Kiltearn Partners LLP cut its stake in Tenaris S.A. (NYSE:TS - Free Report) by 15.9% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 514,359 shares of the industrial products company's stock after selling 97,300 shares during the period. Tenaris makes up about 2.2% of Kiltearn Partners LLP's holdings, making the stock its 19th largest holding. Kiltearn Partners LLP owned approximately 0.09% of Tenaris worth $16,351,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

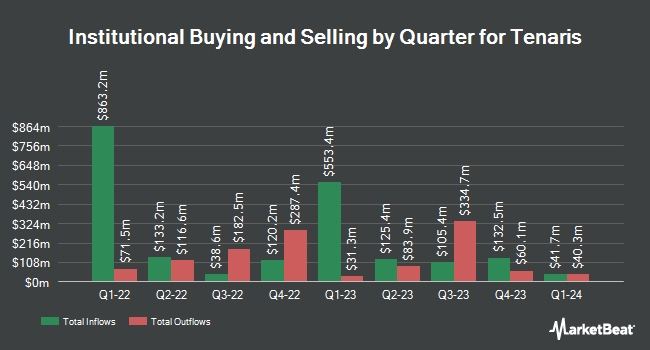

Several other hedge funds and other institutional investors have also recently made changes to their positions in TS. FMR LLC lifted its holdings in Tenaris by 21.3% in the third quarter. FMR LLC now owns 3,503,644 shares of the industrial products company's stock valued at $111,381,000 after acquiring an additional 614,884 shares during the last quarter. Cerity Partners LLC increased its holdings in Tenaris by 28.3% in the 3rd quarter. Cerity Partners LLC now owns 24,967 shares of the industrial products company's stock valued at $794,000 after purchasing an additional 5,502 shares during the last quarter. Charles Schwab Investment Management Inc. raised its position in Tenaris by 48.3% in the third quarter. Charles Schwab Investment Management Inc. now owns 23,132 shares of the industrial products company's stock valued at $735,000 after purchasing an additional 7,533 shares during the period. Integrated Investment Consultants LLC purchased a new position in shares of Tenaris during the third quarter worth $365,000. Finally, West Family Investments Inc. acquired a new stake in shares of Tenaris in the third quarter valued at $200,000. Institutional investors and hedge funds own 10.45% of the company's stock.

Tenaris Stock Performance

NYSE TS traded up $0.58 during trading hours on Wednesday, hitting $38.19. The company had a trading volume of 1,590,842 shares, compared to its average volume of 1,944,922. The business has a 50 day moving average of $33.37 and a 200-day moving average of $31.63. The company has a market cap of $22.20 billion, a PE ratio of 8.19 and a beta of 1.43. Tenaris S.A. has a 1-year low of $27.24 and a 1-year high of $40.72.

Tenaris Cuts Dividend

The company also recently announced a Semi-Annual dividend, which was paid on Wednesday, November 20th. Stockholders of record on Tuesday, November 19th were issued a $0.54 dividend. This represents a dividend yield of 3.6%. The ex-dividend date was Tuesday, November 19th. Tenaris's payout ratio is 23.53%.

Analyst Ratings Changes

Several analysts have recently issued reports on TS shares. Stifel Nicolaus reduced their price target on shares of Tenaris from $37.00 to $36.00 and set a "buy" rating on the stock in a research report on Friday, October 11th. StockNews.com raised Tenaris from a "hold" rating to a "buy" rating in a report on Wednesday. One analyst has rated the stock with a sell rating, two have issued a hold rating and three have assigned a buy rating to the company. According to MarketBeat.com, Tenaris has a consensus rating of "Hold" and a consensus price target of $38.67.

Check Out Our Latest Analysis on Tenaris

Tenaris Profile

(

Free Report)

Tenaris SA, together with its subsidiaries, produces and sells seamless and welded steel tubular products and related services for the oil and gas industry, and other industrial applications. The company offers steel casings, tubing products, mechanical and structural pipes, line pipes, cold-drawn pipes, and premium joints and couplings; and coiled tubing products for oil and gas drilling and workovers, and subsea pipelines.

Featured Articles

Before you consider Tenaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tenaris wasn't on the list.

While Tenaris currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.