KeyCorp upgraded shares of First Industrial Realty Trust (NYSE:FR - Free Report) from an underweight rating to a sector weight rating in a research note published on Tuesday morning, MarketBeat reports.

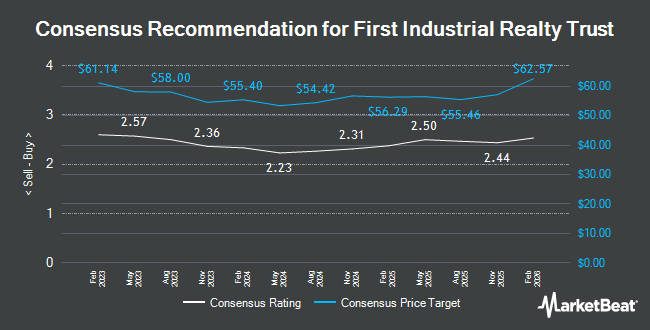

A number of other research analysts have also weighed in on FR. Wells Fargo & Company lifted their price target on shares of First Industrial Realty Trust from $50.00 to $61.00 and gave the company an "equal weight" rating in a research note on Wednesday, August 28th. Mizuho lifted their price target on shares of First Industrial Realty Trust from $58.00 to $62.00 and gave the company an "outperform" rating in a research note on Thursday, September 5th. Barclays lowered their price target on First Industrial Realty Trust from $56.00 to $55.00 and set an "equal weight" rating on the stock in a research report on Monday, November 18th. Finally, Scotiabank lifted their target price on First Industrial Realty Trust from $55.00 to $58.00 and gave the stock a "sector perform" rating in a research note on Monday, August 26th. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $57.83.

Read Our Latest Report on FR

First Industrial Realty Trust Trading Down 0.8 %

Shares of FR traded down $0.44 during trading hours on Tuesday, hitting $52.01. 863,394 shares of the stock traded hands, compared to its average volume of 1,069,531. The business has a fifty day moving average of $53.41 and a 200-day moving average of $52.73. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 0.80. The firm has a market capitalization of $6.88 billion, a PE ratio of 22.50 and a beta of 1.07. First Industrial Realty Trust has a 1-year low of $45.10 and a 1-year high of $57.35.

First Industrial Realty Trust (NYSE:FR - Get Free Report) last released its earnings results on Wednesday, October 16th. The real estate investment trust reported $0.75 EPS for the quarter, topping analysts' consensus estimates of $0.67 by $0.08. The firm had revenue of $167.60 million during the quarter, compared to analyst estimates of $164.01 million. First Industrial Realty Trust had a net margin of 47.34% and a return on equity of 11.53%. The business's quarterly revenue was up 8.1% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.62 EPS. Analysts expect that First Industrial Realty Trust will post 2.63 EPS for the current year.

First Industrial Realty Trust Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, January 21st. Shareholders of record on Tuesday, December 31st will be paid a dividend of $0.37 per share. This represents a $1.48 annualized dividend and a yield of 2.85%. The ex-dividend date of this dividend is Tuesday, December 31st. First Industrial Realty Trust's payout ratio is 63.52%.

Institutional Investors Weigh In On First Industrial Realty Trust

Several hedge funds have recently added to or reduced their stakes in FR. Rush Island Management LP acquired a new position in First Industrial Realty Trust in the third quarter valued at $60,848,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its stake in First Industrial Realty Trust by 290.6% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 895,046 shares of the real estate investment trust's stock worth $50,105,000 after purchasing an additional 665,920 shares during the period. Land & Buildings Investment Management LLC lifted its stake in First Industrial Realty Trust by 256.4% in the second quarter. Land & Buildings Investment Management LLC now owns 808,212 shares of the real estate investment trust's stock valued at $38,398,000 after buying an additional 581,472 shares during the period. Healthcare of Ontario Pension Plan Trust Fund acquired a new stake in First Industrial Realty Trust in the 2nd quarter valued at $23,755,000. Finally, Bank of Montreal Can raised its holdings in First Industrial Realty Trust by 442.8% during the second quarter. Bank of Montreal Can now owns 559,132 shares of the real estate investment trust's stock worth $26,570,000 after buying an additional 456,124 shares during the last quarter. 99.85% of the stock is currently owned by institutional investors and hedge funds.

About First Industrial Realty Trust

(

Get Free Report)

First Industrial Realty Trust, Inc NYSE: FR is a leading U.S.-only owner, operator, developer and acquirer of logistics properties. Through our fully integrated operating and investing platform, we provide high quality facilities and industry-leading customer service to multinational corporations and regional firms that are essential for their supply chains.

Featured Stories

Before you consider First Industrial Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Industrial Realty Trust wasn't on the list.

While First Industrial Realty Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.