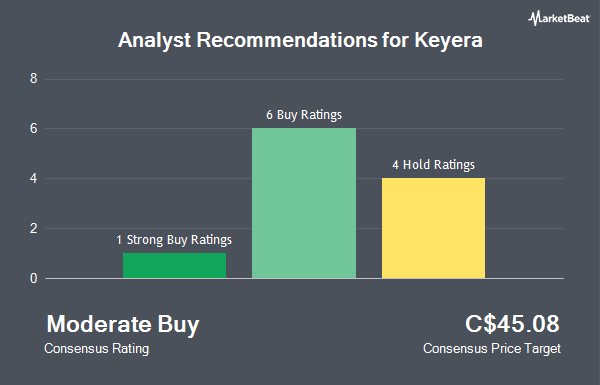

Shares of Keyera Corp. (TSE:KEY - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the fourteen analysts that are presently covering the firm, MarketBeat.com reports. Five research analysts have rated the stock with a hold recommendation, seven have issued a buy recommendation and two have issued a strong buy recommendation on the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is C$44.77.

A number of research analysts have weighed in on the stock. TD Securities set a C$45.00 price objective on shares of Keyera and gave the stock a "hold" rating in a research report on Wednesday, January 15th. CIBC raised their price objective on Keyera from C$46.00 to C$48.00 in a report on Friday, February 14th. Finally, Cibc World Mkts raised Keyera from a "hold" rating to a "strong-buy" rating in a research note on Friday, February 14th.

View Our Latest Report on Keyera

Keyera Stock Performance

Shares of KEY traded up C$1.23 during trading hours on Tuesday, hitting C$40.05. The stock had a trading volume of 1,768,683 shares, compared to its average volume of 1,300,658. The firm has a 50-day moving average price of C$42.35 and a 200 day moving average price of C$43.21. Keyera has a fifty-two week low of C$34.38 and a fifty-two week high of C$47.90. The firm has a market capitalization of C$9.23 billion, a price-to-earnings ratio of 20.64, a PEG ratio of 1.35 and a beta of 2.09. The company has a debt-to-equity ratio of 137.59, a quick ratio of 0.57 and a current ratio of 1.31.

Keyera Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Monday, March 31st were given a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a dividend yield of 5.19%. The ex-dividend date of this dividend was Monday, March 17th. Keyera's dividend payout ratio (DPR) is 107.20%.

About Keyera

(

Get Free ReportKeyera is a midstream energy business that operates primarily out of Alberta, Canada. Its primary lines of business consist of the gathering and processing of natural gas in western Canada, the storage, transportation, and liquids blending for NGLS and crude oil, and the marketing of NGLs, iso-octane, and crude oil.

Read More

Before you consider Keyera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keyera wasn't on the list.

While Keyera currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.