarterly dividend of $0.84. The ex-dividend date is Friday, February 14th. WEC Energy Group's dividend payout ratio is presently 81.66%.

About WEC Energy Group

(

Get Free Report)

WEC Energy Group, Inc, through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States. It operates through Wisconsin, Illinois, Other States, Electric Transmission, and Non-Utility Energy Infrastructure segments.

Recommended Stories

Before you consider WEC Energy Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WEC Energy Group wasn't on the list.

While WEC Energy Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report