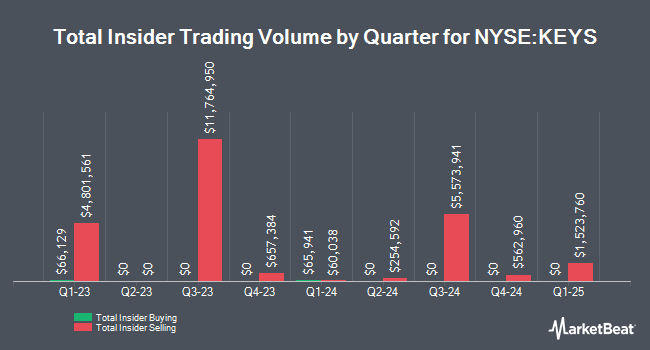

Keysight Technologies, Inc. (NYSE:KEYS - Get Free Report) SVP John Page sold 3,884 shares of the company's stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $169.66, for a total transaction of $658,959.44. Following the completion of the sale, the senior vice president now owns 37,081 shares of the company's stock, valued at approximately $6,291,162.46. This represents a 9.48 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link.

Keysight Technologies Stock Performance

Shares of KEYS traded up $1.26 during mid-day trading on Wednesday, hitting $172.26. 847,018 shares of the company's stock were exchanged, compared to its average volume of 1,210,635. Keysight Technologies, Inc. has a 52 week low of $119.72 and a 52 week high of $175.39. The stock's 50-day simple moving average is $159.17 and its 200-day simple moving average is $147.21. The firm has a market cap of $29.89 billion, a price-to-earnings ratio of 48.85, a price-to-earnings-growth ratio of 2.20 and a beta of 1.00. The company has a quick ratio of 2.27, a current ratio of 2.98 and a debt-to-equity ratio of 0.35.

Wall Street Analysts Forecast Growth

KEYS has been the subject of a number of research reports. JPMorgan Chase & Co. increased their target price on Keysight Technologies from $155.00 to $165.00 and gave the stock a "neutral" rating in a report on Wednesday, August 21st. Susquehanna restated a "positive" rating and set a $185.00 price objective on shares of Keysight Technologies in a research note on Wednesday, November 20th. Deutsche Bank Aktiengesellschaft increased their price objective on shares of Keysight Technologies from $175.00 to $180.00 and gave the stock a "buy" rating in a research note on Wednesday, November 20th. Morgan Stanley increased their price objective on shares of Keysight Technologies from $165.00 to $180.00 and gave the stock an "overweight" rating in a research note on Wednesday, November 20th. Finally, Barclays increased their price objective on shares of Keysight Technologies from $180.00 to $200.00 and gave the stock an "overweight" rating in a research note on Wednesday, November 20th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, Keysight Technologies currently has a consensus rating of "Moderate Buy" and a consensus price target of $177.30.

Get Our Latest Stock Analysis on KEYS

Institutional Inflows and Outflows

A number of hedge funds have recently added to or reduced their stakes in the company. Cetera Investment Advisers boosted its position in Keysight Technologies by 165.2% in the first quarter. Cetera Investment Advisers now owns 23,339 shares of the scientific and technical instruments company's stock valued at $3,650,000 after buying an additional 14,538 shares in the last quarter. Cetera Advisors LLC lifted its holdings in shares of Keysight Technologies by 72.9% during the first quarter. Cetera Advisors LLC now owns 6,448 shares of the scientific and technical instruments company's stock worth $1,008,000 after purchasing an additional 2,718 shares during the period. GAMMA Investing LLC lifted its holdings in shares of Keysight Technologies by 57.8% during the second quarter. GAMMA Investing LLC now owns 524 shares of the scientific and technical instruments company's stock worth $72,000 after purchasing an additional 192 shares during the period. Valeo Financial Advisors LLC lifted its holdings in shares of Keysight Technologies by 3.6% during the second quarter. Valeo Financial Advisors LLC now owns 2,508 shares of the scientific and technical instruments company's stock worth $343,000 after purchasing an additional 88 shares during the period. Finally, Guinness Asset Management LTD lifted its holdings in shares of Keysight Technologies by 3.3% during the second quarter. Guinness Asset Management LTD now owns 3,191 shares of the scientific and technical instruments company's stock worth $436,000 after purchasing an additional 103 shares during the period. 84.58% of the stock is owned by institutional investors.

Keysight Technologies Company Profile

(

Get Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Further Reading

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.